The U.S. has announced new tariff rates ranging from 10-41% for most trading partners, with a 20% tax rate imposed on Vietnamese goods, a reduction from the previously announced rate of 46% in April.

Vietnamese businesses seek advantages to enter the U.S. market

At the regular Government meeting for July, held on August 7, Minister of Industry and Trade Nguyen Hong Dien stated that the Ministry had promptly submitted to the Prime Minister a set of tasks assigned to relevant ministries and sectors to effectively adapt to this tariff policy.

This includes continuing technical negotiations to consolidate the official agreement, which will be carried out in the coming week.

The Ministry of Finance will coordinate with relevant ministries and sectors to assess the impact of the tariff rates on Vietnam and propose tasks, solutions, and mechanisms to effectively respond to this policy.

U.S. Tariffs and Proactive Vietnamese Businesses

Regarding the shrimp industry, the Vietnam Association of Seafood Exporters and Producers (VASEP) stated that the 20% tariff, along with potential tariff increases from trade cases, makes pricing a challenging issue for Vietnamese shrimp in the U.S. market. The U.S. currently imposes tariffs on India (25%), Ecuador (15%), and Indonesia (19%).

However, VASEP assessed that the U.S. market is not solely about price. By坚持ng to unique, high-quality products, excellent services, and investments in sustainability, Vietnamese shrimp can still be a strategic and irreplaceable supplier.

The Minister of Industry and Trade also proposed that the Government assign his ministry to develop and implement a plan for the trade agreement with the U.S. This includes improving the investment and business environment in Vietnam, supporting domestic enterprises in expanding trade and export markets, and enhancing the capacity and consumption potential of the Vietnamese economy and enterprises…

As a company exporting rice to the U.S., Mr. Phan Van Co, Marketing Director of Vrice Rice Company, shared that rice exports to the U.S. market are proceeding normally. For some processed fragrant rice products that competing exporters like Thailand cannot offer, partners are still importing them stably.

According to the 2025 Business Confidence Report by the Private Economic Development Research Board (Board IV) in collaboration with VnExpress, businesses show positive signals in coping with the impact of U.S. tariff policies.

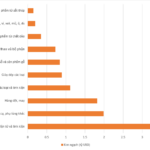

Specifically, 29.7% of businesses choose to find new markets to reduce dependence on the U.S., 20.5% plan to increase localization in the production chain, and 19.6% intend to source raw materials from other trading partners.

Meanwhile, about 24.2% of businesses choose to temporarily suspend operations until the 90-day period ends, reflecting caution amid unfavorable policy changes.

Notably, only about 6% of businesses choose to “increase selling prices for products in the U.S. market,” indicating that this is not a preferred option.

“This result shows that despite the serious challenges posed by U.S. tariff policies, businesses remain proactive, flexible, and positive in proposing practical solutions to maintain business operations and overcome difficulties,” said the survey by Board IV.

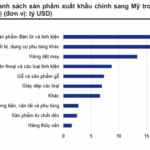

On the Eve of the US’ 20% Retaliatory Tariffs: How Much Has Vietnam Exported to the World’s Largest Economy?

The U.S. government has announced a new decree that will see a 20% tariff imposed on goods from Vietnam, coming into force on August 7th.

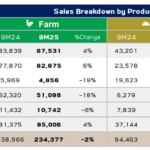

“Vietnam’s Manufacturing Sector Loses Momentum in Late 2024”

The Vietnamese manufacturing sector faced headwinds in the final month of 2024, as the Purchasing Managers’ Index (PMI) dipped from 50.8 in November to 49.8 in December, slipping below the 50-point threshold for the first time in three months. This indicates a mild deterioration in business conditions, presenting a challenging landscape for the industry as the year drew to a close.

“The International ‘Playbook’: Small and Medium-Sized Enterprises Need to Take the Initiative to Adapt”

In the context of exports recording many positive results but still facing challenges, Vietnamese businesses need to be proactive in innovation, build long-term strategies, and focus on investing in technology and human resources. They must also take advantage of free trade agreements (FTAs) to expand their markets.