Vietnam’s Steel Industry Faces Ongoing Challenges in 2025

|

Providing an overview of the steel industry’s performance in 2024, Mr. Dinh Quoc Thai, Secretary General and Vice Chairman of the Vietnam Steel Association (VSA), shared insights at a recent trade promotion conference with the Vietnamese Trade Office System. According to Mr. Thai, the global steel market continued to face challenges due to geopolitical conflicts, strategic competition, trade tensions, and disruptions in the global supply chain, among other factors.

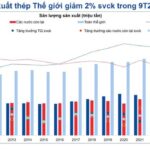

In 2024, global steel production remained in negative territory, reaching 1.839 billion tons, a 0.9% decrease compared to 2023, which also saw a 0.8% decline from 2022.

Vietnam’s steel production, however, showed positive growth. Steel production reached over 21.98 million tons, a 14% increase compared to the same period in 2023. Internal consumption and sales of steel reached 21.41 million tons, also a 14% increase year-over-year. Notably, exports of flat slabs witnessed a significant surge, increasing by 55% compared to 2023.

The production of finished steel products reached 29.443 million tons, representing a 6.1% increase. Among these products, pre-painted metal and color-coated steel recorded the highest growth at 23.1%, followed by construction steel at 10.1%, steel pipes at 3.5%, and HRC at 1.5%. Conversely, cold-rolled coil production experienced a downturn, declining by 19.4%.

Sales of finished steel products reached 29.09 million tons, a 10.4% increase year-over-year. Exports of finished steel products in 2024 amounted to 8.042 million tons, a slight decrease of 0.6% compared to the previous year. All product categories, except for hot-rolled coils, which saw a significant drop of 33.8%, recorded growth.

Despite these improvements, the VSA acknowledges that the steel industry’s recovery has been slow and has not yet reached the levels achieved in 2021. Specifically, crude steel production stood at 95% (23 million tons) compared to 2021, while finished steel production was only 89% (33 million tons) of the 2021 figure.

Looking ahead, the VSA anticipates that the steel industry will continue to face challenges in 2025. These challenges include increased exports from China due to weak domestic demand, which poses a threat to Vietnamese steel producers’ market share and could have significant implications for the industry’s efficiency and employment.

The VSA also foresees a supply surplus for many domestically produced steel products, coupled with a significant increase in steel imports. This situation is expected to intensify price competition in the finished steel market and heighten domestic market competition.

Additionally, the growing instability of the global market, disruptions in supply chains, and fluctuations in international freight rates pose considerable risks for steel producers. Moreover, the volatility of raw material prices will undoubtedly increase production costs for the steel industry.

“Changes in the trade policies of major countries, particularly the erection of technical barriers and the implementation of trade protection measures, as well as the potential misuse of policies related to climate change and green growth, may serve as significant obstacles to Vietnam’s steel exports in the future,” Mr. Thai cautioned.

Expanding Steel Export Markets

To effectively navigate the shifting trade policies of major countries in the current international context, the VSA suggests that, in addition to diplomatic efforts, the Vietnamese government, especially the Trade Office System, should continue to monitor and provide early warnings to businesses and associations. This proactive approach will enable Vietnamese steel enterprises to develop contingency plans and seize opportunities while mitigating risks associated with changing trade policies.

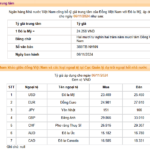

Specifically, this includes staying apprised of the US administration’s decisions regarding the imposition of tariffs, tariff postponements for specific entities, and the timeline for implementation under Section 232 of the US Trade Expansion Act of 1962. It also involves closely following the EU’s carbon tax negotiations and updates on the CBAM mechanism, as well as monitoring procedures for including Vietnam in the list of countries eligible to import scrap from the EU.

The VSA also proposes that the government strengthen and enhance the capacity to protect domestic production. This entails tightening control over inputs while facilitating the export of domestically produced goods. Additionally, there should be a focus on improving enterprises’ trade remedy capabilities to address the current unfair competition from Chinese steel in the Vietnamese market and to prevent potential unfair practices from large economies in the long run.

Ensuring smooth market access is crucial, from exploring new markets for Vietnamese steel products to promoting steel exports through trade promotion activities. Simplifying export procedures, providing early warnings, and enhancing enterprises’ capacity to respond to trade remedy cases initiated by foreign countries are also essential. These measures will collectively enhance the competitiveness of Vietnamese steel in traditional markets and facilitate its expansion into new global markets.

Nhat Quang

– 11:40 17/03/2025

The Power of Persuasive Writing: Crafting a Compelling Headline for “Hòa Phát Leaders Explain Why 9T2024 Profit Margins Are Nearing Historic Levels, with Peak Debt Expected Next Year”

“The leaders at Hoa Phat shared that the depreciation of the Dung Quat 2 plant did not significantly impact the conglomerate’s profits.”

The Battle for Survival: Formosa’s Struggles and Hà Tĩnh’s Revenue Shortfall

The Formosa Ha Tinh Steel Corporation has faced significant challenges in its business operations during the first few months of this year, resulting in a negative impact on the provincial budget revenue.