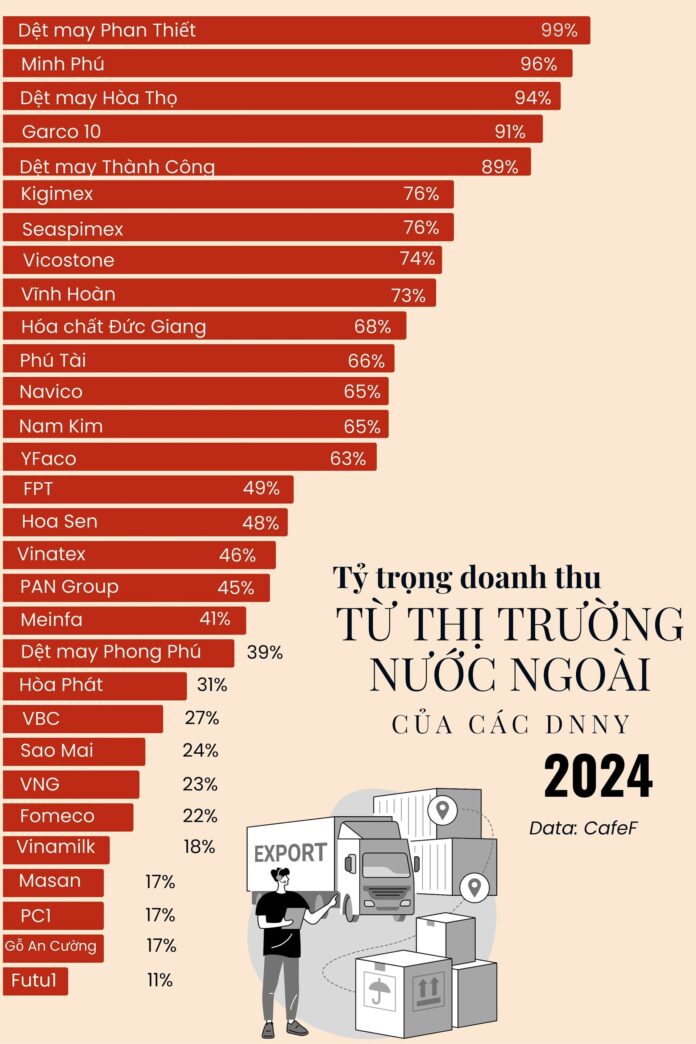

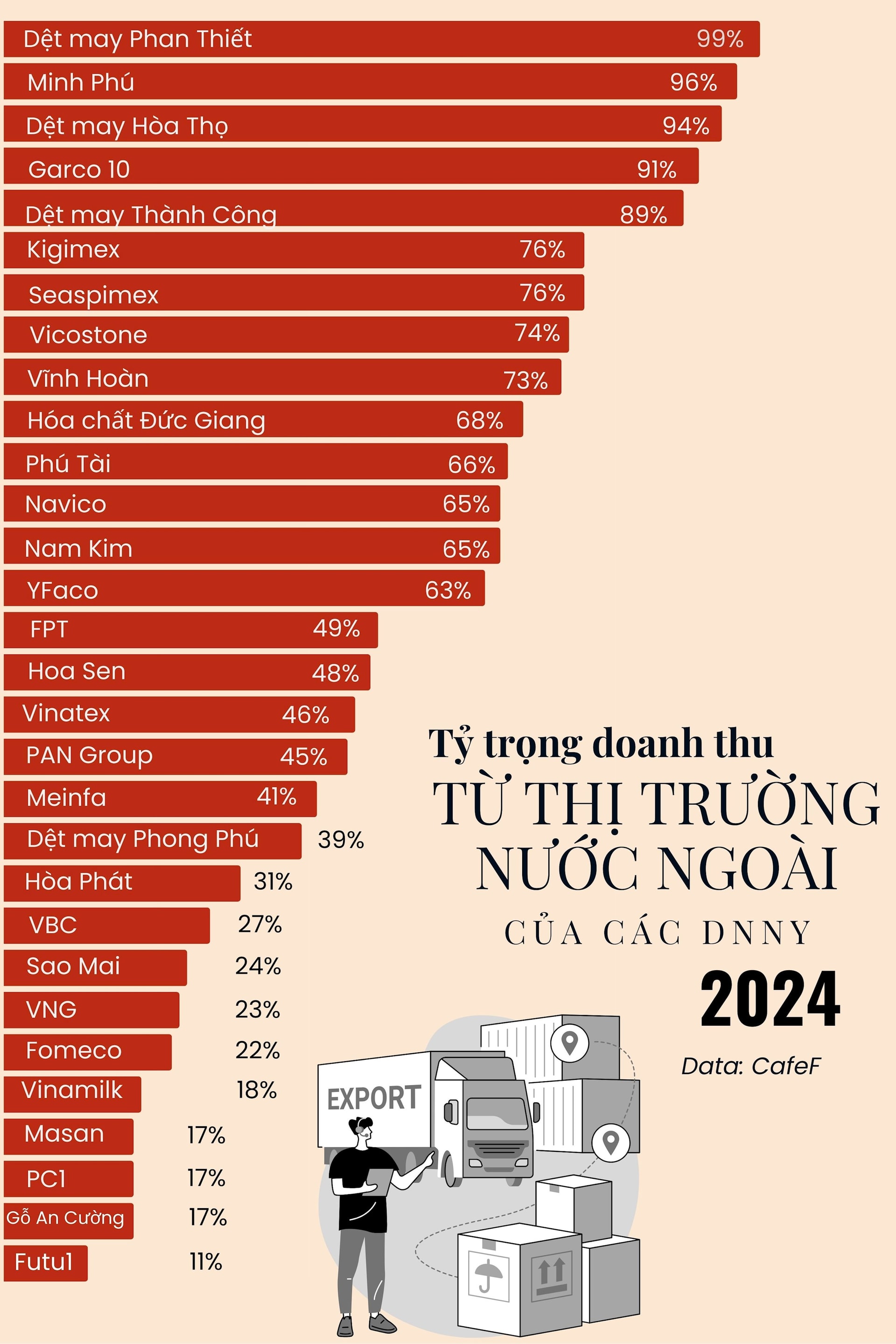

According to statistics from the 2024 financial report of enterprises on the Vietnamese stock exchange, the proportion of revenue from foreign markets compared to total revenue ranged from 11-99%.

The products of the textile and seafood industries are mainly for export, so this group has the highest proportion of foreign market revenue. Leading the pack are Phan Thiet Garment Joint Stock Company (PTG), Minh Phu Seafood Corporation (MPC), Hoa Tho Garment Joint Stock Company (HTG), Garco 10 Joint Stock Company (M10), and Thanh Cong Textile Garment Investment Trading Joint Stock Company (TCM) with ratios ranging from 89-99%.

Proportion of Export Revenue in 2024

In 2024, Vietnam’s export turnover reached US$405.5 billion, a 14.3% increase compared to 2023. Nearly 30% of Vietnam’s export turnover is directed towards American consumers.

In the first three months of 2025, Vietnam’s export turnover continued to bring good news, reaching nearly US$103 billion, a 10.6% increase compared to the same period last year.

However, on April 2, 2025, the US President announced a tariff plan that includes a basic tax rate of 10% and a countervailing tax rate applied to specific trading partners, with Vietnam facing a 46% tax rate.

The basic and countervailing tax rates took effect on April 5 and 9, respectively. A special envoy, Deputy Prime Minister Ho Duc Phoc, went to the US to concretize the negotiation contents to soon reach an agreement, for the benefit of the people and businesses of both countries.

SSI Securities Corporation’s analysis report assesses that with the current basic tax rate of the US on Vietnamese goods at about 3.53%, the new basic tax rate of 10% will not have too negative an impact, as this is a common rate for all countries.

In fact, this may give Vietnam a slight advantage because the tax difference between the US’s main trading partners is not too large.

Meanwhile, the countervailing tax, if implemented, could disrupt global trade as supply chains and demand cannot be adjusted quickly in the short term.

Many experts believe that the countervailing tax policy, if applied, will force enterprises either to accept reduced profit margins or to shift their export activities to regions other than the US.

According to SGI Capital, the most dynamic and robust region for economic and trade growth in the world today is the ASEAN-China-India triangle, thanks to its demographic structure and infrastructure. Countries like Vietnam will need to transform their production and export structures to take advantage of this trend and reduce their dependence on the US market.

This is a long and challenging process, but Vietnam has inherent advantages and the political will to successfully make this transition.

Nevertheless, businesses with a large proportion of revenue from foreign markets are the first to be affected by the latest tax news, until the impact is transmitted to other enterprises in the supply chain.

The US is the largest export market for Vietnam’s textile and garment industry, accounting for about 40% of the industry’s export output in 2024 – four to five times higher than other major markets, including Japan, the EU, South Korea, and China. Therefore, shifting to other markets will take considerable time.

According to SSI, the US accounted for about 18% of Vietnam’s seafood export value in 2024, lower than China (19%) but higher than Japan (15%), the EU (10%), and South Korea (8%). The tax rate for Vietnamese seafood products is lower than that of China, but this gap is narrowing significantly compared to predictions.

The seafood industry may face challenges if global demand stagnates and pressure from Chinese products increases in other export markets. Increased freight rates and prolonged clearance processes could also put additional strain on the industry.

The Global Ambition of RYG: A Promising Newcomer on the HOSE Floor

With a robust foundation, experienced leadership, and strategic vision, RYG is poised to soar and cement its position in the tile industry, both in Vietnam and on the global stage. The company’s strength lies in its solid groundwork, steered by a seasoned management team with a keen eye for strategic growth. This potent combination positions RYG to make a formidable impact, leaving an indelible mark in the tile industry, be it domestically or on the international arena.

“Thaco Agri Invests in its People for Future Growth”

With a strong foundation in industrial management and a highly integrated business model, THACO AGRI is revolutionizing the agriculture industry. As a pioneer in large-scale organic agricultural production, we are committed to an industrial approach, fostering the development of a skilled and specialized workforce in the field of agriculture. By leveraging the strengths and synergies of the THACO Group, we are leading the way towards a sustainable and innovative future for Vietnam’s agricultural sector.

Vinamilk’s Milk Exports Surge: What’s the Company’s Edge in the Global Market?

Vinamilk’s (HOSE: VNM) pure export revenue for Q2 2024 stood at VND 1,740 billion, a remarkable 37% increase compared to the same period last year, outpacing the 5.9% growth achieved in Q1 2024. The company’s continuous product innovation and strong relationships with partners in key markets are expected to remain the foundation for its export growth in the remaining six months of the year.

What Factors Supported Vinamilk’s Export “Surge” in the First Half of 2024?

Vinamilk’s net revenue from exports in Q2 2024 stood at VND 1,740 billion, a remarkable 37% increase compared to the same period last year, outpacing the 5.9% growth achieved in Q1 2024. The company’s continuous product innovation and strong relationships with partners in key markets are expected to remain the foundation for its export growth in the remaining six months of the year.