Novaland Investment Group Joint Stock Company (coded NVL on HoSE) announces Resolutions No. 46 & 47 dated August 4, 2025, and updates on the Extraordinary General Meeting (EGM) documents in 2025.

Specifically, NVL announces two proposals. The first is the “Plan for a convertible loan.” Accordingly, the NVL Board of Directors proposes that the company considers and approves a capital mobilization plan in the form of a loan with the right to convert part or all of the principal balance into the company’s shares, with a total expected value of up to VND 5,000 billion. The term is five years from the disbursement date.

NVL is the borrower and has the right to prepay or the lender has the right to collect the debt in part or in full after three years from the disbursement date.

The conversion period is 12 months, with a conversion price of 115% of the NVL closing price on the last fifth trading day, including the final disbursement date.

The second proposal is the “Plan for private placement of shares to swap debt.” Accordingly, the Company plans to issue 168,014,696 private placement shares to swap a total debt of more than VND 2,645 billion, with an issuance price of more than VND 15,746 per share. Thus, a debt value of more than VND 15,746 will be swapped for one newly issued ordinary share. The conversion price is determined based on the average closing price of Novaland shares on the Ho Chi Minh City Stock Exchange (HoSE) from June 19 to July 30, 2025. The ratio of the number of shares issued to the total number of outstanding shares is more than 8.6%.

If successful, the company’s charter capital will increase from more than VND 19,501 billion to over VND 21,181 billion.

After the general meeting approves the plan for the issuance of shares to swap debt, Novaland will submit it to the State Securities Commission for approval to implement the necessary procedures, in accordance with the law, to carry out the issuance plan. The expected implementation time is in Q4/2025 to Q1/2026.

NVL also announced the list of creditors for the issuance of shares to swap debt, including NovaGroup, Diamond Properties, and Ms. Hoang Thu Chau, based on the list of creditors related to Note V.19 – Payables from the sale of collateralized shares of the guarantors as of December 31, 2024, presented in NVL’s audited separate financial statements for 2024. These creditors have also reached an agreement in principle on debt swapping with Novaland.

This is the amount that Novaland has to pay to the parties who pledged their shares for secured loans to enable the company to fulfill its payment obligations. During Novaland’s most challenging period, these shareholders committed to accompanying and supporting the company to settle due debts when necessary and maintain continuous operations.

As of December 31, 2024, the debt balances of NovaGroup, Diamond Properties, and Ms. Hoang Thu Chau were approximately VND 2,527 billion, nearly VND 112 billion, and nearly VND 7 billion, respectively. Accordingly, the number of shares expected to be used by Novaland for debt swapping with NovaGroup, Diamond Properties, and Ms. Chau is about 160 million shares, nearly 71 million shares, and 424,000 shares, respectively.

Thus, after the private placement share issuance for debt swapping, the total ownership ratio of the major shareholder group (NovaGroup and Diamond Properties) and the family of Mr. Bui Thanh Nhon – Chairman of NVL’s Board of Directors, is expected to reach 42.4% of the charter capital.

These privately placed shares for debt swapping will be restricted from transfer for one year from the end of the issuance. After the debt-to-equity swap, the debts will be written off, and the creditors will become shareholders, holding ordinary shares of the company.

For Novaland, the debts swapped for shares will be accounted for to increase owners’ equity. The swapped debts will be written off, and Novaland will no longer have obligations regarding these debts.

On August 5, NVL shares closed at VND 18,000 per share, down 2.44%.

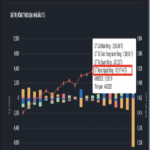

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

The Power of Differentiation: Small and Mid-Cap Stocks Make a Striking Comeback

While the blue-chip stocks dragged the broader index down, the mid and small-cap stocks surged. 21 stocks hit the roof, and nearly 100 others gained over 1%, an unusual phenomenon as the VN-Index dipped.