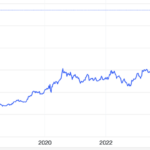

Global gold prices rose overnight and this morning (August 6) but with a cautious increase as the possibility of a US Federal Reserve (Fed) rate cut in September rises, while the US dollar remains firm. Investors are also cautious ahead of President Donald Trump’s announcement of the Fed chair nominee.

At 8:10 am Vietnam time, the spot gold price in the Asian market rose by $0.9/oz compared to the closing of Tuesday’s session in the US, equivalent to a 0.03% increase, trading at $3,382.3/oz, according to Kitco exchange data. This is equivalent to nearly VND 107.7 million/lotte, up VND 400,000/lotte compared to yesterday morning, based on Vietcombank’s USD selling exchange rate.

At the same time, Vietcombank quoted the USD at VND 26,030 (buying) and VND 26,420 (selling), up VND 50 at each price compared to the previous day.

In the New York session last night, spot gold closed at $3,381.4/oz, up $6.1/oz from the previous session’s close, equivalent to a rise of 0.18%.

Analysts say gold prices are fluctuating between two contrasting factors.

On the one hand, the precious metal is supported by the market’s increasing bets on the possibility of a 0.25 percentage point rate cut by the Fed in September, which currently stands at more than 92%, according to data from the FedWatch Tool of the CME exchange, up from less than 50% after the Fed meeting last week.

On the other hand, gold prices are facing downward pressure from the firm US dollar. The Dollar Index, which measures the greenback’s strength against six other major currencies, closed Tuesday at 98.78 points, unchanged from Monday’s session. This morning, the index traded slightly higher around 98.8 points.

Recently, the US dollar’s recovery trend has been a hindrance to gold’s breakthrough. Despite falling more than 1% in the last five sessions due to the increased possibility of a September rate cut, the US dollar has still gained nearly 1.3% in the past month, according to MarketWatch data.

Strategist Bob Haberkorn of RJO Futures said the strong US dollar is putting downward pressure on gold, but the precious metal is receiving support from expectations of a September rate cut.

The recent weak economic data from the US has also reinforced the possibility of two rate cuts this year, each by 0.25 percentage points.

On Tuesday, the Institute for Supply Management (ISM) reported that the services PMI was unchanged in July. This data heightened concerns that the world’s largest economy could be heading towards stagflation – a fear that emerged after Friday’s employment data. Services account for about 70% of the US economy, so a slowdown in this sector means the economy may face more obstacles ahead.

Market sentiment became more cautious as Trump said on Tuesday that he would soon announce some important Fed appointments. The US President will announce the short-term replacement for Fed Governor Andriana Kugler, who unexpectedly announced his resignation last Friday, and the nominee to replace Fed Chairman Jerome Powell, whose term ends in May next year.

In the past, as Trump has repeatedly pressured Powell to cut rates, investors have worried that the independence of the central bank will not be maintained. This has also motivated investors to hold gold as a risk hedge.

The world’s largest gold ETF, SPDR Gold Trust, continued to buy gold in the Tuesday session, with a net purchase of 1.1 tons, bringing its holdings to 955.9 tons, according to the fund’s website. In the first two sessions of the week, the fund bought a net of 2.8 tons of gold.

Gold Prices Maintain Uptrend Amid Fed Rate Cut Expectations

The price of gold surged on Friday after a disappointing jobs report from the U.S. Labor Department. The report, which fell short of expectations, revealed a sluggish jobs market with a mere 132,000 non-farm jobs added in July. This prompted a rush to safe-haven assets, with gold leading the charge.

Gold Prices Dip on Monday, but Short-Term Outlook Remains Positive

The outlook for gold prices is looking brighter, with the precious metal poised to reclaim the $3,400/oz mark. This is according to market analysts who foresee a short-term boost for the commodity.