VinaCapital has been in active dialogue with various government agencies, and there is a strong alignment and determination to drive growth, reforms, and seize opportunities to boost the economy before demographic challenges set in.

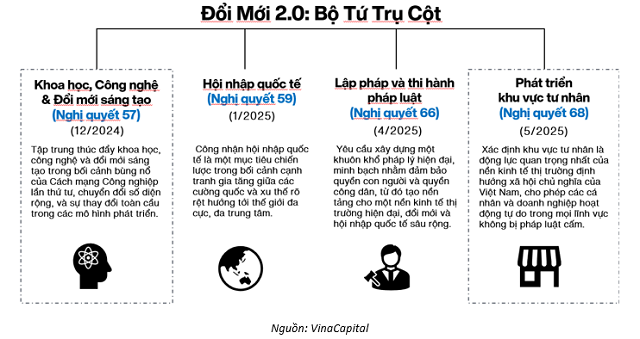

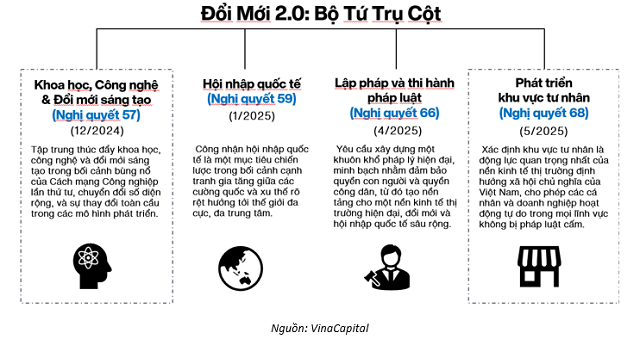

The information disclosed since late 2024 is now being materialized, as new policies are being implemented. Specifically, the National Assembly has passed significantly more laws than in the 2021-2023 period, covering various sectors such as power, personal data, rights of dual citizens, and land reform. Most policy reforms focus on four key pillars:

Resolution 57 emphasizes technological progress, especially in priority sectors. The government aims to increase spending on research and development (R&D), attract international experts, implement measures to boost Vietnam’s technology exports, and form five internationally competitive technology firms by 2030.

Resolution 59 aims to integrate Vietnamese businesses more deeply into global supply chains while attracting more capital into the domestic market from international financial institutions and experts.

Resolution 66 calls for a comprehensive reform of the legal system, eliminating overlapping, contradictory, and inconsistent regulations. The goal is to improve operational efficiency for both the public and private sectors.

Resolution 68 elevates the spirit of entrepreneurship as a pillar of national identity, likening entrepreneurs to “pioneer warriors on the economic front.” These “warriors” are entrusted with the mission of boosting private sector growth at a pivotal moment in Vietnam’s history. According to Resolution 68, the private sector is no longer just a “component” but is elevated to the “most important driving force of the economy.”

Resolution 68: Policies to Support Private Sector Development

Among the issued resolutions, Resolution 68 has attracted the most attention, partly due to the stock price surge of companies perceived to benefit from the government’s policies. Other potential beneficiaries include domestic contractors and construction material manufacturers, who are experiencing increased orders due to accelerated public investment disbursement. The market anticipates the emergence of more beneficiaries as the government implements its strategy to boost private sector growth through the realization of Resolution 68.

The private sector development strategy has a two-pronged approach: developing 20 “national flagship enterprises” and promoting the robust growth of small and medium-sized enterprises (SMEs). The government aims to double the number of SMEs in Vietnam from 1 million to 2 million by 2030 by supporting SME development and transforming informal individual business households into formally registered enterprises, participating in the tax system, and adopting electronic invoicing. Starting in July, businesses conducting VAT deductions were required to provide valid electronic payment documents for invoices valued above VND 5 million. This will encourage small businesses to adopt electronic payment platforms and complete legal documentation procedures.

The strategy to develop 20 large enterprises modeled after the Korean chaebol, deeply integrated into global supply chains, bears similarities to South Korea’s 1970s economic promotion policies, notably the Heavy and Chemical Industry Promotion Program. In South Korea, priority sector enterprises enjoyed benefits such as preferential credit from state-owned banks, tax exemptions, market protection from foreign company competition, and support in accessing international strategic partners. In Vietnam, the government is gradually providing support to selected enterprises to boost economic growth and develop national infrastructure, albeit using more indirect support mechanisms than South Korea in the 1970s.

From Policy to Reality

Since late 2024, there has been a significant increase in policy directives and press releases from the government, signaling major shifts in Vietnam’s public and private sectors. While administrative streamlining efforts began in 2017 (with plans to merge communes and restructure administrative units), the current wave of reforms demonstrates greater urgency, broader scope, and stronger implementation determination. By early 2025, these policy directives had materialized into concrete policies. There is a palpable shift in the mindset of policymakers, and the first tangible outcomes of these resolute reforms are beginning to emerge.

For instance, the long-delayed metro line in Ho Chi Minh City was officially inaugurated in late 2024. In 2025, public investment disbursement increased by over 40% (according to reports), and in June, Vietnam’s National Assembly passed a plan to reform the local government system, reducing the number of provinces from 63 to 34. The government’s swift reform pace is evident in the streamlining of the state apparatus, enacted on June 12 and effective from July 1.

This month, Ho Chi Minh City implemented a pilot policy waiving construction permits for over 55,000 separate housing projects, requiring only simple construction notifications to local authorities. This policy, along with recent proposals to amend the Land Law, aims to address the housing supply shortage (demand doubles supply) and other lingering issues in the real estate market. Additionally, in July 2025, a Technology Steering Committee was established to promote technology development in critical areas such as renewable energy, biotechnology, 6G networks, intellectual property protection, and increased investment in research and development (R&D). A representative from VinaCapital has been invited to join this committee.

Lastly, the above measures are just a few examples of the reforms initiated over the past year. Other notable initiatives include the $67 billion North-South High-Speed Railway project, expected to commence in 2027, and the government-led effort since July 2025 to restart approximately 2,900 stalled infrastructure projects. Several other relatively important measures are also being implemented, including the National Data Center, which centralizes data from thousands of government agencies, enabling the deployment of the National Public Service Portal with digital signatures and electronic authentication across ministries, sectors, and localities, reducing paperwork and improving efficiency. Other policies include substantial R&D tax incentives and a new law to promote the use of digital assets, expected to take effect next year.

Overall, Vietnam is entering a phase of Doi Moi (Renovation) 2.0, a rapid transformation from policy declarations to practical outcomes, evidenced by the 34 laws passed in June 2025 and extensive administrative reforms. These reforms are anchored in four key pillars: Resolution 57 (science and technology), Resolution 59 (deeper integration into high-value global supply chains), Resolution 66 (eliminating overlapping regulations by the end of 2025 and digitizing a transparent legal framework by 2030), and Resolution 68 (private sector as the “most important driving force of the economy,” aiming for 2 million enterprises and at least 20 national flagship enterprises).

In the coming months, VinaCapital expects infrastructure investment disbursement to accelerate, particularly in transportation and energy sectors, due to new mechanisms that shorten approval times and minimize capital delays. Similarly, the real estate sector is anticipated to continue benefiting from recent policies that unblock stalled projects.

– 09:01 02/08/2025

Unlocking Capital: Vietnam’s Public Investment Disbursement Reaches an Estimated VND 388 Trillion by July End

As of July 31, 2025, the Ministry of Finance estimates that disbursement since the beginning of the year stands at VND 388,301.15 billion, representing 39.45% of the plan and 43.9% of the plan assigned by the Prime Minister. This demonstrates a significant improvement compared to the same period in 2024, when disbursement reached only 27.76% and 33.8% of the respective plans.

The CPI for the first seven months is estimated to increase by 3.2-3.3%.

The Ministry of Finance reports that the consumer price index (CPI) for the first seven months of the year is estimated to have increased by 3.2-3.3% compared to the same period last year. This is an appropriate level that supports economic growth, especially as resources are being focused on achieving the highest possible economic expansion. Vietnam’s inflation is being carefully managed within the target range set by the National Assembly and the Government of 4.5-5%, contributing to macroeconomic stability.

“Financial Institutions Embrace the Digital Asset Revolution”

The legalization of digital assets marks a pivotal moment in Vietnam’s legal history. As the regulatory framework evolves, investment appetite from financial institutions is already evident, with many proactively laying the groundwork and poised to enter the market when the proverbial green light shines.