**National Commercial Bank: Empowering Businesses in Industrial Zones**

Businesses in Industrial Zones: Significant Contributions, High Support Needs

According to a report from the Department of Management of Economic Zones (Ministry of Planning and Investment), as of July 2024, Vietnam has established 431 industrial parks (IPs) and export processing zones, covering an area of approximately 132.3 thousand hectares. The planning towards 2030 envisions 221 newly developed IPs, 76 expanded IPs, and 22 IPs with adjusted planning. These IPs not only attract substantial investment capital but also serve as a crucial driver for socio-economic development, especially in local areas.

Data from the Vietnam Chamber of Commerce and Industry (VCCI) reveals that businesses operating within IPs contribute about 50% of the country’s total export turnover. They play a pivotal role in tipping Vietnam’s trade balance from a deficit to a surplus while generating significant budget revenues. Notably, in many localities, IP-based enterprises contribute over 60% of the total budget revenue, cementing their pivotal role in regional economic development. As per the Department of Management of Economic Zones, IPs in local areas have created jobs for approximately 4.15 million direct laborers, mainly concentrated in the Southeast region (accounting for 41.3% of the country’s IP labor force).

NCB consistently offers superior financial solutions to its corporate clients

|

However, behind these commendable achievements, enterprises operating within IPs face numerous challenges, particularly concerning capital. Long-term land lease contracts, ranging from 20 to 50 years, once considered an advantage due to their stability, have now become a burden that necessitates substantial capital mobilization. Most businesses struggle to access credit due to specific limitations regarding collateral assets.

NCB’s Financial Solutions: “Strengthen Your Position, Soar to Prosperity”

To empower Vietnamese enterprises, NCB tackles this intricate capital challenge with optimal and comprehensive financial solutions, enabling businesses to “Strengthen Your Position, Soar to Prosperity.”

NCB’s dedicated product for businesses in IPs, facilitating their capital access for investment and growth

|

NCB caters to diverse capital requirements, from supplementing working capital to investing in fixed assets. We offer competitive interest rates and loan limits of up to 90% of capital needs, alleviating financial burdens and optimizing financial efficiency to establish a robust foundation for production and business operations.

Notably, with our new product, NCB demonstrates flexibility in accepting collateral, including lease-derived property rights in IPs, with a funding ratio of up to 75%. This not only aids enterprises in IPs with capital accessibility but also fuels their confidence to expand their scale, boost investments, enhance competitiveness, and elevate their standing.

In addition to this dedicated product for IP-based businesses, NCB is also offering a preferential credit package of up to VND 1,000 billion for small and medium-sized enterprises (SMEs) with competitive interest rates and swift disbursement procedures.

Specifically, for SMEs requiring short-term capital, the super-preferential package provides instant funding at interest rates from 6.99%/year, with a maximum limit of up to VND 800 billion. Meanwhile, businesses seeking medium and long-term capital will benefit from a loan package with interest rates starting at 7.99%/year and a maximum limit of VND 200 billion. This financial leverage is ideal for enterprises to seize opportunities and accelerate their growth trajectory.

With unwavering dedication, cutting-edge financial solutions, and a keen understanding of practical needs, NCB is increasingly becoming the preferred choice for businesses in the market. We are proud to be a trusted financial partner for the Vietnamese business community.

For more information, please contact our branches/transaction offices nationwide or our Hotline: (028) 38 216 216 – 1800 6166.

SERVICES

– 07:58 22/03/2025

“VPBank and Thegioididong.com Collaborate to Launch Payment Agency Model”

As the first bank to be granted permission by the State Bank of Vietnam to implement a payment agency model in the country, VPBank’s collaboration with The Gioi Di Dong Joint Stock Company marks a significant step forward. Together, they offer customers convenient access to financial services across 3,000 The Gioi Di Dong and Dien May Xanh retail stores nationwide.

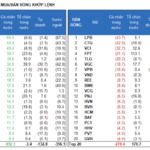

The Foreign Block Turns Net Sellers After 6 Consecutive Buying Sessions, Dumping Real Estate Across the Board

Liquidity on the three exchanges reached 13.4 trillion VND, with foreign investors selling a net of 310.2 billion VND after six consecutive sessions of net buying of over 424.5 billion VND.

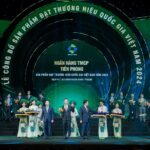

“TPBank: Proud to be a National Brand of Vietnam in 2024”

For two consecutive years, TPBank has been bestowed with the prestigious title of Vietnam National Brand, a testament to the bank’s unwavering commitment to developing innovative financial products and services. This recognition highlights not only the convenience and digital accessibility that TPBank offers to its customers but also its significant contribution to the country’s economic landscape.