The market witnessed its second consecutive boom session with massive liquidity. VN-Index surged 2.41% this morning and reached a new all-time high of 1565.03 points. Notably, the HoSE matching liquidity soared by 109% compared to yesterday morning, reaching VND31,723 billion, just shy of the historical peak of VND35,451 billion on July 29 morning.

Following yesterday’s robust gain of nearly 33 points (2.21%), the index climbed a further 36.84 points (2.41%) today. This “double boost” occurred just two sessions after the market rebounded from the “tariff bottom” at the beginning of April. The difference this time is that the jump pushed the index to a new historic peak, although it eased slightly by around 5.45 points from its 11:10 am high.

Today’s highlight was the reappearance of substantial liquidity, although it fell short of the July 29 session. In contrast to the previous session’s aggressive selling, today witnessed a frenzied buying spree. The HoSE breadth was positive with 221 gainers and 105 losers, including 109 stocks rising over 1%, of which 65 climbed more than 2%.

The large-cap VN30-Index climbed an impressive 2.98%, with 27 gainers and only two losers, underscoring the strength of blue-chip stocks. VIC hit the ceiling and returned to its July 2025 peak, contributing nearly 6.8 points. VHM rose 5.31%, while MBB, TCB, VCB, CTG, VPB, and HPG all posted robust gains, ranging from 1.64% to 5.31%, and were among the top 10 stocks by market capitalization on the HoSE. The influence of bank stocks was evident, with seven out of the top 10 stocks contributing over 26 points to the VN-Index’s rise.

TPB and MBB, from the banking group, surged to their daily limit, while 18 other stocks in this sector climbed over 2%. The entire group was in the green, except for VAB and BAB, which rose less than 1%. Bank stocks also dominated today’s top liquidity, occupying six out of the top 10 spots. TCB led with a matching value of VND1,626.4 billion, followed by SHB with VND1,268.4 billion, MBB with VND1,230.3 billion, and TPB with VND1,176.8 billion.

SAB, down 0.62%, and BCM, down 0.85%, were the only two red stocks in the VN30 basket, with FPT referencing. Twenty-two stocks in this basket rose over 1%, including 17 climbing more than 2%. This clearly demonstrates the strength of blue-chip stocks, regardless of capitalization differences.

The rest of the market also witnessed robust gains. Several mid-cap stocks showed strong performance among the 65 stocks that rose over 2%. VND climbed 2.58% with a liquidity of VND938.7 billion; GEX rose 6.54% with VND821.6 billion; VCI gained 6.72% with VND640.9 billion; and KBC increased by 6.34% with VND503.7 billion. The mid-cap representative index also climbed 1.68%.

However, the heat was not evident this morning, as only six stocks on the HoSE hit the ceiling: VIC, EVG, TTF, TPB, MBB, and HAR. The small-cap group lagged with a modest gain of 0.65% and accounted for only 7.5% of the market’s liquidity. Last week, this basket averaged 9.5% of HoSE liquidity, and yesterday it accounted for 9.8%. Currently, liquidity is mostly concentrated in the VN30 basket, with 55.6%, and the mid-cap group, with 35.8%. Notably, the VN30 basket set a new historical record this morning, with over VND17,645 billion in trading value, surpassing the previous peak of VND14,581 billion on July 29 morning.

This exceptionally high liquidity is also attributed to substantial profit-taking activities, although they have not significantly impacted prices. Most investors opted to sell simultaneously, waiting for buyers to match their orders. In the VN30 basket, except for the three ceiling-hitting stocks, all other stocks retreated from their highest levels. A few stocks experienced sharp declines, such as SHB, which fell 3.0% from its peak, and VJC, which dropped 2.27%. Thirteen other stocks in this basket fell by around 1%. Expanding to the entire HoSE, approximately 42.7% of the stocks that traded this morning witnessed price declines of 1% or more. This indicates varying levels of profit-taking pressure across stocks.

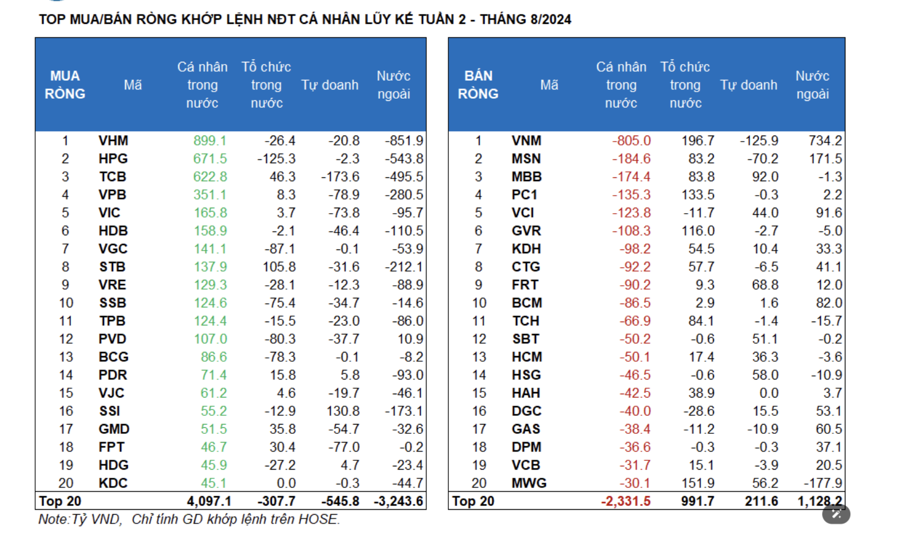

Foreign investors recorded net selling on the HoSE, totaling VND410 billion, lower than yesterday’s net selling of VND628.7 billion. The heavily sold stocks included VIX, SHB, FPT, VPB, VND, SSI, GEX, and VSC. On the buying side, HPG, VIC, GMD, STB, VCB, CTG, MSN, and BID were among the most notable stocks.

Stock Market Blog: Euphoria Turns to Pain?

The market witnessed yet another massive liquidity session with a staggering 82.6 trillion across the three exchanges, following the session on July 29, which saw nearly 79.7 trillion. The VNI was pushed to new heights, stimulating a frenzy of ‘mad’ buying before a sell-off emerged.

The Vietstock Daily: Back on the Upward Trend

The VN-Index witnessed a robust surge and maintained its position above the middle line of the Bollinger Bands. However, a cautionary signal is flashing with the trading volume dipping below the 20-session average. Additionally, the Stochastic Oscillator is exhibiting continued weakness after issuing a sell signal and exiting the overbought territory. Investors should remain vigilant as the risk of volatility persists around the April 2022 peak levels of 1,480-1,530 points.

Market Pulse for August 4th: VIC Records Nearly 10,000 Billion VND in Trading Deals

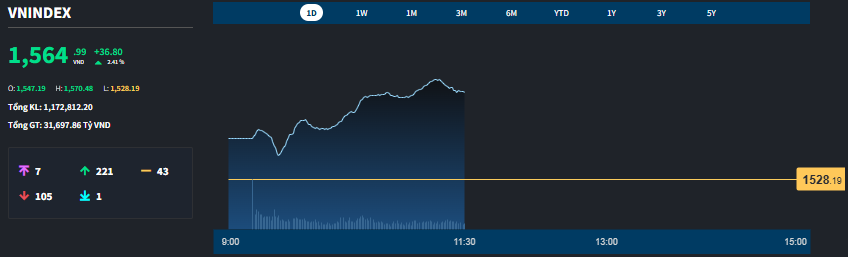

The trading session ended on a positive note, with the VN-Index surging 32.98 points (+2.21%), reaching 1,528.19. The HNX-Index also witnessed a significant boost, climbing 3.41 points (+1.29%) to close at 268.34. The market breadth tilted heavily in favor of advancers, with 498 gainers overwhelming 257 decliners. This bullish sentiment was echoed in the VN30 basket, where 29 stocks advanced, dwarfing the solitary decliner.

Stock Market Update for July 28 – August 1, 2025: Navigating Foreign Outflows

The VN-Index witnessed a decline during the week’s final session, concluding the week’s trading below the 1,500-point mark. Despite the medium-term uptrend remaining technically intact, the index’s failure to hold the crucial psychological support level, coupled with sustained foreign net selling pressure, presents notable signals for investors. Should this trend persist, further market adjustments are likely on the horizon.

The Market Beat: Foreigners Turn Net Buyers, VN-Index Recovers Over 14 Points

The trading session concluded with significant gains, as the VN-Index rose by 14.22 points (+0.95%), closing at 1,507.63. Meanwhile, the HNX-Index also witnessed a notable increase of 6.15 points (+2.41%), finishing the day at 261.51. The market breadth tilted in favor of advancers, with 426 tickers in the green and 337 in the red. Similarly, the VN30 basket painted a bullish picture, as 20 stocks advanced, 9 declined, and 1 remained unchanged, ending the day on a positive note.