The S&P 500, a broad-based measure of US stock market performance, has surged over 60% since 2022, largely driven by the strong momentum of big tech stocks. This has pushed the market’s concentration into a handful of stocks to its highest level in decades.

There were moments this year when analysts feared a potential recession in the US economy. But, at least for now, a soft landing for the world’s largest economy seems more likely.

Each US recession has different causes, and thus, their impact on the stock market varies. For instance, the economic downturn in the 1980s led to a milder drop in the S&P compared to the 2000s recession.

From 1970 onwards, recessionary periods in the world’s largest economy have typically triggered sharp downturns in the stock market, with the S&P 500 averaging a 36% decline. Therefore, assuming an impending recession in the US, the S&P 500 could potentially fall back to its 2022 lows.

The infographic below, based on data from Goldman Sachs, illustrates the sharpest declines of the S&P 500 during US recessions since 1970.

As evident from the infographic, the steepest drop in US stock market history occurred during the global financial crisis. The S&P 500 index lost more than half of its value, and financial giants like Citigroup and AIG saw their stock prices plummet by over 90% due to their exposure to subprime loans.

In the years leading up to the crisis, the US housing market had been overheating, fueled by the subprime mortgage market that began in 1999. By 2008, subprime borrowers started defaulting on their loans, resulting in 3.1 million foreclosure filings that year.

The dotcom bubble of the 2000s marks the second-largest decline in stock market history, with the S&P 500 index falling nearly 49%. As the Federal Reserve began raising interest rates in 1999 and 2000, the highly valued internet stocks of the time were hit the hardest. Amazon, Yahoo, and Qualcomm saw their stock prices plunge by over 80%. While some companies perished with the burst of the dotcom bubble, others like Amazon rebounded and witnessed astonishing growth in the following decades.

During the recessions of the 1980s and 1981-1982, the Fed, under Paul Volcker’s leadership, implemented tight monetary policies to curb inflation, raising the federal funds rate to a record high of over 19% in 1981.

Despite the tight monetary policy environment causing economic downturns, the stock market declines during these recessions were milder. In fact, the 1980s turned out to be one of the strongest decades for the S&P 500, with a remarkable 232% growth over the ten-year period.

The Market Beat – 28/02: Foreigners’ Robust Sell-off Continues in the Final Trading Session of February

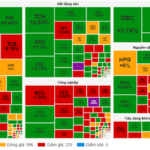

The market closed with slight losses, as the VN-Index dipped by 2.44 points (-0.19%) to end the day at 1,305.36. Similarly, the HNX-Index edged lower by 0.2 points (-0.08%), finishing at 239.19. The market breadth tilted towards decliners, with 408 tickers in the red versus 390 in the green. The large-cap segment mirrored this sentiment, as reflected in the VN30 basket, where 18 stocks retreated, seven advanced, and five remained unchanged.

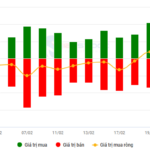

Is the Uptrend Supported?

The VN-Index rebounded with a Hammer candlestick pattern, reflecting investors’ optimism as the index broke through the old peak of October 2024 (1,290-1,305 points). This bullish sentiment is further reinforced by the MACD indicator, which continues to trend upward, providing a buy signal. If the index sustains levels above this threshold, accompanied by high trading volume, the upward trajectory will be solidified.

Steady Growth Surge: Vietstock Daily’s Insight for 25/02/2025

The VN-Index has been on a remarkable run recently, with five consecutive sessions in the green, closely hugging the upper band of the Bollinger Bands. What’s more, the index is retesting the old peak from October 2024 (1,290-1,305 points) amid sustained trading volumes above the 20-day average, indicating consistent participation from investors. Should the VN-Index decisively breach this zone, the outlook would turn even more bullish. However, the Stochastic Oscillator, now deeply embedded in overbought territory, suggests that the risk of a correction will heighten if sell signals reemerge.

Market Beat 27/02: Stocks, Steel and Real Estate Surge to Keep VN-Index Above 1,300

The VN-Index took investors on a wild ride as it breached the 1,300-point threshold in the early afternoon session, only to swiftly rebound and close at 1,307.8 points, a gain of 4.84 points. This dramatic turnaround came after a pressured morning session that saw the index hovering just above the 1,300 mark.

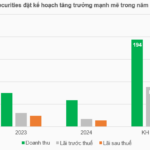

“VISecurities Rebrands as OCBS, Announces Capital Increase to 1,200 Billion”

Vietnam International Securities Joint Stock Company (VISecurities) is gearing up for its upcoming 2025 Annual General Meeting of Shareholders, scheduled for March 14. The company has ambitious plans on the agenda, including a proposed name change and a move to relocate its headquarters from Hanoi to Ho Chi Minh City. VISecurities is also setting its sights on achieving record-high revenue and profit targets, aiming to make this fiscal year the most successful in the company’s 16-year history.