The Vietnam National Oil and Gas Group (Petrovietnam – PVN) is a state-owned enterprise that serves as a pillar in the national economy, pioneering in the oil and energy sector.

Over 50 years of establishment and development, Petrovietnam has built a synchronized and modern energy industry ecosystem, with a total oil extraction output of 460 million tons and 180 billion cubic meters of gas, a total power capacity of 8,229 MW, and the operation of a series of key national projects ranging from oil and gas exploration and exploitation to electricity and renewable energy industries.

According to Petrovietnam, the enterprise is currently operating 12 drilling rigs, including 4 exploration wells under development.

The Group supplies over 75% of the domestic demand for gasoline, more than 73% of fertilizer demand, over 75% of the LPG market share, and contributes 10% to the country’s total electricity production, playing a central role in Vietnam’s essential energy supply chain.

Impressive production growth in the first 7 months of 2025 compared to the same period in 2024

In July, amidst significant market fluctuations and challenging contexts, Petrovietnam carried out numerous activities to promote production, business, and sustainable development. The Group achieved several important milestones in its operations.

Specifically, on July 14th, the Kình Ngư Trắng – Kình Ngư Trắng Nam project officially welcomed its first flow of oil, ahead of schedule. This event positively contributes to the goal of increasing production and ensuring national energy security.

In terms of international cooperation, Petrovietnam promoted the expansion of relations with energy enterprises in Brazil. Domestically, the Group signed a comprehensive cooperation agreement with the People’s Committee of Ha Tinh province to develop the local economy and established cooperation with member companies of the Vietnam National Textile and Garment Group (VINATEX)…

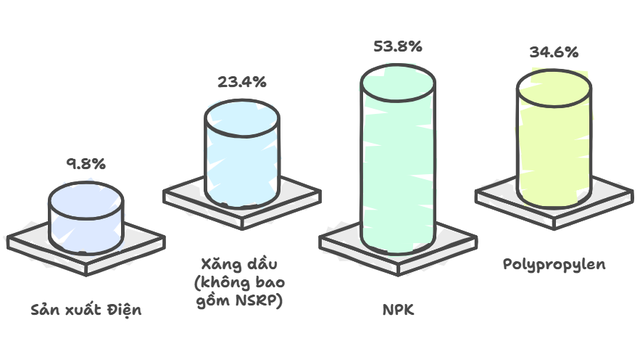

As a result, in July, Petrovietnam achieved a growth rate of 1-45% in some production indicators compared to the same period last year, including crude oil extraction, LNG imports, electricity production, gasoline production excluding NSRP, fertilizer production, NPK production, and Polypropylen production.

In the first seven months, compared to the Group’s management plan, Petrovietnam achieved and exceeded the plan by 1-10% in some indicators, including foreign crude oil extraction, gasoline production excluding NSRP, fertilizer production, NPK production, and LPG production. Compared to the same period in 2024, some indicators showed strong growth, such as a 9.8% increase in electricity production, a 23.4% rise in gasoline production excluding NSRP, a 53.8% surge in NPK production, and a 34.6% jump in Polypropylen production.

Overall, in the first seven months of 2025, Petrovietnam also recorded positive growth in various service products: New contracts for ship repair services (PVSM) increased by 22% compared to the same period; Construction of oil and gas and wind power platforms, oil and gas processing platforms, and OSS platforms (PTSC); Revenue from the fabrication and construction of new oil and gas and renewable energy projects increased by 88% over the same period last year.

In the first seven months of 2025, the Group’s total revenue is estimated at VND 602,165 billion, and the state budget contribution is estimated at VND 83,013 billion. These indicators have grown compared to the previous year.

In the consolidated revenue structure over the past seven months, Petrovietnam recorded VND 5,204 billion in new revenue from scientific and technological development and innovation and VND 67,365 billion from international business. The Group also promoted investment disbursement, increasing by 49% over the same period in 2024, estimated at VND 24,766 billion.

The Ultimate Road Trip: Unveiling the New 24,000 Billion VND Expressway in Nghe An, Slashing Travel Times Across the Region.

The Vinh – Thanh Thuy Expressway project boasts a total length of approximately 60 kilometers and an impressive investment of 23,950 billion VND. This ambitious undertaking is slated for completion and operation by 2029.

A Real Estate Firm with a 14x Land Bank Increase in Just 5 Years

The Real Estate Investment Joint Stock Company, Taseco (TAL), announced its consolidated revenue for the second quarter of 2025, which amounted to VND 557 billion, a 12% decrease compared to the same period last year. This revenue stream primarily comprises earnings from real estate ventures and, to a lesser extent, construction contracts.