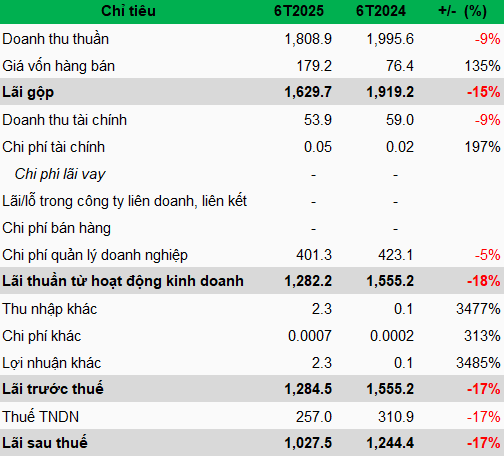

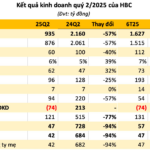

For the first half of 2025, VNX recorded a net revenue of nearly VND 1,809 billion, a 9% decrease compared to the same period last year. The main contributors to this revenue were the securities trading services provided on the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX).

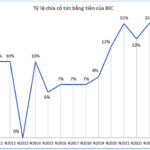

According to VNX’s report on governance and organizational structure for the first six months of 2025, the remaining profit after contributions to various funds amounted to nearly VND 760 billion from HOSE and over VND 248 billion from HNX. These figures represent a decline compared to the previous year’s report, which showed contributions of over VND 953 billion from HOSE and nearly VND 268 billion from HNX.

Compared to the same period last year, the gross profit margin decreased from 96.2% to 90.1%, resulting in a 15% decrease in gross profit to nearly VND 1,630 billion.

On a positive note, there was a 5% reduction in management expenses, totaling over VND 401 billion. Of this amount, nearly VND 275 billion was supervision fees paid to the State Securities Commission, a 7% decrease.

Consequently, VNX’s net profit for the first half of the year reached nearly VND 1,028 billion, a 17% drop compared to the same period in 2024. For the full year 2025, VNX set a consolidated business plan with an after-tax profit target of nearly VND 2,398 billion. As of the first half, the company has achieved 43% of this plan.

|

VNX’s Business Results for the First Half of 2025

Unit: Billion VND

Source: VNX

|

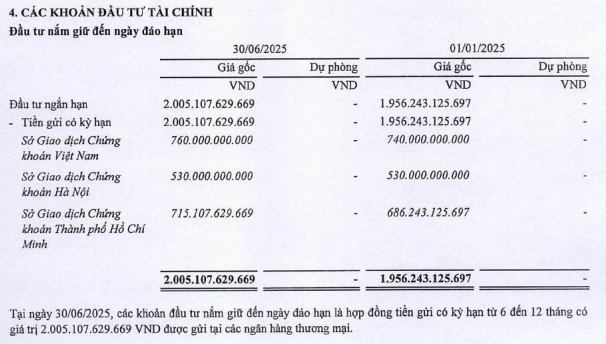

By the end of the second quarter, VNX’s total assets exceeded VND 4,209 billion, a 7% increase from the beginning of the year. The largest portion of these assets was held in investments until maturity, which grew from over VND 1,956 billion to over VND 2,005 billion. These include term deposits with a maturity of 6-12 months at commercial banks by VNX, HOSE, and HNX.

Source: VNX’s Consolidated Financial Statements for the First Half of 2025

|

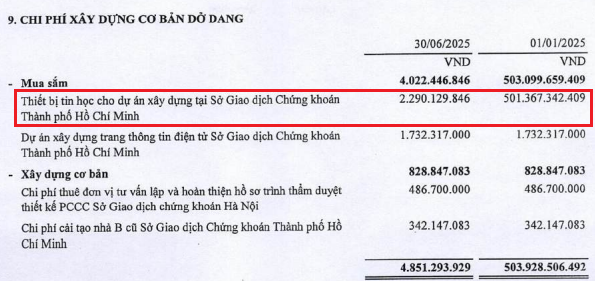

Fixed assets also witnessed a significant increase, rising from over VND 472 billion to over VND 1,016 billion, while construction in progress expenses decreased from nearly VND 504 billion to approximately VND 5 billion. These expenses are related to IT equipment for the construction project at HOSE.

Source: VNX’s Consolidated Financial Statements for the First Half of 2025

|

In other news regarding personnel changes, Mr. Le Xuan Hai has recently been appointed as a member of the Board of Directors and General Director of VNX, effective July 1, 2025.

Mr. Le Xuan Hai, born in 1971, holds a Master’s degree in Business Administration from the University of Economics – Vietnam National University, Hanoi. He has been working at the Ministry of Finance since 1997 and served as Deputy Director of the Department of Finance and Enterprise from October 2020 to February 2025. From March 2025 to June 2025, he held the position of Deputy Director of the Department of State-owned Enterprise Development (Ministry of Finance).

Mr. Le Xuan Hai delivering his speech upon assuming the role of Member of the Board of Directors and General Director of VNX

|

The current Board of Directors of VNX comprises Mr. Luong Hai Sinh (Chairman), Mr. Le Xuan Hai (also the General Director), and Mr. Le Trung Son. The company has two Deputy General Directors: Mr. Nguyen Quang Thuong and Mr. Nguyen Tien Dung.

– 6:26 PM, August 6, 2025

Profitable Quarter: An Gia’s Q2 Profits Surge to Over Three Times the Previous Year’s

“An Gia has successfully trimmed costs and ramped up its consulting prowess, resulting in a remarkable threefold increase in net profit for Q2 2025 compared to the same period last year.”

Construction Firm, Hòa Bình (HBC), Turns a Profit by Liquidating Fixed Assets

Let me know if you would like me to tweak it or provide any additional ideas!

The six-month profit for Construction Hòa Bình has plummeted by 94% compared to the same period last year, with only about 13% of the annual target achieved so far.

The Green Airport: CEO Group’s Profitable Venture into Industrial Park Development

“CEO Group reports a doubling of profits for the second quarter of 2025, attributed to successful cost-cutting measures. The Group’s quarterly profits soared to 39 billion VND. During this period, CEO Group also invested 50.5 billion VND in its newly established subsidiary, which has a charter capital of 450 billion VND.”