TCLife is anticipated to have a chartered capital of VND 1,300 billion, with Techcombank contributing VND 1,040 billion, equivalent to an 80% stake.

TCLife will combine the strengths of its two large shareholders, Techcombank and Vingroup Joint Stock Company (HOSE: VIC), in terms of financial resources, customer base, and ecosystem.

TCLife plans to operate in seven life insurance businesses (whole life, endowment, term, mixed, and periodic payment investment-linked insurance) and two health insurance businesses (health and bodily insurance, and medical expenses).

The expected operating period for TCLife is 50 years from the date of licensing by the Ministry of Finance.

According to Techcombank, the Vietnamese life insurance market has ample room for growth, and with the economy recovering, there is an opportunity to increase revenue from insurance fees by effectively leveraging the bank’s customer base potential.

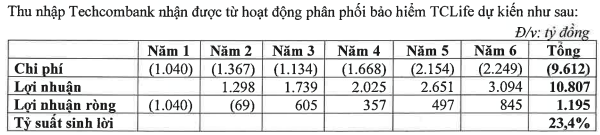

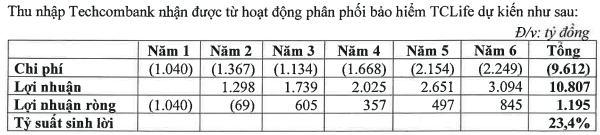

Techcombank expects a net profit of VND 1,195 billion, equivalent to a return on equity of 23.4%, after five years of TCLife’s operations.

In addition to this income, Techcombank believes that TCLife will contribute to increasing net assets for the contributing shareholders, thereby improving their position in the financial market. TCLife’s total assets in the first year are expected to be VND 728 billion, rising to VND 16,081 billion in the fifth year.

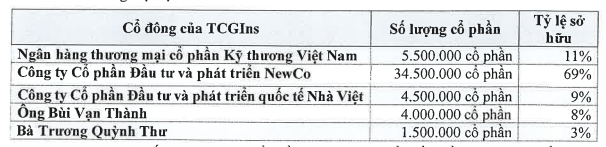

Furthermore, the Board of Directors of Techcombank has also passed a resolution to implement the plan to buy back shares, making Techcombank Non-life Insurance Joint Stock Company (TCGIns) a subsidiary of the bank. TCGIns has a chartered capital of VND 500 billion.

Techcombank plans to acquire 57% of the shares (equivalent to 28.5 million shares at VND 10,000 per share) in TCGIns from NewCo Development and Investment Joint Stock Company.

Currently, Techcombank holds 11% of TCGIns, equivalent to 5.5 million shares. If the acquisition is successful as planned, the bank will increase its ownership to 68% (34 million shares) and become the parent company of TCGIns.

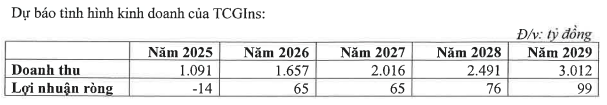

In the five months since its establishment in October 2024 until February 2025, TCGIns has generated insurance revenue of VND 150 billion (unaudited). With these figures, TCGIns is expected to have a positive financial impact, particularly on Techcombank’s revenue and total assets.

Han Dong

– 08:35 22/03/2025

An Urgent Proposal for the $4 Billion Metro Line Connecting Can Gio

The Ho Chi Minh City Department of Transportation has proposed to the People’s Committee to request the Prime Minister’s approval for the addition of a new metro line to Can Gio District (Metro Line 12) to the list of projects under the National Assembly’s Resolution 188.