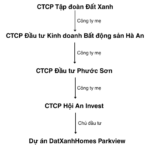

The Joint Stock Company Dat Xanh Group (code DXG-HOSE) announces the resolution of the Board of Directors on additional capital contribution to its subsidiary, Ha An Real Estate Investment and Trading JSC.

Accordingly, DXG’s Board of Directors has approved a plan to privately offer 93.5 million shares, equivalent to an offering rate of 9.18%, and the number of professional securities investors participating in the offering is less than 20.

The expected offering price is VND 18,600 per share, and it is estimated that if the issuance is successful, VND 1,739.1 billion will be raised to contribute capital to its subsidiary, Ha An Real Estate Investment and Trading JSC, which contributes capital to members to implement the high-rise apartment project – commercial services with a green vision (DatXanhHomes Parkview).

The DatXanhHomes Parkview project in Ho Chi Minh City (formerly Thuan An – Binh Duong) has an area of 103,889 m2 and an investment capital of VND 1,680 billion.

The privately issued shares are restricted from transfer for 1 year from the end of the offering period. The expected issuance time is from the third to the fourth quarter of 2025, after being approved by the SSC. If the transaction is successful, Dat Xanh will continue to own 99.99% of the charter capital at Ha An.

It is known that DXG announced its business results for Q2/2025 with revenue of VND 1,000 billion (-7% over the same period last year but +13% over the same quarter last year) and after-tax profit after minority interests reached VND 84 billion (+157% over the same period). last year and +75% over the same period last year)

VCSC believes that DXG’s after-tax profit after minority interests in Q2/2025 was higher, mainly due to: First, the positive results of brokerage activities; Second, the handover of unrecorded apartments at Gem Sky World (GSW; about 4,000 low-rise apartments; about 60% sold and about 48% handed over by the end of Q1/2025)

DXG’s after-tax profit after minority interests in the first 6 months of 2025 reached VND 133 billion (+107% over the same period last year) and completed 49% of VCSC’s full-year forecast. VCSC sees no significant changes to VCSC’s profit and sales forecasts for DXG, although a detailed evaluation is needed.

Also, according to VCSC, DXG’s real estate development revenue in the first 6 months of 2025 decreased by 34% over the same period last year, mainly due to the scheduled handover at GSW (compared to the handover of high-rise Opal Skyline in the first 6 months of 2024). In addition, the gross profit margin of this segment improved by 4 percentage points to 44%.

In terms of sales outlook, VCSC expects the ‘The Privé’ project (4.3 ha; Ho Chi Minh City; a total of about 3,200 apartments) will be the main sales driver for DXG in 2025. This project has opened booking while the company is completing the foundation construction to obtain the project’s sales license.

In addition, VCSC expects the progress of Long Thanh International Airport will support the restart of GSW (Dong Nai; low-rise) in the last 6 months of 2025.

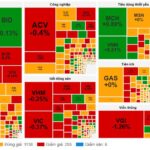

The Market Beat on December 24th: Strong Inflows in the Afternoon Session See VN-Index Recover to Near Reference.

Despite a negative mid-session turn, the market recovered to close near reference levels today. The VN-Index ended at 1,260 points, a minor loss of 2.4 points, while the HNX-Index dipped 0.15 points to 228.36 points.

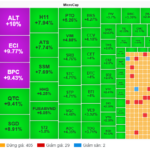

Market Beat: Real Estate and Finance Sectors Lead the Recovery, VN-Index Surges Over 11 Points

The market closed with strong gains, as the VN-Index rose by 11.39 points (0.95%) to reach 1,216.54, while the HNX-Index climbed 1.61 points (0.73%) to 221.29. The market breadth tilted heavily in favor of bulls, with 471 advancing stocks against 247 declining ones. The large-cap stocks in the VN30 basket painted a similar picture, with 24 gainers, 2 losers, and 4 stocks closing flat.