The Western Bus Station currently has over 145 transport units with approximately 3,450 vehicles operating on 175 routes to 29 provinces and cities nationwide – Illustration |

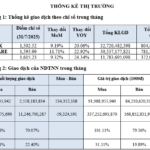

WCS announces that August 15 is the ex-rights date for a 20% bonus share issue (a ratio of 5 shares held for every 1 new share received), equivalent to 500,000 new shares. The issuance source is the development investment fund as of December 31, 2024.

After the bonus issue, WCS’s charter capital will increase from 25 billion VND to 30 billion VND, meeting the minimum requirements for public companies according to Law No. 56 issued by the National Assembly on November 29, 2024. The management affirms that the 5:1 ratio will not dilute value or affect the interests of minority shareholders.

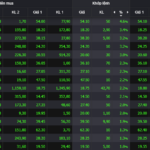

As of August 7, WCS is the stock with the highest market price on the HNX, reaching 411,000 VND/share, 27% higher than the second-placed code HGM. This is also one of the rare stocks on the HNX with a “three-digit” market price.

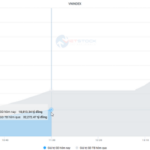

In the past 3 months, WCS’s market price has increased by nearly 11% and up to 76% in the past year, but liquidity is very low, with an average of only 294 shares/session. At the end of February 2025, the code once hit a historical peak of over 440,000 VND/share, nearly three times the price of 154,000 VND/share a year ago.

| WCS stock price movement in the past year |

|

|

Record business results

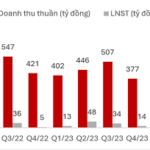

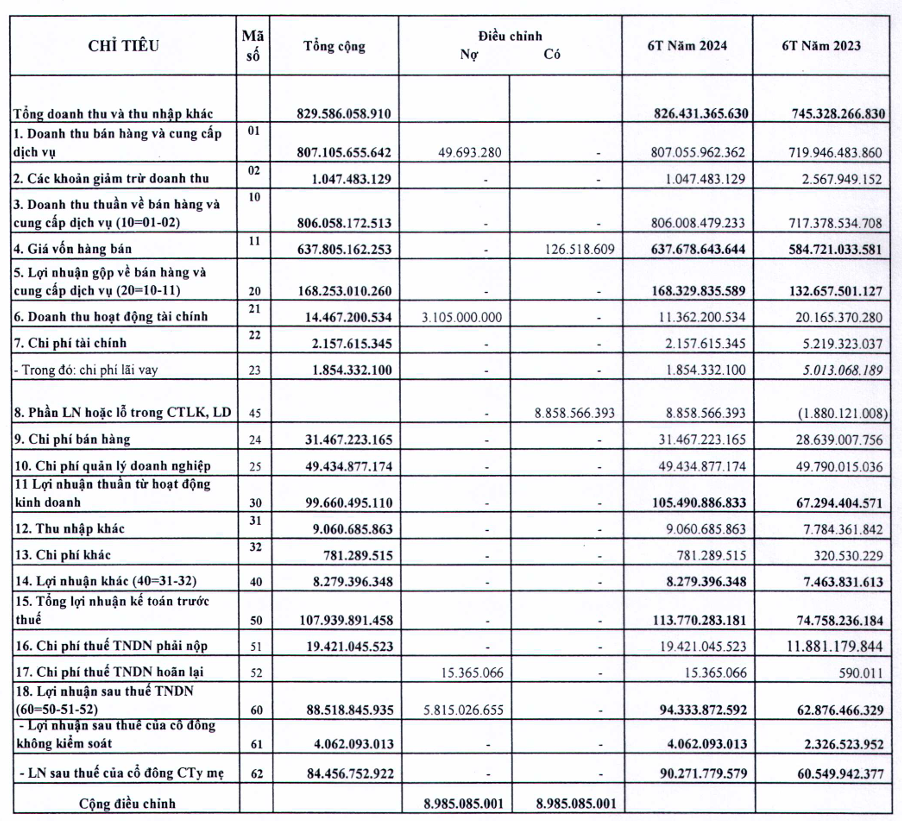

In Q2 2025, WCS recorded revenue of 43.5 billion VND, up 10% over the same period last year, thanks to the registration of more enterprises to operate and the increase in routes during the 4/30 holiday. Post-tax profit reached more than 22 billion VND, up 11%, the highest quarterly profit ever.

In the first 6 months of the year, WCS achieved revenue of over 86 billion VND and after-tax profit of more than 43 billion VND, both up 10%. The enterprise has achieved 49% of its revenue plan and more than 56% of its annual profit target.

| WCS’s semi-annual business results over the years |

|

|

– 10:06 08/08/2025

Record-Breaking Revenue and Profits: Nafoods Group Breaks Ground on Nasoco Project Phase 2

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.

The VN-Index: A Stunning Surprise

The stock market continued its upward trajectory on today’s trading session (August 6th), with the VN-Index surging over 26 points to reach a new high of 1,573. Banking stocks witnessed a collective rally, led by TCB, which extended its gains following the announcement of its subsidiary’s initial public offering (IPO). Notably, foreign investors returned as net buyers, injecting optimism into the market.

The Stock Market Surges in July: HOSE Welcomes Six New Billion-Dollar Companies.

In July 2025, Vietnam’s stock market rallied enthusiastically, with the VN-Index surging 9.2% to reach 1,502.52. This remarkable performance resulted in a significant shift in the landscape of the Ho Chi Minh Stock Exchange (HOSE). By the end of the month, HOSE boasted six newly minted companies with a market capitalization of over USD 1 billion each, and impressively, an additional company joined the ranks of those valued at over USD 10 billion.

Stock Market Blog: Bulls Run Wild, the Party’s Not Over Yet

The flow of capital is shifting towards speculative opportunities, while the blue-chip group is experiencing a divergence. If VCB, VIC, and VHM had not been restrained today, VNI and VN30 could have further boosted market sentiment.

Market Beat: Green Dominance, VN-Index Extends Gains

The trading session concluded with significant gains, as the VN-Index surged by 26.56 points (+1.72%), closing at 1,573.71. Meanwhile, the HNX-Index also witnessed a robust increase of 2.54 points (+0.95%), ending the day at 268.66. The market breadth was strongly positive, with 529 advancing stocks versus 254 declining ones. This bullish sentiment was echoed in the VN30 basket, where 28 stocks climbed while only 2 witnessed losses.