I. MARKET ANALYSIS OF SECURITIES ON AUGUST 04, 2025

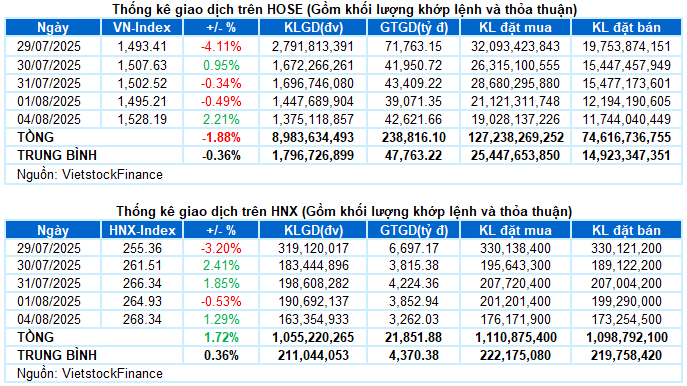

– The main indices surged strongly in the trading session on August 04. Specifically, VN-Index added 32.98 points (+2.21%), reaching 1,528.19 points. HNX-Index also increased by 1.29%, to 268.34 points.

– Matching volume on the HOSE floor decreased by 10.9%, to 1.2 billion units. HNX recorded more than 160 million units, a decrease of 14.1% compared to the previous session.

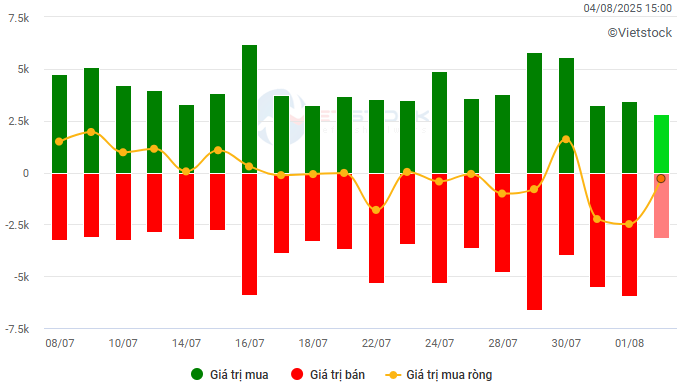

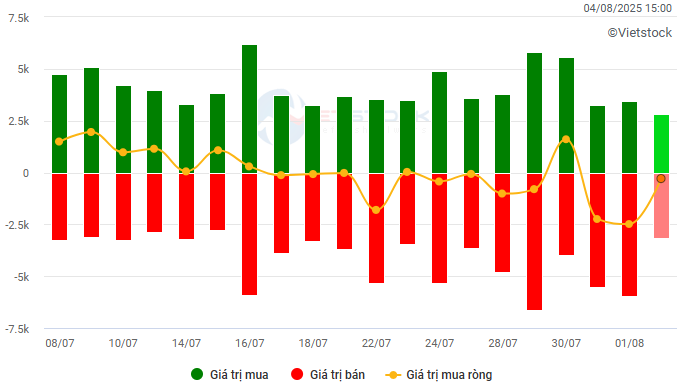

– Foreign investors continued to sell a net value of nearly VND 309 billion on the HOSE floor but returned to net buy more than VND 72 billion on the HNX floor.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

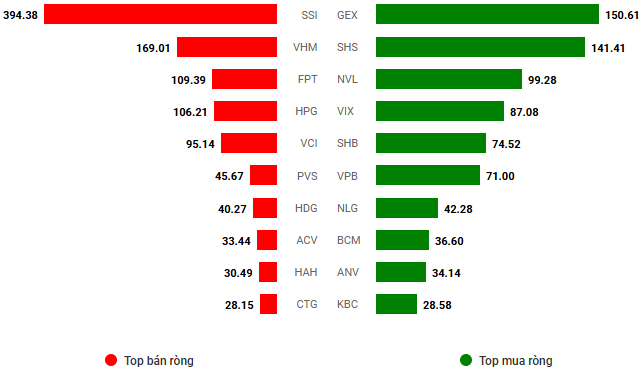

Net trading value by stock code. Unit: VND billion

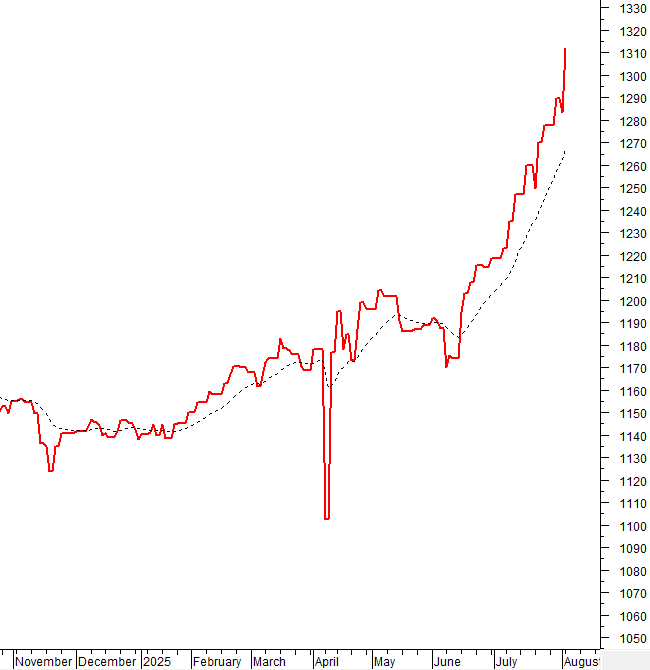

– The securities market started the new week on a positive note. VN-Index quickly regained the 1,500-point mark after just 30 minutes of trading in the morning session and widened its gain thanks to the good lead of large-cap stocks. Although profit-taking pressure returned in the late morning session, buyers still held the upper hand when entering the afternoon session. VN-Index continued to accelerate and closed at the highest level of the day, reaching 1,528.19 points, up 2.21% from the previous week.

– In terms of impact, VIC was the main driver, bringing about a 6.8-point increase in the VN-Index. Following were VHM, TCB, and CTG, which also helped the index add a total of nearly 6 points. Meanwhile, PNJ and GEE were the two most negative-impact stocks on the opposite side, but they also took away less than half a point from the overall index.

– VN30-Index broke through strongly with 39 points, reaching 1,653.22 points. The breadth was heavily skewed towards buyers with 29 gainers and only one loser, which was FPT. Stocks such as VJC, SHB, VIC, and TPB surged to the maximum daily limit. In addition, HDB, TCB, SSB, and CTG also rose by more than 3%.

The green color dominated most industry groups. The real estate sector index led the market, recording a broad rally, notably VIC and NVL, which hit the daily limit, along with a series of stocks rising by more than 2%, including VHM, VRE, DIG, PDR, TCH, NLG, SCR, CRE, DXS, HQC, and TAL. Notably, VIC stock witnessed a massive negotiated trading transaction worth nearly VND 10,000 billion in today’s session.

The financial group also performed well, led by strong gains in banking and securities stocks. Notably, SHB, TPB, and SHS hit the ceiling prices, while VCB (+1.5%), BID (+2.28%), TCB (+3.67%), CTG (+3.05%), MSB (+4.44%), SSB (+3.32%), VIX (+5.32%), SSI (+2.41%), VND (+4.73%), and ORS (+5.99%) all posted solid gains.

In contrast, the information technology group moved against the overall market trend, falling by 0.36%. This was mainly due to losses in large-cap stocks in the sector, including FPT (-0.37%), CMG (-0.75%), and VEC (-5.98%). Similarly, the energy group also remained subdued as selling pressure dominated BSR, PVS, PVD, OIL, PVT, PVC, etc.

VN-Index surged strongly and stayed above the Middle line of the Bollinger Bands. However, the trading volume fell below the 20-session average, signaling a short-term warning. Additionally, the Stochastic Oscillator indicator continued to weaken after giving a sell signal and exiting the overbought zone. Investors should be cautious of potential volatility around the April 2022 peak area (equivalent to 1,480-1,530 points).

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Trading volume falls below the 20-session average

VN-Index surged strongly and stayed above the Middle line of the Bollinger Bands. However, the trading volume fell below the 20-session average, signaling a short-term warning.

Additionally, the Stochastic Oscillator indicator continued to weaken after giving a sell signal and exiting the overbought zone. Investors should be cautious of potential volatility around the April 2022 peak area (equivalent to 1,480-1,530 points).

HNX-Index – The MACD indicator continues to widen the gap with the Signal line

HNX-Index rose after a volatile session, trading closely above the upper band (Upper Band) of the Bollinger Bands.

Currently, the MACD indicator continues to widen the gap with the Signal line since giving a buy signal at the beginning of July 2025, reinforcing the positive outlook for the index in the near term.

Money Flow Analysis

Changes in smart money flow: The Negative Volume Index indicator of VN-Index is currently above the EMA 20-day moving average. If this condition persists in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Changes in foreign capital flow: Foreign investors continued to be net sellers in the trading session on August 04, 2025. If foreign investors maintain this stance in the coming sessions, the situation may turn more pessimistic.

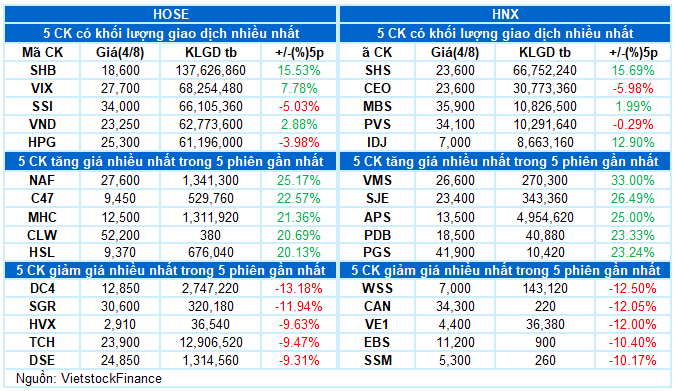

III. MARKET STATISTICS ON AUGUST 04, 2025

Economic and Market Strategy Analysis Department, Vietstock Consulting and Research

– 17:07 04/08/2025

Market Pulse for August 4th: VIC Records Nearly 10,000 Billion VND in Trading Deals

The trading session ended on a positive note, with the VN-Index surging 32.98 points (+2.21%), reaching 1,528.19. The HNX-Index also witnessed a significant boost, climbing 3.41 points (+1.29%) to close at 268.34. The market breadth tilted heavily in favor of advancers, with 498 gainers overwhelming 257 decliners. This bullish sentiment was echoed in the VN30 basket, where 29 stocks advanced, dwarfing the solitary decliner.

Stock Market Update for July 28 – August 1, 2025: Navigating Foreign Outflows

The VN-Index witnessed a decline during the week’s final session, concluding the week’s trading below the 1,500-point mark. Despite the medium-term uptrend remaining technically intact, the index’s failure to hold the crucial psychological support level, coupled with sustained foreign net selling pressure, presents notable signals for investors. Should this trend persist, further market adjustments are likely on the horizon.

The Market Beat: Foreigners Turn Net Buyers, VN-Index Recovers Over 14 Points

The trading session concluded with significant gains, as the VN-Index rose by 14.22 points (+0.95%), closing at 1,507.63. Meanwhile, the HNX-Index also witnessed a notable increase of 6.15 points (+2.41%), finishing the day at 261.51. The market breadth tilted in favor of advancers, with 426 tickers in the green and 337 in the red. Similarly, the VN30 basket painted a bullish picture, as 20 stocks advanced, 9 declined, and 1 remained unchanged, ending the day on a positive note.

Stock Market Insights: Can the Uptrend Persist?

The VN-Index showcases a near-Doji candle pattern, with liquidity maintained above the 20-session average, indicating investor indecision. In the short term, the index is likely to retest the historical peak around the 1,530-point level. However, investors should be cautious of potential volatility at higher price levels, as the Stochastic Oscillator indicator weakens in the overbought territory.

Market Beat: Foreigners Turn Net Buyers, VN-Index Holds Firm at 1,510 Points

The trading session concluded with the VN-Index climbing 2.77 points (+0.18%), reaching 1,512.31. Meanwhile, the HNX-Index witnessed a rise of 1.48 points (+0.6%), ending the day at 249.33. The market breadth tilted towards the bulls, as evident from the advance-decline ratio of 467:296. A similar trend was observed in the VN30 basket, with 17 gainers outpacing 13 losers.