Mr. Mai Huy Tuan, CEO of SSI Digital (SSID), candidly shared his thoughts on the opportunity to establish an international financial center in Vietnam. He suggested that instead of competing with traditional financial models, Vietnam should leverage blockchain and digital assets as a strategic advantage.

With its infrastructure already in place, SSID aims not only to build a standard digital asset exchange but also to contribute to Vietnam’s entry into the global arena, where finance, technology, and community converge.

In recent times, the idea of establishing an international financial center in Ho Chi Minh City and Da Nang has garnered significant interest from the business community and international investors. As someone closely following this project, what are your thoughts on the current opportunity?

Mr. Mai Huy Tuan: An international financial center should offer more freedom and significantly more fluid financial flows than traditional frameworks. If everything is constrained within old structures, how can it be considered an international financial center?

Recently, the Prime Minister signed Decision No. 1646/QD-TTg dated August 1, 2025, establishing the Steering Committee for the International Financial Center in Vietnam, with the Prime Minister as its head. This demonstrates the government’s strong determination. By developing a legal framework for digital assets and exchanges, Vietnam is taking early steps, belonging to the group of pioneering countries in this field, rather than being a latecomer. Enterprises like ours also feel confident in participating in this journey of innovation, accompanying the country under the leadership of the Party into a new era.

In your opinion, what competitive advantage should Vietnam seek to avoid being overshadowed by established financial centers such as Singapore, Hong Kong, or Dubai?

Mr. Mai Huy Tuan: Competing with the world in traditional finance is like “bringing a knife to a gunfight.” However, if we know how to leverage blockchain, something that Vietnam is quite strong in, that will be the key to creating a breakthrough.

Every enterprise or center needs a “lever.” Singapore used to be a hub for transshipment, attracting merchants. The same goes for Hong Kong and Shanghai. If Vietnam wants to become a financial center, it needs a focal point, and blockchain, in my opinion, is the key. If we dare to choose a new and different path, we can certainly make a leap forward.

Today’s financial world is no longer bound by physical boundaries; crypto, blockchain, and digital assets are borderless. The core lies in the community, the flow of capital, and individuals who know how to navigate the global playground. If Vietnam can gather this community and create an ecosystem for them to develop ideas in both traditional and new finance, we will have a true financial center.

The concept of a financial center today goes beyond physical space. From a comparative perspective with major financial centers in the region, what do you think the business community expects for Vietnam to be competitively attractive, making them consider shifting their investment focus?

Mr. Mai Huy Tuan: First and foremost, we need an open policy; this is the primary key. Following that, when the doors are open, we need people who understand global financial operations and have the confidence to develop their careers in Vietnam. With a legal foundation and resources, we can then manage capital flows and attract both traditional and new forms of finance.

A financial center is not about the size of a building or the number of hectares of land. It lies in the legal corridor, the mindset of the leaders, and, most importantly, the ability to create an environment where new ideas can be experimented with. A financial center should not only be a place for financial institutions to congregate but also provide a space for experimentation, such as sandboxes. Anyone with an idea for a new financial model, a new way of creating jobs, industries, or making money, should be able to experiment, receive support, and materialize their vision within this financial center.

After the government announced its intention to build a digital asset exchange, what steps have you and your colleagues at SSID taken in terms of legal and technical infrastructure preparation?

Mr. Mai Huy Tuan: According to the draft resolution, the minimum chartered capital for enterprises operating digital asset exchanges is VND 10,000 billion, and we have prepared for that.

In terms of technology, human resources, and international connections, we are ready with our platform, operational team, and security measures. International partners have also been waiting, working, and discussing throughout this time. They are just waiting for the green light from Vietnam to proceed immediately. Events like GM Vietnam are actually very important steps, contributing to the world’s perception that Vietnam is gradually opening up to new trends and allowing experimentation with novel ideas, something that hasn’t been done before.

In your role as a potential operator of the exchange, what digital assets do you think should be prioritized for listing?

Mr. Mai Huy Tuan: From a personal perspective, I believe there will be several main criteria to consider. First is whether the project generates cash flow, second is the size of its community, third is practicality—whether the asset is widely used—and finally, capitalization and liquidity, i.e., tokens that are well-known globally and have real value.

In the initial phase, if approved for implementation, we would prioritize listing digital assets, cryptos that are already established in the international market, have large capitalization, high liquidity, a vast user community, and, especially, clear practical applications.

Lately, the trend of “tokenizing real assets” has been a hot topic. What are your thoughts on this subject? Is it any different from the “fractional real estate” models that previously existed in Vietnam?

Mr. Mai Huy Tuan: Tokenizing real assets, specifically real estate, could be a very attractive proposition. However, in the initial phase, these tokens will likely only be sold to foreign investors, and Vietnamese individuals may not be allowed to participate at the beginning.

Notably, all tokens issued must be backed by real assets such as real estate, gold, silver, or artwork. In other words, issuance must be based on tangible assets.

This is also different from the “fractional real estate” model. In the past, companies divided real estate into smaller units for sale but still adhered to traditional financial thinking. Now, with tokenization, it’s about the community and blockchain’s decentralization. In reality, the most important aspect of the crypto world is the community. Selling to investors is also a challenge because it requires international marketing and attracting a global community. Events like GM Vietnam are crucial connection points in this journey.

However, some argue that the crypto market has a “fast food” nature, often being quite volatile and risky. How does this affect the quality of listed products?

Mr. Mai Huy Tuan: Not just crypto or digital assets, but traditional finance also has its bright and dark sides. Perhaps the peculiarity of coded assets is that trends come very quickly, and that’s the market’s taste. For example, I installed TikTok because I wanted to know what people ten years younger than me were doing. Recently, I also downloaded Locket, a popular app among Gen Alpha (born between 2010 and 2015), to observe how they interact and consume content.

To me, this is how I stay updated with trends and understand the current generation, which is mandatory for anyone in strategy. We cannot develop a future-oriented product if our mindset is stuck in the past. If we don’t understand how different generations think, we easily lose our ability to connect with the market.

Many still believe that a generation spans 30–40 years, but I believe this is no longer true in a world that is changing at a breakneck pace. Every 5–10 years, a new generation emerges with distinct behaviors, needs, aesthetics, and perspectives. The digital asset market reflects this clearly—a young, constantly evolving world where a phone model, hairstyle, color palette, or even a watch can become a trend in just a few days. If we don’t keep up, listen, and adapt, we will surely be left behind. Clinging to old mindsets in a new market is the fastest way to fall behind.

With the rapid pace of crypto, won’t the legal system have to “catch up” with businesses?

Mr. Mai Huy Tuan: That’s why we need an international financial center with “rapid response teams” to experiment with new things. In a socialist-oriented market economy, we need to continue innovating to keep up with the times. I believe the government is heading in the right direction, very quickly and timely. Our enterprise looks at this with confidence and is ready to embark on a new era.

Some are concerned about the requirement to “transfer assets to Vietnam” within six months—is this too forceful? Are there any risks of price differences between domestic and foreign exchanges?

Mr. Mai Huy Tuan: People often misunderstand this. No one forces you to immediately transfer coded assets to the country. But if you have buy, sell, or exchange transactions, they will have to take place on a licensed platform in the future.

Crypto is not like a mobile phone that you can turn off and put away. But if you don’t transact, no one will force you to do anything.

Regarding price differences, this must be market-driven. Personally, I think that since the draft resolution allows third parties to participate in creating liquidity, the gap between international and domestic transaction values will be minimal.

Running a crypto exchange means operating 24/7, unlike traditional stock exchanges. What has SSID prepared for this operational model?

Mr. Mai Huy Tuan: Of course, crypto means 24/7 because incidents can happen at any time. In reality, stock exchange employees used to work until 4 pm, but the technical team often worked late into the night. However, if we’re dealing with digital assets, the workload will be even more intense, and the processing speed must be continuous, with the office always lit.

But it’s not just the office; the marketing and community teams also need to be “lit.” Because crypto customers don’t come between 8 am and 4 pm; they can come between 8 pm and 3 am. GM Vietnam is a prime example. Besides the main event, there were over 150 side events. All the restaurants and bars in Hanoi were almost fully booked. Digital assets are not just about coming to the office, signing a contract, and leaving; it’s about the ecosystem. It’s a community that connects people, and sometimes a conversation at a street-side beer stall can lead to a million-dollar project.

So, in your opinion, what is the most important aspect of building a digital asset exchange?

Mr. Mai Huy Tuan: Many people ask me if security is the most expensive part. In reality, security is essential but not the most challenging aspect. The most difficult part is building the community.

Anyone can build a platform, and security can be developed in-house or outsourced. But attracting the community to gather, leading trends, and becoming the choice for major industry players to develop new projects is the hardest part. And that’s what SSID is focusing on doing well.

Does SSID intend to create its own digital coin if the exchange is licensed to operate?

Mr. Mai Huy Tuan: Creating a digital coin is easy. There’s a fact that the international crypto community respects Vietnamese startups for their speed in issuing coins and their agile coding skills. The technology to create a token is simple. But the challenge lies not in creation but in the ecosystem’s operation and community support. Without a community, a coin is just a piece of code.

In the current market, the gap between Bitcoin and altcoins seems to be widening. People expected an “altcoin season,” but it hasn’t materialized. What are your thoughts on this?

Mr. Mai Huy Tuan: I think it’s simple: if digital assets don’t continuously produce new products, they’re no longer digital assets. Hundreds or even thousands of new projects can emerge daily, and just as many can disappear. That’s the nature of digital assets. Major coins like BTC, ETH, and SOL have good liquidity and large communities, so they persist.

But the new is always scary because it comes after and is more potent than the old. Just like asking Gen Z about Yahoo, many may not know. But if there’s no new, how can we have TikTok to watch or Locket to play? We shouldn’t fear the new; we just need to maintain our development momentum in the right direction.

With such a fast-paced market, how can we prevent users from “chasing highs” and investing blindly?

Mr. Mai Huy Tuan: One of the reasons I decided to work in digital assets is that, in the past, I witnessed too many friends lose money in scam projects like Pincoin or ICOs. I kept thinking, “Why isn’t there a place for investors to ask questions? Why is the market so unregulated?”

Of course, having a legal framework doesn’t mean eliminating scams entirely, but at least, with a trustworthy source of information and advice, the likelihood of being scammed decreases. In the future, if SSID is licensed to operate a digital asset exchange, there will be educational programs and TV shows to spread investment knowledge, enabling people to ask the right questions and seek advice from the right places.

Looking long-term, what is SSID’s ultimate goal in entering the digital asset market?

Mr. Mai Huy Tuan: As I mentioned, the first goal of any enterprise is to make profits and generate cash flow. But if we stop there, we don’t have a mission.

Our mission is to help the investment community become safer and more transparent. By doing so, not only will enterprises thrive, but the economy will also gain a new piece. As SSI Chairman Nguyen Duy Hung once said, being an enterprise is about creating jobs, contributing to the state budget, and elevating the country’s stature.

The Digital Asset Exchange is Almost Here.

The early launch of the crypto asset exchange for beta testing is a significant step forward, offering legal trading opportunities for citizens.

“Asia’s Leading Blockchain Event: ‘Instead of Dubai or Singapore, I Want Them to Come to Vietnam’”

As GM Vietnam 2025 officially kicked off at the National Convention Center in Hanoi in the first week of August, little did anyone know that the master director behind the scenes was a young and dynamic individual: Nguyen Ngoc Son Quynh (Jenny Nguyen, 27 years old) – the Operations Director at Kyros Ventures and Coin68.

Tokenizing Real-World Assets: Dragon Capital Proposes Pilot with ETFs

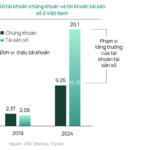

The Vietnamese economy has witnessed remarkable growth over the past few decades, resulting in a significant increase in household wealth and a heightened demand for more diverse investment options. Notably, digital assets have captured the interest of individual investors seeking to diversify their portfolios and embrace higher risk to maximize their wealth.