|

VND’s Q1 2025 Financial Results

Source: VietstockFinance

|

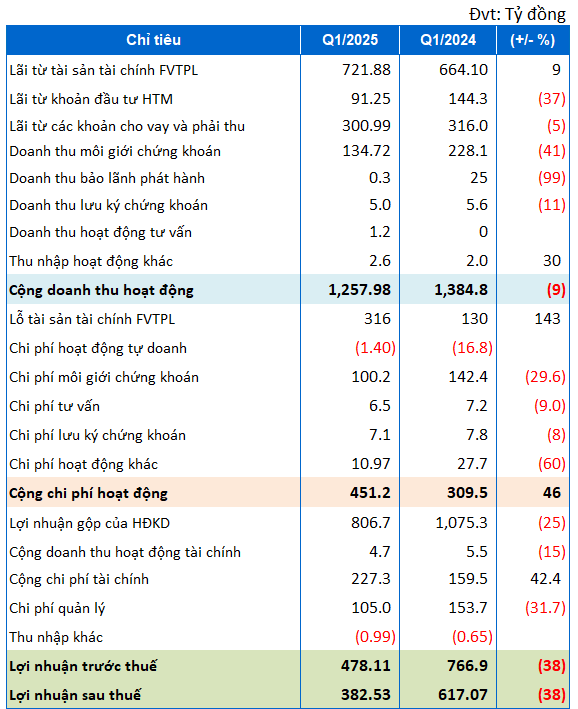

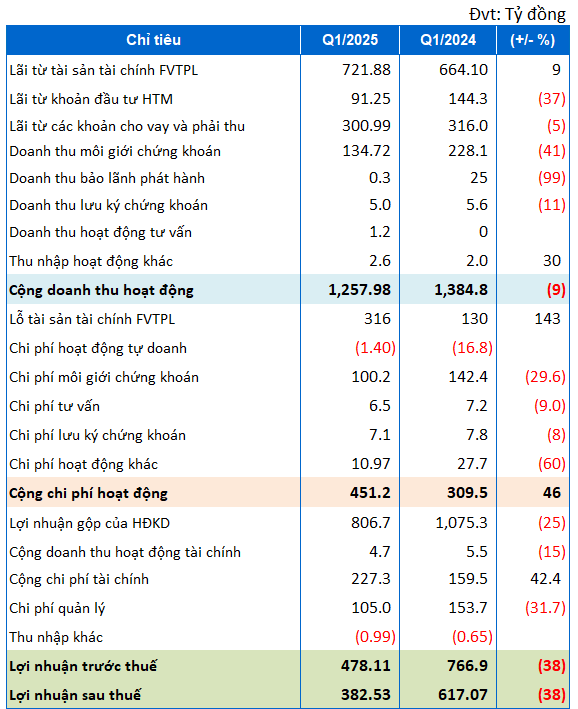

A rare bright spot was the profit from financial assets recorded through profit/loss (FVTPL), which reached nearly VND 722 billion, up 9% from the same period last year. However, all other business segments recorded declines. Profit from holdings to maturity (HTM) decreased by more than 36%, to VND 91 billion.

Profit from margin lending also slightly decreased to VND 300 billion. Notably, revenue from securities brokerage decreased by 41%, to VND 134 billion.

Revenue from underwriting securities decreased by nearly 99%, to just over VND 300 million.

While revenue was down, VND’s operating expenses increased by nearly 50%, from VND 309 billion to VND 451 billion. The main reason for this was the loss from FVTPL, which increased by 144% to VND 315 billion. Financial expenses for the quarter also increased by more than 42%, to VND 227 billion.

For the quarter, VND’s profit after tax was VND 382 billion, a decrease of nearly 40% compared to the figure of VND 617 billion in the same period last year.

As of March 31, 2025, VND recorded total assets of over VND 50,000 billion, a significant increase from VND 44,294 billion at the end of 2024. Of this, payables increased by 22%, to nearly VND 30,000 billion, mainly due to the company’s increase in short-term bank loans by nearly VND 5,700 billion during the period.

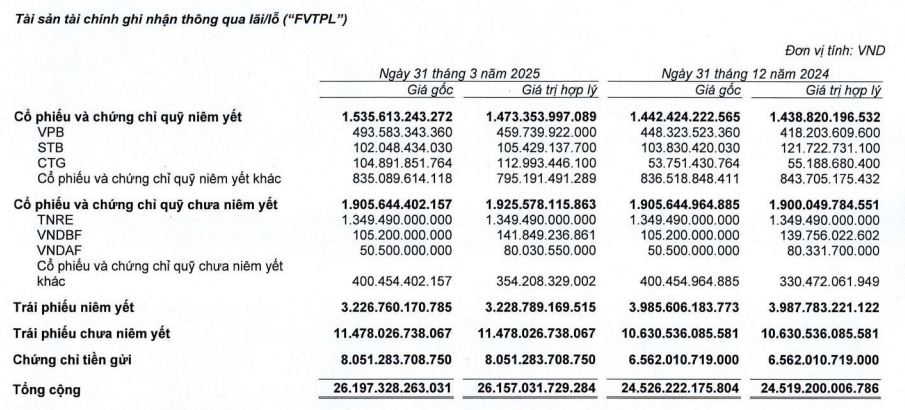

As of the end of Q1, the fair value of the financial assets recorded through profit/loss portfolio was nearly VND 26,200 billion, an increase of about VND 1,600 billion compared to the end of last year. Specifically, the company invested VND 1,500 billion in listed stocks and VND 1,900 billion in unlisted stocks, unchanged from the end of 2024. Some notable stocks in the portfolio include VPB, STB, and CTG. Compared to the beginning of the year, the company has increased the scale of its holdings in CTG (from VND 54 billion to VND 105 billion).

|

VND’s FVTPL Asset Portfolio

Source: VND Financial Statements

|

Investments in unlisted bonds and deposit certificates increased by VND 800 billion and VND 1,500 billion, respectively, to VND 11,478 billion and VND 8,052 billion.

In addition, the company added VND 1,600 billion to its holdings-to-maturity portfolio, bringing the scale to VND 7,189 billion. Margin loans also increased by 8%, to VND 11,120 billion.

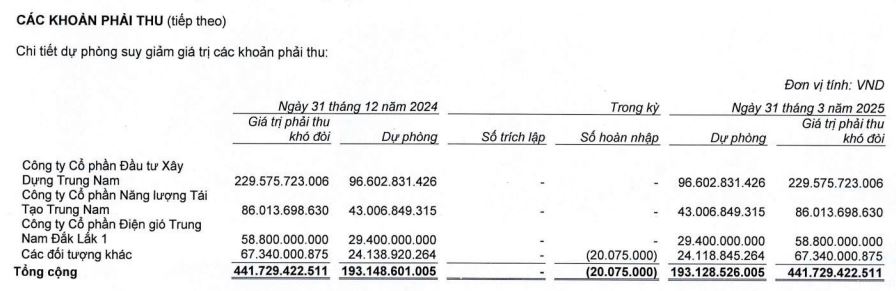

VND has nearly VND 442 billion in difficult-to-collect receivables, of which VND 374 billion is from Central Southern Construction Investment Joint Stock Company, Central Southern Renewable Energy Joint Stock Company, and Central Southern Dak Lak 1 Wind Power Joint Stock Company. The total provision for difficult-to-collect receivables is more than VND 193 billion.

Source: VND Financial Statements

|

– 17:36 21/04/2025

DNSE Captures 33% of New Brokerage Accounts in Q1

In Q1 of 2025, DNSE Securities witnessed a remarkable 34% surge in revenue compared to the same period last year. This impressive growth is further accentuated by a 10% increase in margin loan balances since the beginning of the year. DNSE Securities also maintained its dominant position in the market, capturing a substantial 33% of all new brokerage accounts opened, solidifying its leadership in the industry.

SSI Aims for Over VND 1,000 Billion in Pre-Tax Profit in Q1 2025, Sets Record with Outstanding Loan Balance

With an outstanding loan balance of over 27,000 billion, SSI has reached its highest lending level since its inception. This figure surpasses the peak lending period when the VN-Index climbed to 1,500 in late 2021 and early 2022.

BAOVIET Bank: Accelerating Digital Transformation, Leveraging the Power of the Bao Viet Ecosystem

As per the recently published 2024 audited financial report, BAOVIET Bank has demonstrated impressive growth across key metrics, further cementing its position as a powerhouse in the Vietnamese banking sector. The bank has strategically leveraged its digital transformation journey and synergistic strengths within the Bao Viet ecosystem to drive this remarkable performance.

The First Bank Targeting Over 30% Profit Growth by 2025

This bank has set an ambitious target for its 2025 performance, aiming for a pre-tax profit of 5,338 billion VND, representing a remarkable 33% increase from 2024.