In the past few weeks, global financial markets have been on edge due to statements made by the President of the United States, Donald Trump, regarding import tariffs. Tensions seem to have eased as Trump recently hinted that the back-and-forth with China may soon come to an end. However, concerns about a recession, slow economic growth, and inflation are causing headaches for many. And the person feeling the most pressure is likely none other than the Fed Chairman, Jerome Powell.

THE UNINTENDED CONSEQUENCES OF TARIFFS

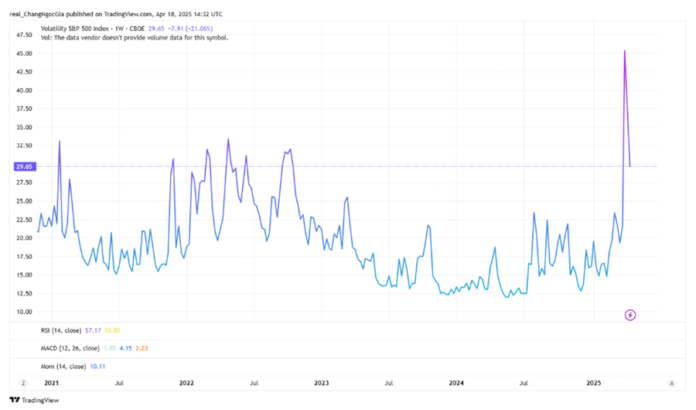

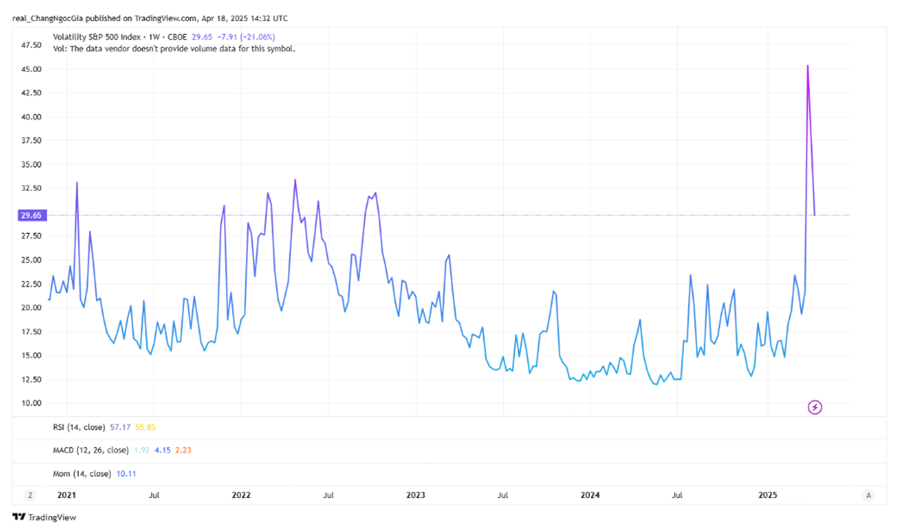

With the significant increase in tariffs on imports from several countries into the US, followed by retaliatory actions from China and the EU, trade policy uncertainties have exceeded traditional boundaries. Financial markets have witnessed dramatic spikes and dips in the VIX index, surging from the 20x range to 60x and then falling back to 30x. A Reuters survey showed that the probability of a US recession in the next twelve months has jumped to 45% from 25% last month.

Representatives from the International Monetary Fund (IMF) also acknowledged the severe implications of trade tensions, and the upcoming Spring meeting of the IMF and World Bank will focus on this issue. However, a recession is not imminent, despite a significant decline in growth. Earlier this year, the IMF predicted a 3.3% global economic growth rate for 2025, and the new figure will be released in a few days.

Trade uncertainties have also caused abnormal fluctuations in various asset prices. The price of gold surged, surpassing $3,300 per ounce, as it is a preferred safe-haven asset. Meanwhile, oil prices plummeted to a record low, with some futures contracts falling below $60 per barrel. The US dollar suffered a similar fate, with the DXY index dipping below 100 at one point, compared to 110 at the beginning of the year—an incredible drop.

An unusual development occurred in the first week of April, when the yield on 10-year US Treasury bonds surged. Typically, US Treasury bonds are considered a safe haven during times of uncertainty. However, concerns about inflation, pressure from the Chinese government, and margin calls from some investment funds led to an increase in supply, causing bond prices to fall and yields to rise.

The pressure of retaliatory tariffs also weighs heavily on other major economies, such as China and the EU. China has devalued the yuan, pushing it to its lowest level since 2007, with an exchange rate of 1 USD = 7.3498 RMB. Additionally, monetary policy easing through interest rate cuts is a possibility in the near future. The European Central Bank (ECB) has reduced its benchmark interest rate to 2.25%, following seven cuts since last June. Even if inflationary pressures return, the ECB is likely to continue its rate-cutting plan.

In a recent analysis by Professor Gianluca Benigno (HEC Lausanne), he argued that this tariff shock could lead to a financial shock. The basis of this argument is that the impact is significant, unexpected (due to the high tariff rates), and systemic (aiming to isolate the US from the global trading system). As trade uncertainties increase, they will spread to financial markets following the classic Kindleberger–Minsky framework. Consequently, markets will adjust expectations about profits and growth, leading to a downward revaluation of various assets, margin trading tensions, a downward spiral of deleveraging forced sales, and ultimately contagion to the banking credit system.

PRESSURE ON THE FED

On the one hand, President Donald Trump is exerting tariff pressure on many countries, including US allies. On the other hand, he is constantly pressuring the Fed, and specifically Chairman Jerome Powell, to cut interest rates sooner rather than later to support the economy. The Fed finds itself in a difficult position as tariffs increase inflation while the Fed wants to reduce it, and they also aim to keep unemployment rates in check, as employment significantly impacts inflation and, consequently, interest rate policies.

During a talk at the Chicago Economics Club on April 16, Powell discussed the risks of future uncertainties affecting the decisions of households and businesses. In a worst-case scenario, the investment environment in the US would become less attractive. However, he reassured that financial markets are functioning orderly and that the Fed is prepared to provide liquidity through dollar swap lines with other central banks if necessary.

Trump has repeatedly pressured Powell, even suggesting his dismissal and attempting to limit the Fed’s independence. However, independence is the most valuable asset of a central bank, as it builds public trust and enables better control over inflation. In an extremely unlikely scenario, Trump could dismiss Powell based on a “good cause” reason, but this is vague and challenging to execute. Even in this rare case, the former Fed chairman would likely continue to serve on two crucial boards: the Board of Governors and the FOMC.

Thus far, Powell and the Fed have maintained their composure and independence from the Trump administration. The Fed’s upcoming decisions will undoubtedly be challenging, but prudence and the public’s best interests will likely take precedence over governmental pressure.

If tensions escalate, the unintended consequences of retaliatory tariffs will affect all parties involved, and this has surely been considered. However, it is challenging to accurately estimate the exact figures. Hopefully, Trump and his advisors will find a balanced approach, reducing uncertainties and helping the world, especially the US, avoid a recession or even a crisis.

—

(*) Lecturer at the University of Economics Ho Chi Minh City and IPAG Business School Paris, member of the Global Vietnamese Scientists and Experts Organization – AVSE Global.

The Golden Rush: Soaring Prices of Gold Rings and SJC Gold

Late in the afternoon of April 8th, domestic gold prices rebounded, surging back above the 100 million VND per tael mark after a sharp decline earlier in the day. This dramatic turnaround saw the price of gold jewelry and SJC gold reclaim their lofty perch, offering a glimmer of hope to investors and enthusiasts alike.

The Shifting Economic Trends: Standard Chartered Adjusts USD/VND Exchange Rate Forecast

In its latest Vietnam Macroeconomic Report released on March 26, Standard Chartered Bank revised its USD/VND exchange rate forecast, reflecting shifts in the global and regional economic landscape.

The New Interest Rate Cuts: A Strategic Move by Banks to Boost Their Economy.

As per the State Bank of Vietnam’s (SBV) update on deposit interest rate movements at commercial banks from February 25 to March 18, 2025, a significant 23 banks adjusted their deposit interest rates, with reductions ranging from 0.1% to 1% per annum, depending on the term. Notably, the SBV also recorded up to six instances of banks lowering their interest rates within this period.