Factors Contributing to the Profit Gap Between Techcombank and VPBank

In the realm of Vietnamese private banking, Techcombank and VPBank are demonstrating their prowess, outperforming their peers. These two banks are neck-and-neck in terms of total asset size, becoming the first private banks to surpass the impressive milestone of 1 quadrillion VND in total assets in the second quarter of 2025. VPBank’s consolidated total assets reached nearly 1,104 trillion VND, while Techcombank also surpassed 1,037 trillion VND.

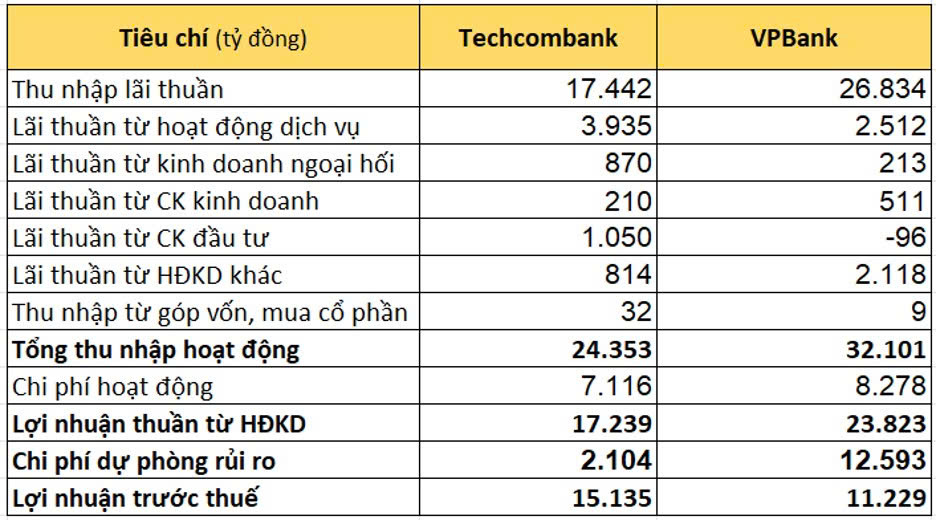

Despite their comparable asset scales, there is a significant difference in their profit figures. Techcombank’s consolidated pre-tax profit for the first half of 2025 stood at 15,135 billion VND, nearly 4,000 billion VND higher than VPBank’s 11,229 billion VND. Notably, Techcombank’s semi-annual profit remained 35% higher than VPBank’s, despite a slight 3.2% decrease compared to the same period last year, while VPBank reported a nearly 30% increase in profit.

A comparison of the profit structures of these two banks reveals that the discrepancy in profits between Techcombank and VPBank can be attributed to the credit risk provision expenses.

Specifically, Techcombank only set aside 2,100 billion VND for credit risk provision expenses in the first half of 2025 (equivalent to over 12% of their net profit of more than 17,200 billion VND). In contrast, VPBank, with a net profit of over 23,823 billion VND, allocated nearly 12,600 billion VND for credit risk provisions (equivalent to almost 53%).

The pressure of credit risk provisions has resulted in VPBank’s net profit lagging far behind Techcombank’s, despite VPBank’s total operating income being 7,700 billion VND higher and their superior cost optimization, reflected in a CIR ratio of 25.8% compared to Techcombank’s 29.2%.

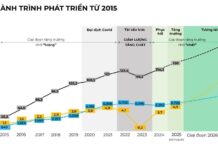

This difference in provision levels between VPBank and Techcombank is not a new phenomenon but has persisted for several years. Analyzing their financial reports from 2015 to 2024 reveals that VPBank’s average credit risk provision expenses as a percentage of net profit over the last ten years were nearly 57%, while Techcombank’s ratio was only around 14%.

In other words, for every 100 VND of net profit generated, Techcombank sets aside only about 14 VND for credit risk provisions, whereas VPBank allocates nearly 57 VND.

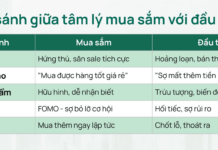

The disparity in provision levels is not merely a numerical difference but also reflects the distinct business strategies pursued by each bank.

Techcombank focuses on serving large corporations and high-income individual clients, while VPBank targets small and medium-sized enterprises and the mass market, even venturing into the sub-mass market through its subsidiary, FECredit.

Techcombank’s segment is smaller but entails lower credit risk. On the other hand, VPBank pioneers serving low-income customers, a segment with immense potential but higher credit risk.

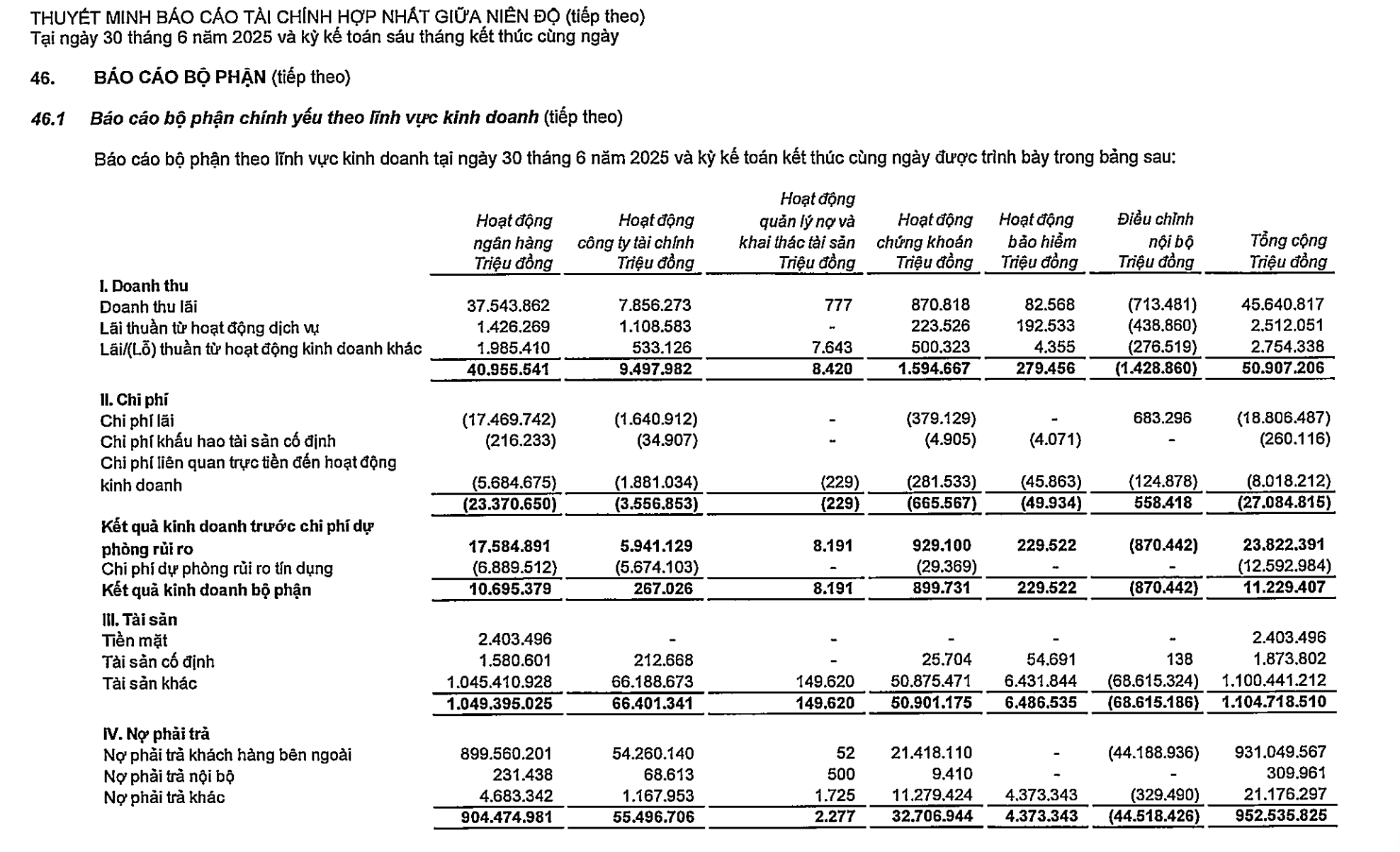

Indeed, in the first half of 2025, nearly 5,700 billion VND of VPBank’s credit risk provision expenses came from FECredit. This substantial provision level resulted in FECredit contributing only over 200 billion VND to the consolidated business results, despite a net profit from business operations of more than 5,900 billion VND.

FECredit generated over 5,941 billion VND in net profit in the first half of 2025 but had to set aside 5,674 billion VND in provisions.

In contrast, Techcombank’s focus on high-income customers has spared them from the pressure of non-performing loans and high credit risk provisions. They consistently maintain one of the lowest non-performing loan ratios and credit risk provision expenses in the industry. Additionally, Techcombank’s substantial non-interest income from securities and insurance activities reduces their reliance on credit activities and provides a stable source of operating income (with Techcom Securities alone contributing over 3,000 billion VND to the consolidated profit in the first half of 2025)

The Race to Become Vietnam’s Leading Private Financial Group

As competition in the credit sector intensifies and the industry-wide NIM continues to decline, both Techcombank and VPBank have set their sights on becoming comprehensive financial groups by venturing into insurance and strengthening their securities and asset management businesses.

At VPBank’s 2025 Annual General Meeting of Shareholders, the establishment of a life insurance company was approved. The new subsidiary is expected to have a charter capital of 2,000 billion VND, with the specific amount to be decided by the bank’s board of directors based on agreements. The company will offer basic life insurance, health insurance, linked insurance, and other insurance services permitted by law and approved by the Ministry of Finance.

Previously, in 2022, VPBank acquired OPES, transforming it into one of Vietnam’s leading non-life insurance companies.

Techcombank, on the other hand, received approval from the Ministry of Finance in July 2025 to establish Techcom Life Insurance Company with a charter capital of 1,300 billion VND. Additionally, they have increased their ownership in Techcom Non-life Insurance Company (TCGIns), positioning it as a subsidiary with high expectations for this business segment.

According to Techcombank, this move aims to enhance their services and products, increase financial benefits and competitiveness, and tap into the untapped potential of the Vietnamese life insurance market. They believe that offering diverse and superior insurance products will bring financial benefits, including competitive fee income and an increase in total assets from their investment in the life insurance company.

“We strongly believe that now is the right time to establish a life insurance company, and we are confident in our ability to make a difference,” said Techcombank’s CEO at a press conference following the Annual General Meeting of Shareholders.

Techcombank also anticipates steady and sustainable growth in the Vietnamese non-life insurance market and expects that increasing their investment in TCGIns will boost their consolidated pre-tax profit.

Thus, coincidentally, Vietnam’s two largest private banks have both announced plans to expand their insurance businesses in 2025. Moreover, both VPBank and Techcombank have ambitious plans for their securities businesses, with each owning leading securities companies: TCBS and VPBank Securities.

Techcombank aims to conduct an IPO for TCBS in 2025. Currently, TCBS leads the market in corporate bond issuance advisory services, holding a 47% market share. They are also among the top three securities companies in terms of brokerage market share on the HoSE and the second-largest on the HNX.

TCBS recently announced a share offering price of 46,800 VND per share for their upcoming IPO. This values the company higher than many established names already listed on the stock exchange, such as The Gioi Di Dong, Sacombank, ACB, Vietnam Airlines, Becamex IDC, and SSI. TCBS’s market value even surpasses that of industry peers like VIX, VNDirect, HSC, and Vietcap.

TCBS’s management shared their aspiration to achieve a capitalization of 5 billion USD (approximately 131,500 billion VND). Their shares are expected to be listed by the end of this year.

Meanwhile, VPBank Securities, leveraging its parent bank, has joined the top four securities companies in terms of margin lending. Their margin lending balance nearly doubled in just six months, increasing by 8,206 billion VND from the beginning of the year to 17,653 billion VND as of the first half of 2025.

At the 2025 Annual General Meeting of Shareholders, VPBank also approved a plan to contribute capital and acquire shares to make an investment fund management company a subsidiary. According to VPBank’s Vice Chairman, Bui Hai Quan, this move aligns with the bank’s strategy to develop into a comprehensive financial group, as life insurance and fund management are essential components of such a group.

“AI: The Ultimate Showdown”

“Vietnam is embracing the digital age with the rapid advancement of Artificial Intelligence (AI) – a key technology in the strategy to boost economic and social growth. Under the patronage of the Ministry of Public Security, Vietnam Television, the National Data Center, the National Data Association, and Techcombank have jointly announced the official launch of the “AI Master Challenge” on a national scale. This competition aims to identify top talent in the field of AI. The program is expected to be a highlight among initiatives to propel Vietnam towards becoming a hub for innovation, developing AI solutions, and applications with regional and global impact.”

Is Life Insurance Profitable?

Life insurance is inherently about financial protection against risks. However, today’s investment-linked insurance policies offer a unique combination of investment and protection, creating an opportunity for policyholders to profit. It’s important to note that returns are not fixed and depend on market fluctuations, the duration of the contract, and the financial discipline of the individual.

“FE Credit Bounces Back: VPBank Confident in 2025 Plan as GPBank Turns a Profit”

In the first half of 2025, VPBank recorded a consolidated profit of over VND 11,200 billion and successfully mobilized a record loan of $1.56 billion. Based on the results of the first half and the 4-pronged strategy, the leadership affirmed their confidence in achieving the set business goals for the year.

“VPBank Secures a Monumental $350 Million Agreement for Sustainable Growth.”

“VPBank joins forces with renowned global development institutions, SMBC, BII, EFA, FinDev Canada, and JICA, in a groundbreaking partnership. Together, they have secured a landmark loan, a pivotal step towards financing Vietnam’s sustainable and eco-friendly future. This collaboration marks a significant milestone in the country’s journey towards a greener tomorrow.”