The Vietnam-US negotiation kick-off event on the evening of April 23 was cautiously welcomed by the market. This was expected to happen, and setting a date was good news, but fundamentally, it’s all about results. The cautious stance of both buyers and sellers was evident in the balanced tug-of-war trading with a significant drop in liquidity.

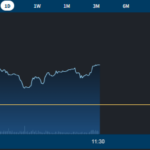

The market still had a positive early upward momentum, with the VN-Index’s highest amplitude exceeding the reference by nearly 11.5 points (+0.95%), but it weakened afterward. Just before 11 a.m., the index even dipped below the reference, losing 0.55 points. The market slowly recovered in the remaining minutes, with the VN-Index closing up 3.08 points, or +0.25%.

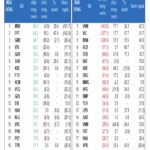

The change in the breadth of the index also indicated strong differentiation: At the VN-Index peak at 9:43 a.m., there were 286 gainers and 100 losers. At the bottom at 10:55 a.m., there were 218 gainers and 222 losers, and at the close, there were 230 gainers and 226 losers.

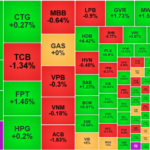

VIC was the stock that shaped the VN-Index’s final 30-minute recovery. After four consecutive losing sessions, VIC stabilized in the morning and surged strongly from 11 a.m. onwards. In just 30 minutes, VIC gained 3.2% and closed above the reference by 4.44%. VIC alone contributed nearly 2.4 points to the VN-Index.

In the Top 10 capitalization of the index, only FPT’s 1% gain was notable, but this stock mainly played a role in the first upward momentum. In the first 30 minutes after the opening, FPT rose 2.99%, and the rest of the time, it slid. Nonetheless, FPT contributed 0.4 points to the VN-Index. So, VIC and FPT almost carried the entire morning’s points.

The rest of the VN30 basket of blue chips was generally differentiated, but the weighted capitalization was in the declining group. Specifically, the basket’s breadth at the close was 14 gainers and 14 losers, but the index lost 1.32 points (-0.1%). Besides VIC and FPT, the gainers were mid-cap stocks: BVH rose 4.66%, HDB 2.21%, BCM 1.82%, GVR 1.51%, and SSB 1.08%. On the declining side, CTG fell 1.07%, TCB 1.15%, and MBB 1.07%, all in the Top 10 capitalization. SHB, ACB, MSN, and STB also fell more than 1% but had smaller capitalizations.

In terms of indices, the market is showing a tug-of-war without any significant surprises. The relatively balanced breadth also indicates this. However, money flow remains robust and concentrated. Specifically, out of the 230 gainers, 105 stocks rose more than 1%, but only 53 out of the 226 losers fell more than 1%. Moreover, the liquidity of the strongest gainers accounted for 39% of the matched orders on the HoSE floor, while the liquidity of the losers accounted for 30%.

Positive trading was concentrated in medium- and small-cap stocks. FPT and VIC were also outstanding stocks with high liquidity and strong gains. Additionally, NVL, VTP, KBC, VHC, DIG, and FTS had high liquidity and significant price increases. Among the approximately 20 healthiest stocks with gains of over 3%, only VIC and BVH were blue chips.

On the declining side, four notable blue chips were SHB, STB, MBB, and TCB, all in the banking group, with liquidity exceeding 100 billion VND. About 15 other codes had transactions of over 10 billion VND, with a decline of more than 1%. It can be seen that the selling pressure was also quite concentrated, and not many stocks were dumped. GEX and VIX were the only two codes sold off, with liquidity exceeding 200 billion VND, and prices falling by more than 2%.

The liquidity of the two listed exchanges this morning decreased by nearly 19% compared to yesterday morning, reaching 8,064 billion VND. HoSE decreased by 20% with 7,554 billion VND. This is the weakest trading session in the last six sessions. Foreign investors also reduced their intensity, slightly net selling 38 billion VND. The slow trading status after yesterday’s excitement and this morning’s early session indicates that a cautious sentiment is dominating. When there is no worse news, it can be considered good, but when new expectations arise, more concrete signals are needed than speculation.

The Great Sell-Off: Foreigners Dump Real Estate Stocks en Masse

Individual investors sold a net amount of 516.1 billion VND, including 541.1 billion VND in matched orders. The top stocks sold were VHM, VIC, MSN, ACB, STB, BAF, DXG, MWG, and HPG.

“The Super Pillar” Returns: VN-Index Surges Past 1220 Points as Foreign Investors Turn Net Buyers

The morning’s trading conundrum continued for a few minutes into the afternoon session, culminating in an explosive surge. VIC and VHM, the prominent large-cap stocks, led the charge, propelling a host of other blue-chips to significant gains. The VN-Index closed above the crucial 1220-point mark, as foreign investors also unexpectedly ramped up their buying activity.

The Red Hot Electric Board: VN-Index Plunges Below the 1200-Point Mark, Foreigners Sell Off in the Highest 7 Sessions

The significant weakening of pillars, coupled with unfavorable developments in the international market, sent Vietnamese stocks into a sharp decline this morning. Investors tried to offload their positions, and while it didn’t quite turn into a panic sell-off, it still resulted in hundreds of stocks plunging. The VN-Index tumbled to 1,189.07 points…

The Roaring Mid and Small-Caps

The blue-chips’ steady hand is guiding the market with a confident stride. Lower liquidity and selling pressure advantageously brightened the mid and small-cap space this morning.

The Stock Market Slump: VN-Index Plunges Towards 1200 Points

Concerns about pressure from large-cap stocks, particularly VIC, are being realized. VCB is the sole pillar trying to swim against the tide, but it’s unable to counterbalance the decline of numerous other large-cap stocks. The VN-Index plummeted throughout the morning session, closing at its lowest point, down nearly 13 points, or -1.06%, at 1,206.15.