Conference on Implementing Solutions to Stabilize Deposit Interest Rates and Reduce Lending Rates – Photo: VGP/HT

|

Banks commit to reducing lending rates and propose additional support mechanisms.

At the conference, Mr. Le Quang Vinh, CEO of Vietcombank, shared that Vietcombank has maintained stable deposit interest rates, thereby securing preferential capital sources to support businesses and individuals. He proposed that the SBV consider reducing and stabilizing deposit interest rate ceilings. Notably, Vietcombank also suggested that the SBV coordinate with the Ministry of Finance to adjust the ratio of State Treasury deposits to provide additional capital support. This proposal aims to help commercial banks have more capital leverage to boost the economy amid rising credit demands.

Agribank’s CEO, Pham Toan Vuong, mentioned that Agribank had reduced its average lending rates by nearly 0.5% and launched preferential credit packages totaling VND 500,000 billion.

Agribank is committed to maintaining interest rate stability, even during the reorganization of its operational areas in 34 new provinces and cities. Additionally, Agribank’s leadership proposed that the SBV strengthen policy implementation supervision to ensure fairness among credit institutions, guarantee liquidity, and support sustainable credit growth.

BIDV’s CEO, Le Ngoc Lam, shares insights into BIDV’s operations – Photo: VGP/HT

|

BIDV’s CEO, Le Ngoc Lam, revealed that in the first seven months, BIDV reduced its income by approximately VND 3,000 billion to support lending rate reductions. BIDV’s deposit interest rates have decreased.

Furthermore, the bank’s management proposed that the SBV increase the electronic lending limit from the current VND 100 million to meet practical needs and reduce credit costs.

Mr. Pham Quang Thang, Techcombank’s Deputy CEO, stated that the bank had achieved a 10.6% credit growth in the first six months, mainly targeting businesses. Lending rates decreased by 0.6%, while deposit interest rates dropped slightly by 0.09% compared to February and remained stable.

The bank adjusted its customer portfolio without changing the posted interest rates, maintaining stable average interest rates through a reasonable capital structure.

“Techcombank continues to reorganize its structure and digitize processes to save costs and reduce credit inputs. We also propose raising the electronic lending limit, currently capped at VND 100 million. A higher limit will reduce operating costs and accelerate credit disbursement,” said Mr. Pham Quang Thang.

Mr. Pham Quang Thang, Techcombank’s Deputy CEO, presents his proposals – Photo: VGP/HT

|

Mr. Nguyen Viet Anh, TPBank’s Deputy CEO, appreciated the SBV’s flexible and responsible management. TPBank is undergoing restructuring, reducing hierarchies, and investing in digital banking to automate processes, reduce costs, and pave the way for lower lending rates.

The bank has diversified its capital mobilization, increased non-term deposits (CASA), attracted foreign capital, maintained low interest rates, and ensured stable capital mobilization. In the last six months, TPBank committed to maintaining stable interest rates to support production, consumption, and exports.

High Credit Growth and Efforts to Reduce Lending Rates

Ms. Pham Thi Trung Ha, Deputy CEO of MB, shared that MB had developed a credit growth plan for critical sectors of the economy and actively participated in preferential credit programs and new initiatives from the SBV.

According to Ms. Ha, MB implemented specific solutions to boost credit, especially for production and business activities and individual customers. However, there was a downward trend in home loan credit for individual customers. Nevertheless, production credit witnessed a significant increase, contributing considerably to GDP growth in the first half.

To maintain low lending rates, MB focused on cost-cutting measures, promoted digital transformation, and strictly adhered to the SBV’s directives. Additionally, Ms. Ha emphasized the need for synchronized management of deposit interest rates to prevent rate fluctuations that could impact customer and market psychology.

MB highly appreciated the SBV’s proactive amendment of Circular 39, creating a legal framework for electronic lending. MB is ready to collaborate with the SBV to share implementation experiences, especially in controlling electronic lending tools and automated credit granting models based on data and analytics.

Ms. Pham Thi Trung Ha, MB’s Deputy CEO, delivers her speech – Photo: VGP/HT

|

According to MB’s representative, with comprehensive data and analytics for individual and super-small business customers, banks can enhance their credit granting capabilities and better support the economy.

Regarding data connectivity, MB proposed that the SBV assign the Vietnam Credit Information Center or a specialized unit to coordinate with credit institutions to identify data requirements and facilitate data connections beyond the banking sector, such as the e-Government system, tax and social security agencies, and industry associations. Having a dedicated entity will help clarify requirements and build a robust data system for more effective credit evaluation.

Additionally, MB suggested that the SBV provide early warnings about industries, businesses, and customer segments with potential risks to ensure that credit growth is coupled with safety controls.

“Commercial banks also have internal information, but a single bank’s data is insufficient. Data sharing across the system is necessary to ensure prudent credit granting and long-term sustainable development,” said MB’s representative.

HDBank’s leadership shared that amid global geopolitical and economic fluctuations, the SBV has proactively and flexibly managed monetary policies, ensuring liquidity stability and enabling credit institutions to stabilize interest rates and gradually reduce lending rates.

HDBank recorded its highest-ever credit growth, focusing on priority sectors such as agriculture, high technology, infrastructure, digital transformation, and green development.

“Rural and secondary urban areas account for 52% of our total credit, demonstrating our commitment to local economic development. Lending rates for individual customers decreased by 0.8%, and corporate customers by 0.5%. HDBank also actively participates in key programs like social housing, rice in the Mekong Delta region, and digital technology, with a total outstanding balance of over VND 32,000 billion,” said HDBank’s representative.

The bank also enhances support for technology investment funds in AI and blockchain and maintains flexible policies for customers. A significant promotional package will be launched by HDBank on the occasion of National Day on September 2nd.

VPBank’s representative shared that the bank strictly adheres to the Government’s and SBV’s directives. In the first half, VPBank significantly reduced deposit rates for both short- and long-term deposits. The average lending rates for individual and corporate customers decreased by approximately 0.79% and 0.22%, respectively.

VPBank’s priority sectors witnessed substantial credit growth: a 19.4% increase in SME lending, a 34.4% rise in green credit, a 30% boost in trade finance, and a remarkable 200% surge in project home loans.

VPBank also recorded a 27% increase in individual customer deposits and disbursed international loans for sustainable development.

“However, since July, there has been a slowdown in deposit growth as funds are diverted to investment channels like securities and real estate. Therefore, relevant authorities should accelerate public investment disbursement, increase flexibility in interest rate management, and consider adjusting the LDR (loan-to-deposit ratio) to support the system’s liquidity,” VPBank’s representative suggested.

Mr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Bankers Association, appreciated Circular 14/2025 issued by the SBV, which allows credit institutions to be more autonomous in risk management, thereby reducing interest rate pressure.

Mr. Nguyen Quoc Hung affirmed, “The Association will continue to encourage credit institutions to align with the SBV’s and Government’s directions, maintain stable deposit rates, and reduce lending rates according to each bank’s capacity.”

“Amid numerous challenges, the banking sector has demonstrated its pivotal role in effectively leading capital flows. With commitments from various parties and the SBV’s close management, expectations for stable interest rates and sustained credit growth remain strong,” said Mr. Nguyen Quoc Hung.

Nhat Quang

– 08:20 06/08/2025

“FE Credit Bounces Back: VPBank Confident in 2025 Plan as GPBank Turns a Profit”

In the first half of 2025, VPBank recorded a consolidated profit of over VND 11,200 billion and successfully mobilized a record loan of $1.56 billion. Based on the results of the first half and the 4-pronged strategy, the leadership affirmed their confidence in achieving the set business goals for the year.

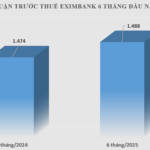

“Forex Trading Success: Eximbank’s Profits Soar to $1.488 Billion in H1 2025”

In the first half of 2025, Eximbank’s foreign exchange business soared, with an impressive net interest income of VND 364 billion, a 76% surge compared to the same period last year. The bank’s international payments business thrived, with a remarkable transaction volume of USD 3.9 billion.