|

Source: VietstockFinance

|

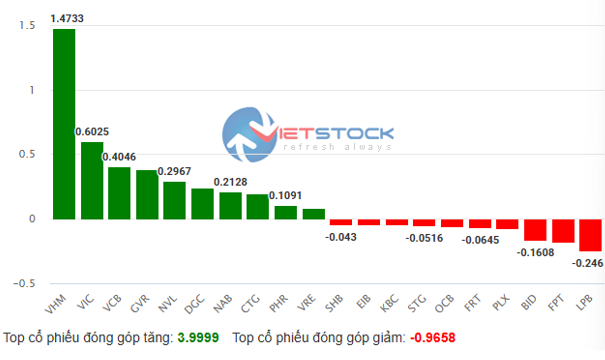

The banking, securities, residential real estate, and chemicals sectors were the main contributors to today’s index gain. While these sectors recorded fairly consistent increases, residential real estate stood out with many stocks witnessing notable price increases and attracting attention, such as the VHM duo rising 3.71% and VIC up 1.36%, while NVL hit the ceiling price after the National Assembly passed a resolution on special mechanisms to address obstacles at the project located at 39-39B Ben Van Don (Ho Chi Minh City), also known by its commercial name, The Tresor, with this company as the investor.

In addition, the mining sector saw positive price movements despite concerns about a possible correction after its strong performance previously, with MSR hitting the ceiling price, up 15%, KSV up 6.14%, KCB rising 12.79%, and HGM gaining 9.98%…

Several other sectors also recorded impressive gains, including healthcare, insurance, and biopharmaceuticals…

On the downside, the market had eight declining sectors, with hardware experiencing the sharpest drop of 2.42%, while the rest fell by less than 0.7%.

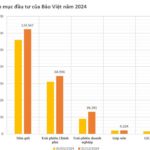

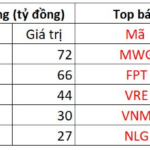

A notable development today was the return of net foreign selling, totaling nearly VND 407 billion, further emphasizing the clear stance of foreign investors. Notable stocks that experienced net selling today included FPT with nearly VND 137 billion, MWG with over VND 77 billion, SSI with more than VND 58 billion, VCB with nearly VND 55 billion, and HPG with almost VND 42 billion.

| Foreign Buying and Selling Activity |

Overall, the trading session on February 20 concluded with positive results but started to show some volatility as it approached the 1,295 level, or more broadly, as the index ventured deeper into the challenging resistance zone of 1,285 – 1,305 points, which has been in place since August 2022.

The performance of Vietnam’s stock market contrasted with that of Asia, which generally witnessed declines, such as the Hang Seng falling 1.58%, the Nikkei 225 losing 1.29%, the Singapore Straits Times dipping 0.09%, and the All Ordinaries decreasing by 1.12%.

Morning Session: “Roller Coaster” towards the End of the Morning

After a period of back-and-forth movement during the first half of the morning session, the VN-Index started to form a clearer upward trend and even surpassed the 1,295-point level at one point. However, it quickly reversed course and closed at 1,293.28, a gain of 4.72 points.

Source: VietstockFinance

|

The HNX-Index and UPCoM also closed in the green, with gains of 0.53 points and 0.6 points, respectively, ending the session at 238.32 and 99.94 points.

The market witnessed a broad-based advance, with 417 stocks rising, including 25 that hit the ceiling price, while only 259 stocks declined. Market liquidity continued to improve in recent sessions, with nearly 478 million shares changing hands, corresponding to a turnover of nearly VND 9,668 billion.

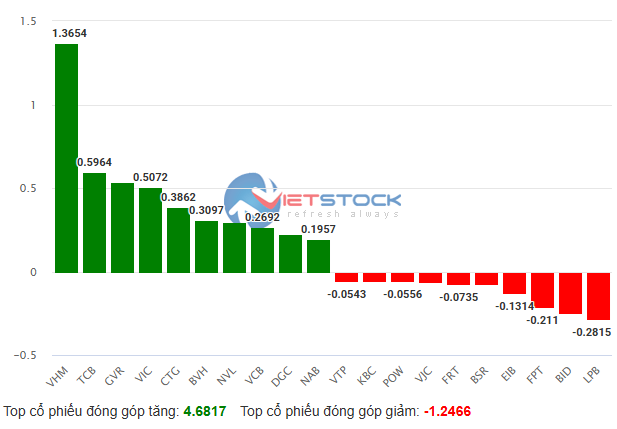

On the VN-Index, a series of real estate stocks, such as VHM, VIC, NVL, as well as banks like TCB, CTG, VCB, and NAB, made positive contributions to the index’s gain, with VHM leading the way, adding nearly 1.4 points.

Additionally, the top 10 stocks influencing the VN-Index included GVR, BVH, and DGC. This list also highlighted the significant contributions of the banking, real estate, and chemicals sectors during the morning session.

|

Top Stocks Impacting the VN-Index

Source: VietstockFinance

|

In terms of sectoral performance, healthcare temporarily took the lead with a 4.24% increase, driven mainly by TNH, which rose 6.27%, and BBT, which climbed 3.57%. This was followed by insurance, up 1.75%; raw materials, up 1.64%; vehicles and components, up 1.43%; specialized services and trading, up 1.17%; and real estate, up 1.14%. Overall, six sectors recorded gains above 1%.

On the downside, only four sectors declined, led by hardware, which fell 5.14% due to pressure from POT, down 8.61%, and SMT, down 6.78%.

Foreign investors were net sellers, offloading more than VND 308 billion worth of shares. FPT faced the strongest net selling, with over VND 69 billion, followed by SSI, VCB, HPG, STB, VNM, and HDB, which all experienced net selling of over VND 20 billion. On the buying side, FPT led with nearly VND 48 billion, outpacing the stocks that followed.

10:40 am: Vin Group Stocks Surge, Real Estate Sector Surges

After an initial enthusiastic period, during which the VN-Index briefly surpassed the 1,294-point level, the market entered a volatile phase and was up 3.62 points at 10:30 am, reaching 1,292.18. Meanwhile, the HNX-Index rose 0.42 points to 238.21, and the UPCoM climbed 0.44 points to 99.78. The real estate sector, particularly the Vin Group stocks, played a significant role in this upward movement.

|

Real Estate Sector Makes a Strong Impact on the Market

Source: VietstockFinance

|

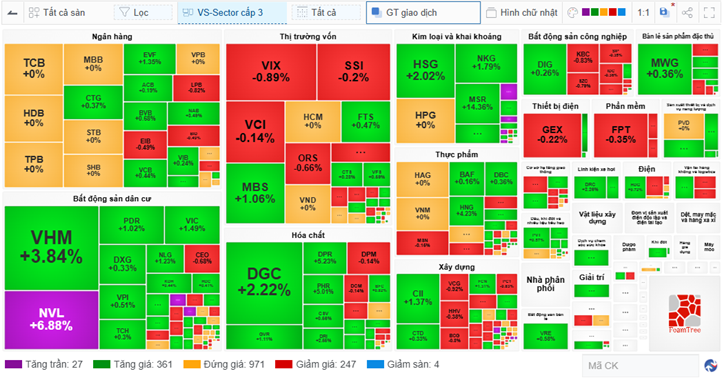

While the banking and securities sectors gradually lost momentum, with many stocks returning to the reference price or even turning red, the residential real estate, metals and mining, and chemicals sectors picked up pace.

In the metals and mining group, stocks that had risen sharply in the past continued their positive momentum, with HGM, BMC, KCB, and BKC hitting the ceiling price and MSR climbing 12.87%…

In the residential real estate sector, Vin Group stocks such as VHM rose 3.84%, VIC gained 1.49%, NLG increased by 1.23%, PDR went up by 1.02%, and NVL even hit the ceiling price, surging 7%. Notably, the VHM and VIC duo led in terms of point contributions to the VN-Index, adding nearly 1.5 points and over 0.6 points, respectively, while VRE also made it to the top 10 contributors.

|

Vin Group Stocks Make Significant Contributions to the VN-Index

Source: VietstockFinance

|

VHM also led in terms of net foreign buying, attracting nearly VND 30 billion. On the other hand, FPT faced the strongest net selling, with over VND 39 billion. Overall, foreign investors resumed net selling today, offloading approximately VND 180 billion worth of shares.

Opening: VN-Index Moves Against the Trend in Asia

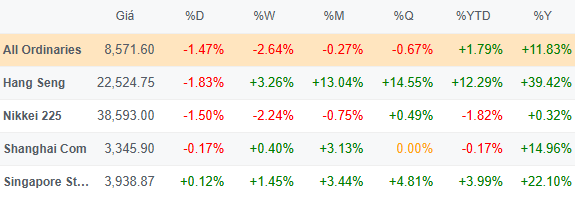

In the first 25 minutes of the trading day, the VN-Index added 3.98 points, or 0.31%, to reach 1,292.54. Meanwhile, the HNX-Index climbed 0.84 points to 238.63, and the UPCoM-Index rose 0.52 points to 99.86. These movements went against the trend observed in many major Asian markets.

Market liquidity reached nearly 79 million shares, corresponding to a turnover of approximately VND 1,575 billion.

Many stocks in the financial sector (banks and securities firms) attracted buying interest, advanced, and contributed to the market’s upward momentum, including MBS, up 1.77%; SSI, up 0.59%; TPB, up 0.59%; SHB, up 0.91%; and FTS, up 1.41%… In the real estate sector, stocks like VHM, up 1.92%; NVL, up 3.39%; and VRE, up 0.58%… also performed well. Additionally, the raw materials sector continued its positive trend observed in recent times.

In the short term, many experts predict that the VN-Index will continue its upward trajectory and approach the 1,300-point level or even surpass it. However, a subsequent correction is possible. Currently, despite positive news and the strong performance of many sectors, market liquidity remains insufficient to sustain a robust upward trend.

Last night, the S&P 500 advanced to 6,144.15 points, marking its second consecutive record-high close. The index also hit an all-time intraday high during the session. The Nasdaq Composite edged slightly higher to 20,056.25 points, while the Dow Jones rose to 44,627.59 points.

The S&P 500 climbed to a new record high as U.S. stocks remained resilient despite the Federal Reserve’s cautious stance and President Donald Trump’s tariff threats.

However, major Asian markets opened on a negative note, with the All Ordinaries down 1.47%, the Hang Seng falling 1.83%, the Nikkei 225 losing 1.5%, and the Shanghai Composite dipping 0.17%.

|

Many Asian Markets Open in the Red

Source: VietstockFinance

|

The previous day, Asian markets showed mixed performances as President Donald Trump expanded tariff threats, and investors assessed the geopolitical landscape following the first official high-level talks between the U.S. and Russia since the Ukraine conflict erupted.

– 09:50 20/02/2025

Market Beat: VN-Index Plunges, Steel Stocks Take a Hit on News of Tariffs

The market closed with notable losses, as the VN-Index dipped by 11.94 points (-0.94%) to close at 1,263.26, while the HNX-Index fell by 1.52 points (-0.66%), settling at 227.97. The market breadth was overwhelmingly bearish, with 489 declining stocks outweighing 270 advancing stocks. Within the large-cap VN30 basket, bears held the edge, as evidenced by 16 tickers in the red versus 9 in the green, while 5 remained unchanged.

The Billionaire’s Joy: VinFast’s Success Story

VinFast’s stock has soared, pushing its valuation to an impressive $11.85 billion. This surge in value places the company sixth among the world’s most valuable electric vehicle manufacturers, following closely behind industry leaders such as Tesla, Xiaomi, Li Auto, Rivian, and XPeng.