I. MARKET ANALYSIS OF THE STOCK MARKET BASED ON DATA FROM FEBRUARY 24, 2025

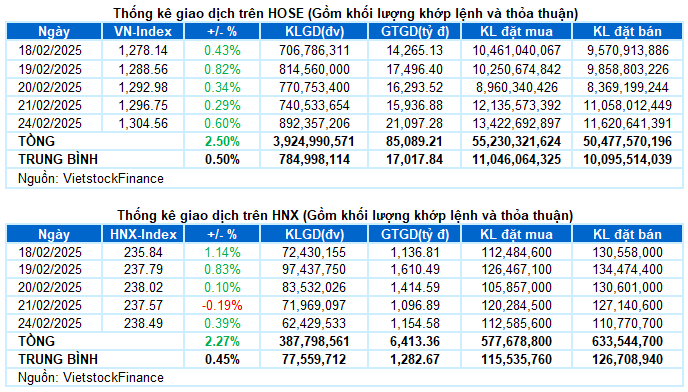

– The main indices witnessed positive growth during the first trading session of the week. The VN-Index closed at 1,304.56 points, a 0.6% increase; while the HNX-Index rose by 0.39% to reach 238.49 points.

– The trading volume on the HOSE reached nearly 808 million units, a 21% increase compared to the previous session. Conversely, the trading volume on the HNX decreased by 10.1%, with over 60 million units traded.

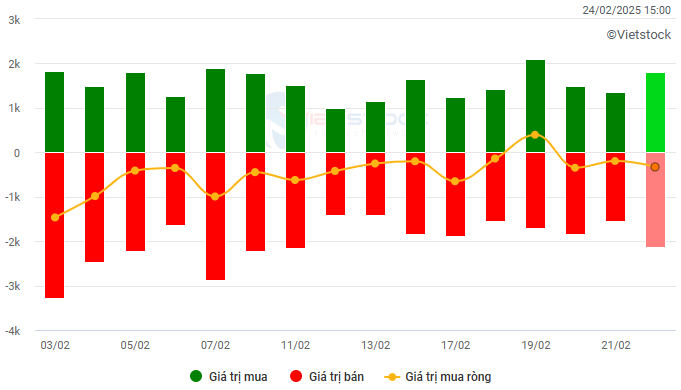

– Foreign investors net sold on the HOSE with a value of over VND 304 billion and net bought over VND 1 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

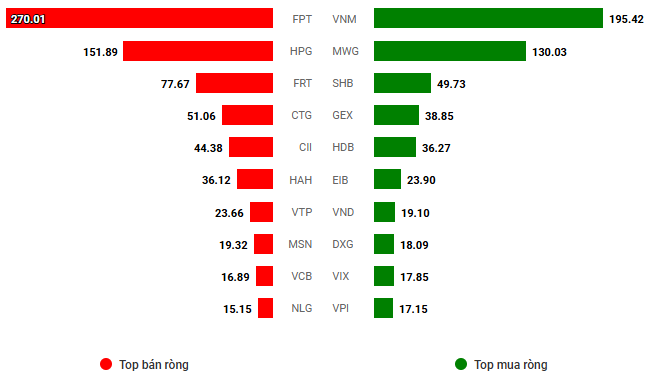

Net trading value by stock code. Unit: VND billion

– The stock market kicked off the week with vibrant movements. After briefly touching the 1,300-point threshold within the first hour of trading, the VN-Index faced familiar pressure at a strong resistance level. This hesitation led to a back-and-forth trading range, but the positive development was a significant increase in liquidity, indicating strong buying power even as profit-taking pressure intensified. The climax occurred towards the end of the session when buyers suddenly surged, propelling the VN-Index to officially break through the resistance and close the session on February 24 with a gain of nearly 8 points, reaching 1,304.56 points.

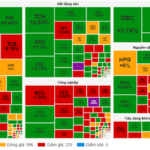

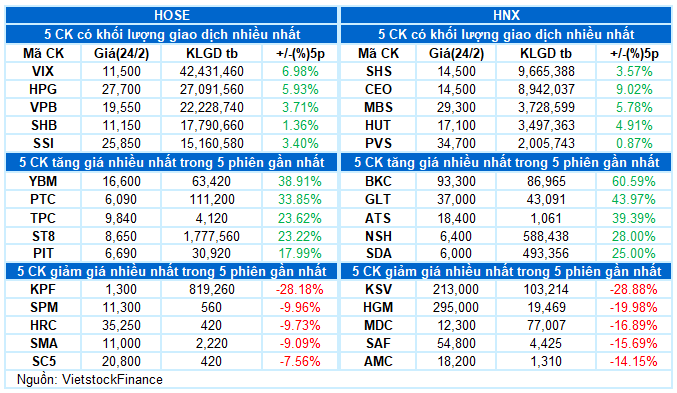

– In terms of impact, HPG was the focal point, contributing up to 2 points to the VN-Index‘s upward momentum. This was followed by VNM, VCB, and CTG, which also traded positively, adding more than 2 points to the index. On the other hand, the opposing pressure was not too strong, as the top 10 stocks with the most negative influence only took away about 1.4 points from the VN-Index, with FPT accounting for more than half a point.

– The VN30 basket significantly contributed to the overall upward momentum, as the VN30-Index rose by nearly 11 points to 1,364.52. The breadth was overwhelmingly positive, with 21 gainers, 6 losers, and 3 unchanged stocks. The top three performers were HPG, VNM, and SSI, with increases of 4.7%, 3.9%, and 2%, respectively. Conversely, FPT went against the general trend, experiencing selling pressure that resulted in a 1.1% decline.

Green dominated the sector performance, although the movements within each group were still quite mixed. On the upside, the essential consumer goods sector recorded the best performance in the market, led by stocks such as VNM (+3.91%), SAB (+1.16%), MML (+6.85%), DBC (+1.61%), BAF (+2.39%), VLC (+2.7%), MCM (+1.85%), and others.

Following closely was the financial sector, which also attracted significant buying interest, particularly in securities stocks after the market successfully “broke through” the 1,300-point threshold. Numerous stocks witnessed impressive gains, including BSI, which hit the daily limit, SSI (+1.97%), HCM (+2.34%), VCI (+1.38%), VND (+1.5%), FTS (+6.64%), SHS (+2.11%), BVS (+3.91%), CTS (+4.55%), ORS (+3.03%), and more.

It is also worth mentioning the notable performance of steel stocks following the news of the Ministry of Industry and Trade’s temporary anti-dumping duties on hot-rolled steel imports from China. Although the momentum cooled compared to the excitement at the beginning of the session, many stocks still closed with outstanding gains, including HPG (+4.73%), TVN (+6.82%), NKG (+2.49%), HSG (+1.99%), VGS (+6.27%), and TIS (+6.06%). However, the stellar performance of steel stocks was not enough to turn the materials sector green for the day, as many other stocks in the sector experienced sharp declines, notably KSV, VIF, MTA, and BMC, which hit the daily lower limit, along with MSR (-13.68%), DPM (-1.08%), CSV (-1.94%), and others.

On the flip side, the telecommunications and information technology groups lagged the market, as strong selling pressure was concentrated in large-cap stocks within these sectors. These included VGI (-4.05%), CTR (-1.99%), YEG (-1.56%), SGT (-3.16%), TTN (-3.79%); FPT (-1.06%), and CMG (-1.23%).

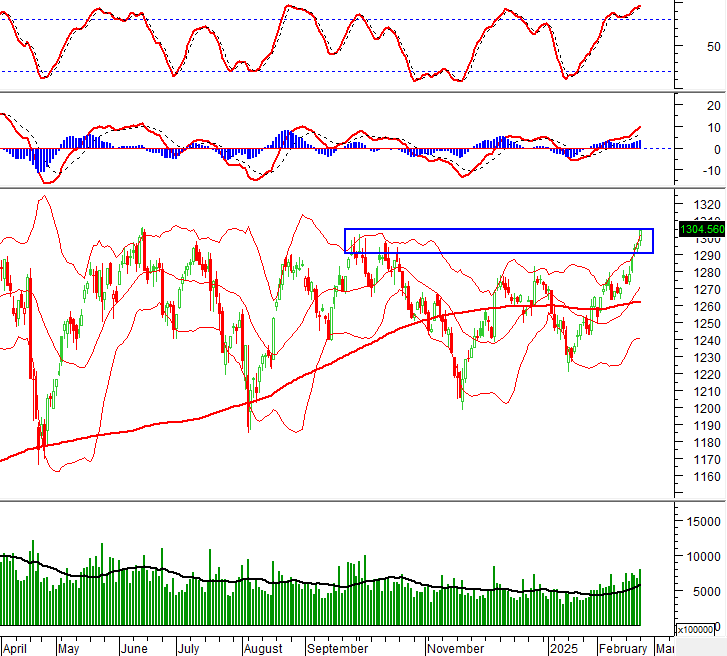

The VN-Index has risen for five consecutive sessions, consistently trading close to the Upper Band of the Bollinger Bands. Additionally, the index is retesting the old peak of October 2024 (equivalent to the 1,290-1,305 range) while the trading volume has been maintained above the 20-day average, indicating stable participation from investors. If the VN-Index breaks through this range in the near future, the outlook will become even more optimistic. However, the Stochastic Oscillator indicator continues to move deeper into the overbought zone, suggesting that the risk of an upcoming correction will increase if sell signals reappear.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Opportunity to Break the Old Peak of October 2024

The VN-Index has risen for five consecutive sessions, consistently trading close to the Upper Band of the Bollinger Bands. Additionally, the index is retesting the old peak of October 2024 (equivalent to the 1,290-1,305 range) while the trading volume has been maintained above the 20-day average, indicating stable participation from investors. If the index breaks through this range in the future, the outlook will be even more positive.

However, the Stochastic Oscillator indicator continues to move deeper into the overbought zone, suggesting a higher likelihood of an upcoming correction if sell signals reappear.

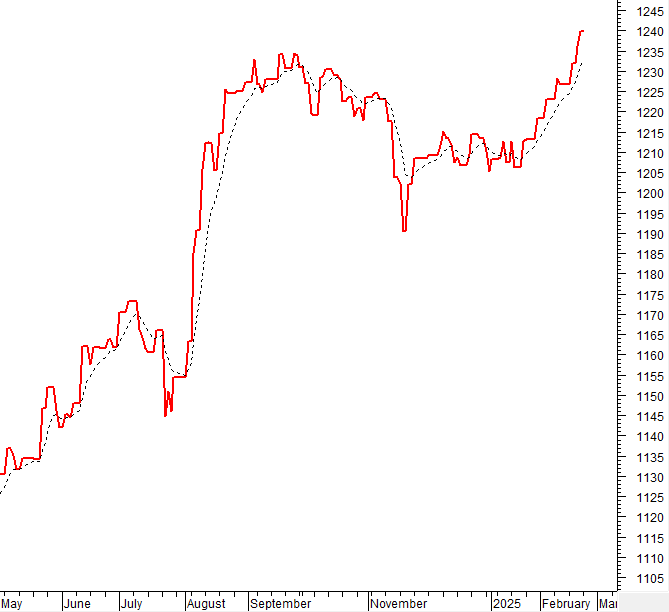

HNX-Index – Stochastic Oscillator Indicator May Give a Sell Signal

The HNX-Index regained positive territory with a strong increase in trading volume after ending its winning streak in the previous session. The trading volume has been maintained above the 20-day average, indicating stable participation from investors. Currently, the index has the opportunity to target the old peak of August 2024 (equivalent to the 239-242 range). If the index surpasses this level, the situation will become even more favorable.

However, the Stochastic Oscillator indicator is moving deeper into the overbought zone and may give a sell signal again. If this happens in the coming sessions, the risk of a correction will increase.

Analysis of Money Flow

Movement of smart money: The Negative Volume Index indicator of the VN-Index has crossed above the EMA 20 day. If this state continues in the next session, the risk of a sudden drop (thrust down) will be limited.

Foreign capital flow: Foreign investors continued to net sell in the session on February 24, 2025. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS FOR FEBRUARY 24, 2025

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 17:12 24/02/2025

Market Beat: Caution Creeps In at the 1,300-Point Threshold

The market closed with the VN-Index down 0.2 points (-0.02%), settling at 1,302.96, while the HNX-Index gained 0.29 points (+0.12%), closing at 238.6. The market breadth tilted slightly in favor of advancers, with 411 gainers against 365 decliners. However, the large-cap stocks in the VN30 basket witnessed a dominance of red, as 18 stocks fell, 10 advanced, and 2 remained unchanged.

Market Beat 27/02: Stocks, Steel and Real Estate Surge to Keep VN-Index Above 1,300

The VN-Index took investors on a wild ride as it breached the 1,300-point threshold in the early afternoon session, only to swiftly rebound and close at 1,307.8 points, a gain of 4.84 points. This dramatic turnaround came after a pressured morning session that saw the index hovering just above the 1,300 mark.

The Market Tug-of-War

The VN-Index declined, sustaining a tug-of-war stance as the High Wave Candle pattern emerged. This reflects investors’ cautious sentiment as the index retests the old peak from October 2024 (1,290-1,305 points territory). Unless the index breaks out of this range soon, a resumption of the downward trend is highly likely. Notably, the Stochastic Oscillator is venturing deep into overbought territory, suggesting a sell signal in the upcoming sessions. Should this materialize, the risks of a market correction intensify.

The Market Tug-of-War: Vietstock Weekly Analysis 03-07/03/2025

The VN-Index continued its impressive upward trajectory, closely hugging the upper band of the Bollinger Bands. Accompanying this rise was a trading volume above the 20-week average, indicative of strong participation and a healthy flow of capital into the market. However, the index’s persistent volatility last week revealed that the 1,300-point mark is a significant resistance level. For the VN-Index to sustain its bullish momentum, breaking through this threshold in the coming period is essential.

Vietstock Daily Recap: Shaking Things Up at the 1,300-Point Threshold

The VN-Index witnessed a slight dip as it faced persistent pressure around the crucial resistance level of 1,300 points, indicating investors’ cautious sentiment. With the index struggling to break free from this range, there’s a significant possibility of a return to a downward trend. Adding to this, the Stochastic Oscillator, a key indicator, has already signaled a sell-off within the overbought territory. This suggests that the risk of a market correction intensifies if the indicator falls out of this zone.