According to statistics from the General Statistics Office (GSO), the total import and export turnover of goods in July reached $82.27 billion, an increase of 8% compared to June and 16.8% over the same period in 2024. In the first

seven months, the total import and export turnover of goods reached $514.7 billion

, up 16.3% compared to the same period last year.

Notably,

July’s export turnover reached $42.3 billion, the highest in a single month to date. Overall, in the first seven months, Vietnam’s export turnover of goods reached $262.44 billion,

an increase of 14.8% over the same period last year. So far this year, 28 commodities have achieved an export turnover of over $1 billion, accounting for 91.7% of the total export turnover.

Vehicles transporting goods for customs clearance at Bac Luan II Border Gate.

As a border province, about 200km from Hanoi, Quang Ninh has emerged as one of the localities with stable import and export activities in recent years.

According to the Quang Ninh Provincial Portal, Mr. Le Hong Giang, Deputy Director of the Department of Industry and Trade, said that

the province’s import and export turnover has continuously grown steadily in recent years at an average rate of about 12%/year.

As of June 15, 2025, the total volume of import and export goods through the province’s border gates reached nearly 1.2 million tons, an increase of 36% over the same period last year.

The province’s export goods have reached more than 80 countries and territories worldwide.

Quang Ninh exports a variety of goods to international markets, including China, South Korea, Japan, India, Pakistan, the EU (Germany, the UK, France, and Italy), and other markets.

The province’s export activities particularly focus on promoting official exports, building brands, and taking advantage of preferential policies from multilateral and bilateral trade agreements.

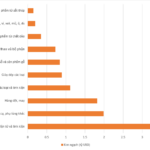

Quang Ninh’s key export commodities include fruits, cassava starch, frozen seafood, dried seeds, shrimp, crab, live fish, cement, clinker, fibers, garments, tiles, ceramics, premium candles, and other agricultural products.

Customs officials supporting an enterprise. Source: Quang Ninh Provincial Portal.

To further enhance exports, Quang Ninh has implemented various measures to reduce administrative procedures for enterprises.

At the Hai Quan Cai Bong Port, groups of goods such as vegetable oil, candy, salt, sanitary equipment, building materials, and even technical products like water pipes and tiles have been proposed for full digitalization of the inspection process. This helps enterprises save time, reduces administrative burdens, and expedites the flow of goods.

Meanwhile, at the Mong Cai International Border Gate, eight administrative procedures have been digitized and made accessible via QR codes, enabling enterprises to easily access and retrieve information, enhancing transparency and proactiveness in the procedure implementation process.

The Customs Branch of Region VIII reported that in the first six months, 726 new enterprises conducted procedures at the branch, contributing over VND 315 billion to the state budget. This is a result of administrative reforms that enhance enterprises’ initiative.

To further expand markets and increase export turnover, the Quang Ninh Department of Industry and Trade will continue to strengthen trade promotion activities, support enterprises in connecting with international markets through trade fairs and forums, and provide export consulting services. The department will also enhance its efforts in providing market and import-export policy information to enterprises.

In addition, the department will coordinate with the customs sector and local authorities to promote administrative procedure reforms and encourage the application of technology to improve enterprises’ competitiveness.

The Fashion Industry’s Positive Outlook: A 9% Surge in Export Revenue

The textile industry’s export turnover for the first seven months of the year surpassed 26.33 billion USD, reflecting a 9% increase. To attain the ambitious target of 47-48 billion USD for the entire year, the industry must strive to achieve monthly exports of over 4 billion USD in the remaining months.

Streamlining Agricultural and Environmental Business Procedures: Cutting Red Tape, Simplifying Processes

With the new scheme, there is a focus on reducing and streamlining administrative procedures related to production and business operations across 13 sectors. This also includes the reduction and simplification of investment and business conditions in 36 sectors, specifically for regulated industries in agriculture and the environment.

On the Eve of the US’ 20% Retaliatory Tariffs: How Much Has Vietnam Exported to the World’s Largest Economy?

The U.S. government has announced a new decree that will impose a 20% tariff on goods from Vietnam, effective August 7th. This significant development in international trade relations has the potential to impact a wide range of industries and businesses, both in the U.S. and abroad. With this new tax in place, it is crucial for companies to reevaluate their supply chains and strategies to mitigate any potential negative consequences. Stay tuned as we bring you in-depth analysis and insights on how this tariff may affect your business and explore possible avenues to navigate this changing economic landscape successfully.

Vietnam Achieves a $10.18 Billion Trade Surplus in the First Seven Months of 2025

In July, the total trade of goods reached 82.27 billion USD, an increase of 8.0% compared to the previous month and a surge of 16.8% from the same period last year. For the first seven months of 2025, the total trade of goods amounted to 514.7 billion USD, reflecting a significant 16.3% year-on-year increase. This comprised a 14.8% rise in exports and an even more robust 17.9% climb in imports, resulting in a favorable trade balance surplus of 10.18 billion USD.