Financial literacy is key to empowering Gen Z with the financial mindset and skills they need to navigate their financial freedom in the digital age through safe, effective, and transparent investment channels.

At the launch event of “The Moneyverse” program, Mr. Pham Luu Hung, Chief Economist and Head of Training and Development at SSI Securities Corporation, emphasized that investing education for young people is a top priority for market development. Financial education is no longer an elective; personal financial management is an essential life skill in today’s world.

“Market development encompasses not only upgrading the market from a frontier to an emerging one but also, more importantly, developing the investor base and upgrading investors from F0 to professionals,” stressed Mr. Hung.

He added, “Programs like The Moneyverse benefit both parties. Young people get to engage in entertaining financial education activities that combine learning with hands-on experience, while securities companies like SSI gain a deeper understanding of the new generation of investors who will shape the market’s future.”

SSI has always welcomed young talents passionate about the finance and securities industry to join their team. The Moneyverse is one such initiative.

Besides partnering to create content and impart investment knowledge through competitive challenges, SSI also educates financial skills through novel, engaging, and youth-friendly formats in the form of side-experience activities.

This event also marks the debut of Moneyescape – Vietnam’s first and only escape room themed around financial investment, developed by SSI.

Moneyescape unfolds the story of the SSI24 spaceship, endowed with hidden powers. It serves as the ultimate weapon to conquer the five planets in The Moneyverse: the Planet of Earning, Spending, Saving, Accumulating, and Investing.

Through their journey and conquest of the four states of an investor’s journey, represented by the distinctive colors on the stock market’s electric board: Z doesn’t fear Red, Lơ the Noise, Take a Lục, and Purple Hít, the astronauts will discover and harness the power of the spaceship to conquer the Investing Planet, considered the largest and most enigmatic planet in The Moneyverse.

By delivering investment knowledge in creative ways, SSI aims to offer young people a fresh perspective on investing, fostering financial awareness and driving the healthy, transparent, and sustainable development of Vietnam’s stock market as it stands at the threshold of market upgrade.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

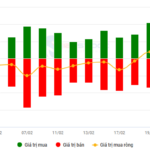

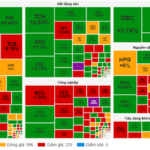

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

Is the Uptrend Supported?

The VN-Index rebounded with a Hammer candlestick pattern, reflecting investors’ optimism as the index broke through the old peak of October 2024 (1,290-1,305 points). This bullish sentiment is further reinforced by the MACD indicator, which continues to trend upward, providing a buy signal. If the index sustains levels above this threshold, accompanied by high trading volume, the upward trajectory will be solidified.

Steady Growth Surge: Vietstock Daily’s Insight for 25/02/2025

The VN-Index has been on a remarkable run recently, with five consecutive sessions in the green, closely hugging the upper band of the Bollinger Bands. What’s more, the index is retesting the old peak from October 2024 (1,290-1,305 points) amid sustained trading volumes above the 20-day average, indicating consistent participation from investors. Should the VN-Index decisively breach this zone, the outlook would turn even more bullish. However, the Stochastic Oscillator, now deeply embedded in overbought territory, suggests that the risk of a correction will heighten if sell signals reemerge.

Market Beat 27/02: Stocks, Steel and Real Estate Surge to Keep VN-Index Above 1,300

The VN-Index took investors on a wild ride as it breached the 1,300-point threshold in the early afternoon session, only to swiftly rebound and close at 1,307.8 points, a gain of 4.84 points. This dramatic turnaround came after a pressured morning session that saw the index hovering just above the 1,300 mark.

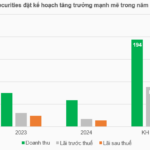

“VISecurities Rebrands as OCBS, Announces Capital Increase to 1,200 Billion”

Vietnam International Securities Joint Stock Company (VISecurities) is gearing up for its upcoming 2025 Annual General Meeting of Shareholders, scheduled for March 14. The company has ambitious plans on the agenda, including a proposed name change and a move to relocate its headquarters from Hanoi to Ho Chi Minh City. VISecurities is also setting its sights on achieving record-high revenue and profit targets, aiming to make this fiscal year the most successful in the company’s 16-year history.