Illustrative image

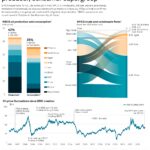

According to Reuters data, Venezuela’s crude oil exports fell by around 10% in July compared to the previous month, as many key partners of the state-owned oil company PDVSA are awaiting US permission to resume or expand their operations in the South American country.

Vessel tracking data and PDVSA internal documents show that Venezuela exported an average of 727,000 barrels per day (bpd) of crude oil and refined products in July, down from 807,000 bpd in June. Exports of petroleum and petrochemical by-products stood at 227,000 tons, almost unchanged from the previous month.

Among the destinations, China remained the primary market, accounting for about 95% of Venezuela’s total oil exports last month. Additionally, Cuba received approximately 31,000 barrels per day of crude oil, gasoline, and aviation fuel.

Towards the end of July, the Washington administration granted Chevron, a major US oil producer, a license to continue operations and export oil from Venezuela to the US. However, this license comes with restrictions, notably prohibiting direct payments to President Nicolas Maduro’s government.

Chevron’s CEO, Mike Wirth, stated that the company expects to resume Venezuela oil exports to the US this month but in “limited quantities.” He did not disclose the specific terms of the license.

Chevron’s exports from Venezuela had been suspended since April when PDVSA canceled scheduled shipments with its joint venture partner due to payment issues related to US sanctions.

Many of PDVSA’s other partners have not yet received similar licenses from the US government to resume or increase their oil purchases. Previously, in March, the Donald Trump administration had revoked licenses and authorizations for PDVSA’s partners, forcing Venezuela to divert many shipments to the Chinese market.

An internal document shows that in the last week of July, Venezuela’s main oil port, the Jose port, was almost empty due to restricted export volumes, leading to high inventories of heavy crude oil and diluents.

Following the reinstatement of its license, Chevron is negotiating a new oil purchase agreement with PDVSA as Venezuela faces a severe cash shortage. According to sources close to the matter, the new deal may include payments of royalties and taxes to the Venezuelan government in the form of in-kind goods, such as a portion of jointly produced crude oil or through oil swap transactions, with Chevron providing diluents to Venezuela.

The resumption of Chevron’s exports, even on a limited scale, marks an important step in the energy relationship between the US and Venezuela. However, the outlook for Venezuela’s oil export growth remains largely dependent on policy decisions from Washington, as well as the potential recovery of the supply chain and infrastructure, which have been affected by years of crisis and sanctions.

How US Sanctions Unwittingly Turned Huawei into China’s Tech “Trump Card”

It turns out that US sanctions on Huawei are inadvertently fueling the growth of China’s tech industry.

China’s New Oil Partners: A Diverse Portfolio of Affordable Suppliers, Including a Sanctioned One

The Chinese refineries are going all out to import crude oil from these countries before Trump officially takes office next year.