Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 752 million shares, equivalent to a value of more than 16.8 trillion VND; HNX-Index reached over 62.4 million shares, equivalent to a value of more than 1 trillion VND.

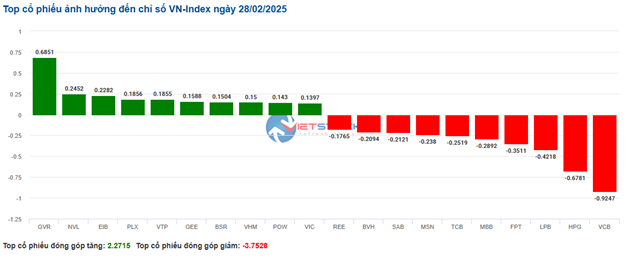

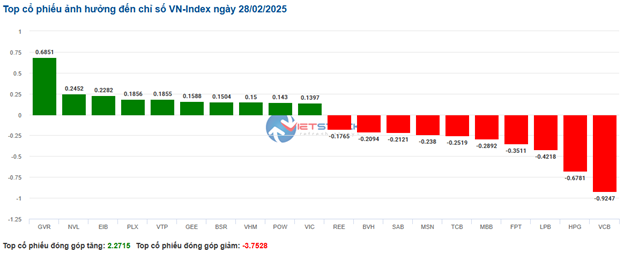

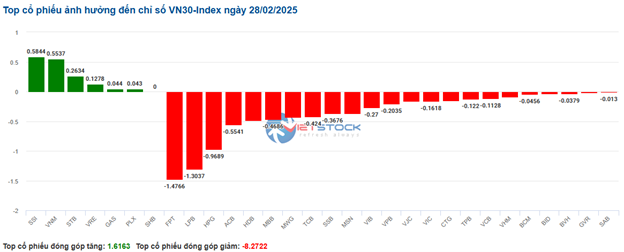

VN-Index opened the afternoon session with a prolonged tug-of-war between buyers and sellers, with the latter gaining the upper hand, causing the index to close in the red. In terms of impact, VCB, HPG, LPB, and FPT were the most negative influences on the VN-Index, causing a drop of more than 2.3 points. On the other hand, GVR, NVL, EIB, and PLX remained in the green and contributed over 1.3 points to the overall index.

Source: VietstockFinance

|

Similarly, the HNX-Index also witnessed a rather negative performance, with the index being negatively impacted by HUT (-1.18%), NTP (-1.82%), MVB (-6.53%), and KSF (-0.99%)…

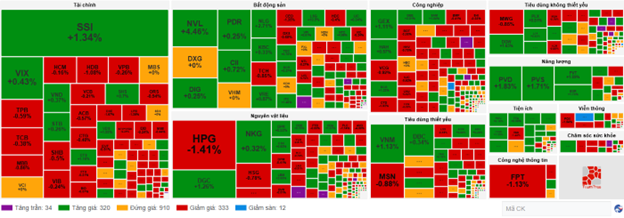

At the close, the market dipped slightly by 0.13%. The information technology sector led the decline with a drop of 0.68%, mainly due to losses in FPT (-0.71%), CMG (-0.11%), CMT (-1.18%), and HPT (-1.33%). This was followed by the financial and consumer staples sectors, which rose by 0.46% and 0.37%, respectively. Conversely, the energy sector witnessed the strongest recovery in the market, climbing by 0.92%, driven primarily by PVS (+1.42%), PVD (+0.81%), POS (+3.05%), and PVC (+1.77%).

Source: VietstockFinance

|

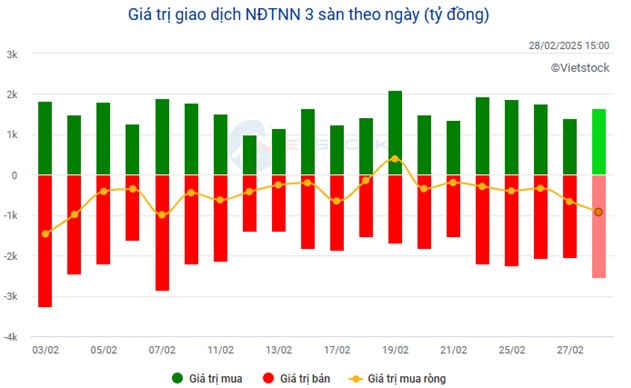

In terms of foreign trading activities, foreign investors continued to net sell on the HOSE exchange, focusing on stocks such as HPG (115.98 billion VND), VHM (99.44 billion VND), MSN (69.57 billion VND), and HCM (57.31 billion VND). On the HNX exchange, foreign investors net sold over 62 billion VND, mainly offloading PVS (19.92 billion VND), SHS (10.66 billion VND), CEO (8.93 billion VND), and MBS (8.71 billion VND).

12:00 PM: Foreigners continued to ramp up selling pressure

After retreating to the 1,300-point region, the VN-Index managed to narrow its losses slightly towards the end of the morning session. At the midday break, the VN-Index lost 2.63 points, or 0.2%, to 1,305.17 points, while the HNX-Index edged up 0.08% to 239.59 points.

Large-cap stocks were the main drag on the indices during the morning session, with the VN30-Index falling nearly 9 points. Specifically, FPT, HPG, LPB, and VCB were the biggest contributors to the decline, taking away more than 2 points from the VN-Index. On the flip side, GVR and VNM offset nearly 1 point for the overall index.

In terms of sector performance, the energy sector stood out with a robust upward momentum as green dominated the sector. Notable gainers included BSR (+1.73%), PVS (+1.42%), PVD (+1.63%), PVC (+2.65%), and POS (+3.82%).

On the contrary, significant pressure from FPT (-1.27%) caused the information technology sector to lag, declining by 1.22%. Other sectors exhibited a mixed performance. The financial sector exerted considerable pressure, with most banking stocks trading in negative territory. Despite the absence of aggressive selling, the sector’s large market capitalization weighed on the overall market performance. Nonetheless, several bright spots were maintained in the securities sector, including SSI (+1.34%), CTS (+1.03%), BSI (+1.11%), VIX (+0.43%), VDS (+1.74%), SHS (+0.7%), CSI (+1.7%), and PSI (+1.25%).

Additionally, multiple stocks in the real estate sector attracted notable buying interest despite the overall gloomy sentiment, such as VRE (+2.03%), NVL (+4.95%), NTC (+5.05%), NLG (+4.51%), and HQC (+3.1%)…

Foreign investors further intensified their net selling pressure, offloading over 590 billion VND across all three exchanges during the morning session. TPB and MSN were the two stocks that witnessed the strongest net selling, with values of approximately 55 billion VND each. On the net buying side, VNM led with a value of around 35 billion VND.

10:30 AM: Sellers dominated the market

Selling pressure intensified compared to the beginning of the session, pushing the main indices below their reference levels. As of 10:30 AM, the VN-Index dropped by more than 10 points, hovering around 1,258 points, while the HNX-Index fell by 0.71 points to trade around 236 points.

Almost all stocks in the VN30 basket encountered strong selling pressure. Specifically, FPT, LPB, HPG, and ACB subtracted 1.47 points, 1.3 points, 0.97 points, and 0.55 points from the index, respectively. Conversely, SSI, VNM, STB, and VRE were among the few stocks that managed to stay in positive territory, although their gains were not significant.

Source: VietstockFinance

|

The information technology sector recorded the most significant weakness in the market, declining by 1.14%. Notable losers within the sector included FPT, which fell by 1.2%, along with ITD (-1.34%), CMT (-0.59%), and POT (-2.23%)…

Following closely was the telecommunications sector, where red dominated, with VGI losing 0.25%, FOX declining by 1.94%, CTR dropping by 1.16%, and SGT falling by 0.24%…

Additionally, the financial sector faced selling pressure across most stocks, exerting a considerable impact on the overall market. Notable losers included VCB, which fell by 0.21%, along with BID (-0.37%), CTG (-0.36%), and TCB (-0.19%)… Only a handful of stocks managed to stay in the green, including SSI, which rose by 1.53%, STB (+0.26%), VCI (+0.14%), and VND (+0.73%)…

In contrast, the energy sector displayed a rather optimistic performance, surging by 1.64%. Buying interest was concentrated mainly in oil and gas stocks, such as PVS, which climbed by 1.71%, PVD (+1.83%), POS (+3.82%), and PVC (+2.65%)…

Compared to the opening, the tug-of-war between buyers and sellers continued, with sellers slightly gaining the upper hand. There were 333 declining stocks (including 12 at their lower limits) and 320 advancing stocks (including 34 at their upper limits).

Source: VietstockFinance

|

Opening: VN-Index witnessed a tug-of-war

At the start of the February 28 session, as of 9:30 AM, the VN-Index fluctuated around the reference level, reaching 1,307.09 points. The HNX-Index also edged higher, touching 240.14 points.

As of 9:30 AM, red dominated the VN30 basket, with 22 declining stocks, 7 advancing stocks, and 1 stock trading unchanged. Among them, FPT, BVH, SSB, and BCM were the top losers. Conversely, SSI, GAS, VNM, and PLX were the top gainers.

The energy sector exhibited positive signals right from the start, climbing by 2.15%. Green dominated the sector, with notable gainers including PVS, which rose by 2.28%, along with PVD (+2.04%), PVC (+2.65%), PVB (+0.56%), and MGC (+5.88%)…

On the other hand, the information technology sector witnessed declines and exerted a relatively negative impact on the overall market performance. Notable losers within the sector included FPT, which fell by 0.99%, along with CMG (-0.34%) and CMT (-2.35%)…

– 09:37 28/02/2025

Is the Uptrend Supported?

The VN-Index rebounded with a Hammer candlestick pattern, reflecting investors’ optimism as the index broke through the old peak of October 2024 (1,290-1,305 points). This bullish sentiment is further reinforced by the MACD indicator, which continues to trend upward, providing a buy signal. If the index sustains levels above this threshold, accompanied by high trading volume, the upward trajectory will be solidified.

Steady Growth Surge: Vietstock Daily’s Insight for 25/02/2025

The VN-Index has been on a remarkable run recently, with five consecutive sessions in the green, closely hugging the upper band of the Bollinger Bands. What’s more, the index is retesting the old peak from October 2024 (1,290-1,305 points) amid sustained trading volumes above the 20-day average, indicating consistent participation from investors. Should the VN-Index decisively breach this zone, the outlook would turn even more bullish. However, the Stochastic Oscillator, now deeply embedded in overbought territory, suggests that the risk of a correction will heighten if sell signals reemerge.

Market Beat: Caution Creeps In at the 1,300-Point Threshold

The market closed with the VN-Index down 0.2 points (-0.02%), settling at 1,302.96, while the HNX-Index gained 0.29 points (+0.12%), closing at 238.6. The market breadth tilted slightly in favor of advancers, with 411 gainers against 365 decliners. However, the large-cap stocks in the VN30 basket witnessed a dominance of red, as 18 stocks fell, 10 advanced, and 2 remained unchanged.

Market Beat 27/02: Stocks, Steel and Real Estate Surge to Keep VN-Index Above 1,300

The VN-Index took investors on a wild ride as it breached the 1,300-point threshold in the early afternoon session, only to swiftly rebound and close at 1,307.8 points, a gain of 4.84 points. This dramatic turnaround came after a pressured morning session that saw the index hovering just above the 1,300 mark.

The Market Tug-of-War

The VN-Index declined, sustaining a tug-of-war stance as the High Wave Candle pattern emerged. This reflects investors’ cautious sentiment as the index retests the old peak from October 2024 (1,290-1,305 points territory). Unless the index breaks out of this range soon, a resumption of the downward trend is highly likely. Notably, the Stochastic Oscillator is venturing deep into overbought territory, suggesting a sell signal in the upcoming sessions. Should this materialize, the risks of a market correction intensify.