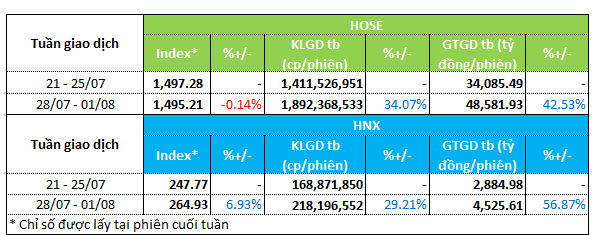

The trading week of July 28 – August 1 witnessed a euphoric session on July 28, with the VN-Index reaching a record high of 1,557 points. However, a correction followed, and the HOSE benchmark index ended the week almost flat, dipping 0.1% to 1,495.2 points. In contrast, the HNX-Index surged 7% during the week to near 265 points.

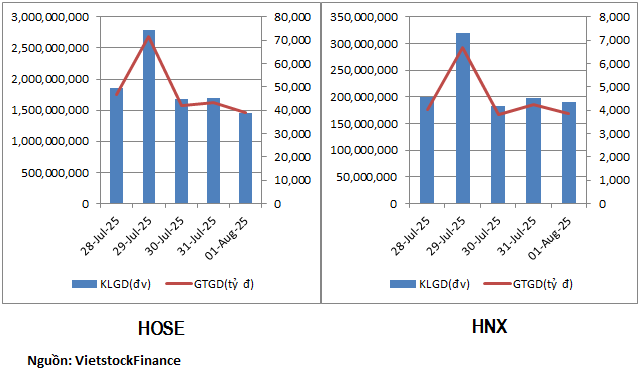

At the new peak, market liquidity surged. The HOSE recorded a 34% increase in average trading volume to nearly 1.9 billion units per session, while trading value rose over 40% to VND48.5 trillion per session.

On the HNX exchange, trading volume rose 30% to 218 million units per session, while trading value climbed nearly 60% to VND4.5 trillion per session.

The market also witnessed a record trading session on July 29, with liquidity surpassing VND80 trillion.

|

Weekly Liquidity Overview for July 28 – August 1

|

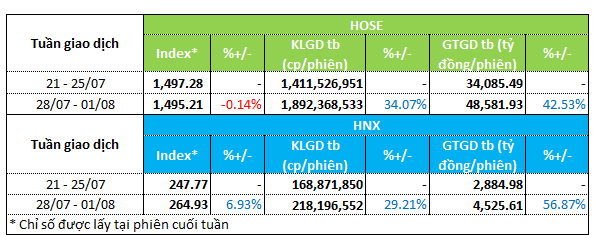

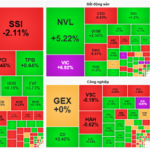

While liquidity surged, sectoral trends indicated a divergence in fund flows. Real estate and construction sectors stood out.

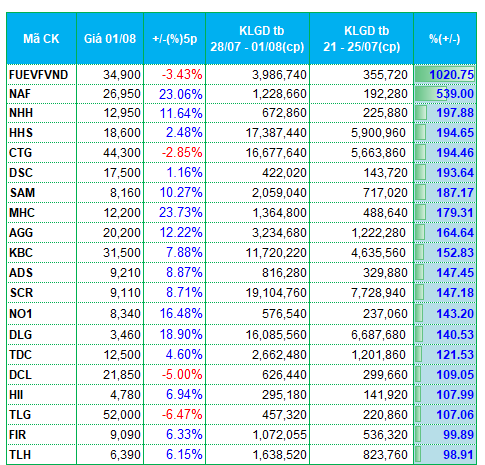

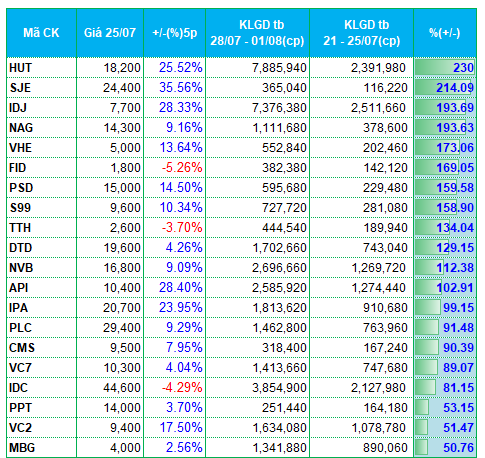

In the real estate sector, stocks like AGG, KBC, TDC, FIR, IDJ, DTD, IDC, and API were among the top gainers in liquidity. On the other hand, PTL, D2D, BCG, and NRC witnessed a decline in trading activity.

In the construction sector, SJE, S99, CMS, and VC2 saw increased trading volume, while VIG, HTI, DRH, BCE, TCD, C69, LIG, and MST experienced fund outflows.

Among the sectors attracting investment, the electrical equipment group also performed well. SAM, NAG, and MBG witnessed liquidity increases ranging from 50% to nearly 200%.

Funds continued to exit the insurance sector, with BMI and MIG recording a 25% drop in trading volume compared to the previous week. In the financial sector, some securities stocks on the HNX exchange experienced mild outflows. WSS, IVS, and EVS saw trading volume declines ranging from 3% to 14%.

|

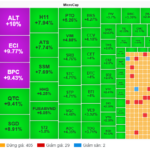

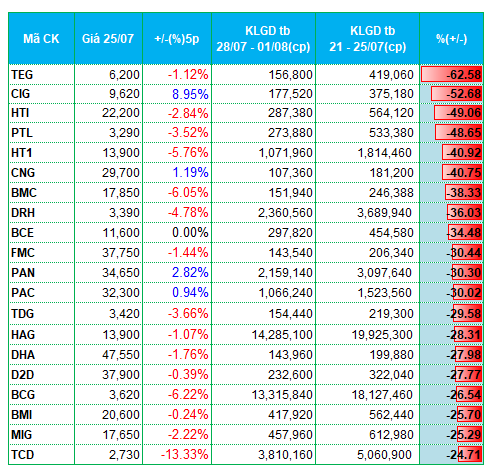

Top 20 Stocks with Highest Liquidity Increase/Decrease on the HOSE

|

|

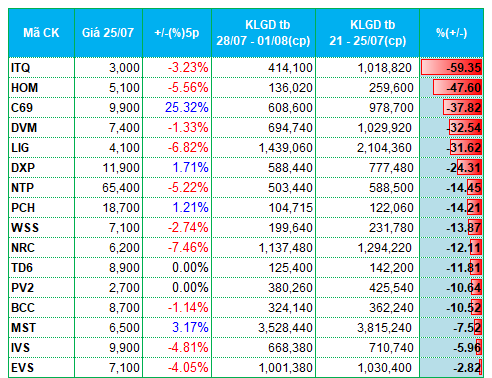

Stocks with Highest Liquidity Increase/Decrease on the HNX

|

The lists of stocks with the highest and lowest liquidity changes are based on a minimum average trading volume of 100,000 units per session.

– 7:28 PM, August 4, 2025

The Liquidity Boom: VN-Index Hits All-Time High, Foreigners Sell Over VND 410 Billion

The market witnessed a second consecutive boom day with massive liquidity. VN-Index surged 2.41% this morning, reaching a new all-time high of 1565.03 points. Notably, the trading volume on the HoSE exchange surged by 109% compared to yesterday’s morning session, reaching VND 31,723 billion, just shy of the historical peak of VND 35,451 billion on the morning of July 29th.

The Great Retail Reset: Institutions Dump Stocks en Masse, Offloading 1.3 Trillion, as Retail Investors Try to “Ride the Wave”

Today, proprietary trading witnessed a net sell-off of 1,314 billion VND, with a significant sell-off of 823.8 billion VND in matched orders. In contrast, individual investors displayed confidence with a net buy position of 2,725.3 billion VND.

The Vietstock Daily: Back on the Upward Trend

The VN-Index witnessed a robust surge and maintained its position above the middle line of the Bollinger Bands. However, a cautionary signal is flashing with the trading volume dipping below the 20-session average. Additionally, the Stochastic Oscillator is exhibiting continued weakness after issuing a sell signal and exiting the overbought territory. Investors should remain vigilant as the risk of volatility persists around the April 2022 peak levels of 1,480-1,530 points.

Market Pulse for August 4th: VIC Records Nearly 10,000 Billion VND in Trading Deals

The trading session ended on a positive note, with the VN-Index surging 32.98 points (+2.21%), reaching 1,528.19. The HNX-Index also witnessed a significant boost, climbing 3.41 points (+1.29%) to close at 268.34. The market breadth tilted heavily in favor of advancers, with 498 gainers overwhelming 257 decliners. This bullish sentiment was echoed in the VN30 basket, where 29 stocks advanced, dwarfing the solitary decliner.