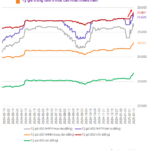

Two days after Donald Trump officially returned to the White House, the US dollar index in the international market fell sharply. This morning, January 22, the US dollar index fell to 107.9 points, a significant drop from last week’s high of nearly 110 points.

As a result, the USD/VND exchange rate also eased. Currently, USD prices at commercial banks and in the free market are both declining.

Specifically, Vietcombank is trading USD at 25,060 VND per USD for buying and 25,420 VND per USD for selling, a decrease of 30 VND per USD from yesterday. This is the fourth consecutive day that the bank has lowered its selling rate.

If we look at the past week, the USD/VND exchange rate at banks has cooled down by more than 200 VND, equivalent to a 0.78% decrease.

Similarly, other banks such as BIDV, Eximbank, ACB, and Sacombank have also lowered their USD buying and selling rates.

USD rates at banks continue to cool down |

In the free market, foreign exchange trading points this morning are buying USD at 25,470 VND and selling at 25,570 VND per USD, a decrease of 20 VND from yesterday. Currently, the free market USD rate is only about 250 VND higher than the bank rate.

According to analysts, the exchange rate pressure has been easing in recent days. The interbank USD/VND rate has also fallen sharply and retreated below 25,330 VND per USD.

MBS Securities predicts that the exchange rate will fluctuate between 25,500 and 25,800 VND per USD in the first quarter of 2025, as the new administration’s fiscal easing plans, combined with tighter immigration policies, higher US interest rates compared to other countries, and relatively high US protectionism, are expected to support the strengthening of the US dollar in 2025.

On the other hand, there are positive factors supporting the VND, such as a positive trade surplus of about $24.77 billion in 2024, FDI disbursement of over $25.3 billion, strong international tourist arrivals, and strong remittance inflows in the last months of the year… At the same time, the stability of the macro environment is likely to be maintained and further improved, which will be the basis for stabilizing the exchange rate in 2025.

Thai Phuong, Photo: Lam Giang

– 10:24 22/01/2025

The Art of Asset Allocation: A Guide to the Portfolio Strategies of Top Fund Managers

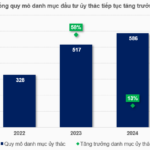

As of the end of 2024, the total scale of the entrusted investment portfolio of 43 fund management companies (FMCs) in the market reached nearly VND 586.5 trillion, a 13% increase from the beginning of the year and 59 times the scale of the industry’s total assets, equivalent to 8.2% of the capitalization of the Vietnamese stock market.

The Soaring Dollar: USD Surges to Record Highs in Bank Rates

Today’s USD exchange rate, 12th February 2025, sees the US dollar continue its impressive surge in the banking sector, reaching unprecedented heights. The selling rate at banks has edged closer to the symbolic milestone of VND 25,800 per USD. Meanwhile, the central exchange rate has also set a new record.