Vietnam-based real estate group,

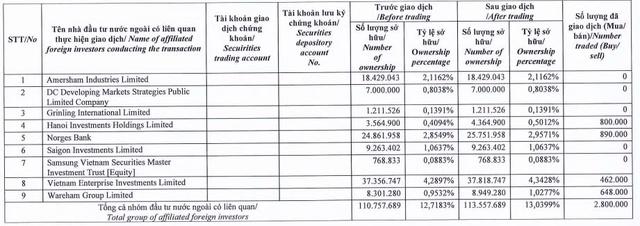

On April 29, 2025, the foreign fund Dragon Capital, represented by Ms. Truong Ngoc Phuong, successfully acquired 2.8 million DXG shares through four of its member funds.

Specifically, Hanoi Investments Holdings Limited purchased 800,000 DXG shares, Norges Bank acquired 890,000, Vietnam Enterprise Investments Limited bought 462,000, and Wareham Group Limited secured 648,000 shares.

Following this transaction, Dragon Capital’s holdings in DXG increased from nearly 110.8 million to approximately 113.6 million shares, raising their ownership stake from 12.7183% to 13.0399% in the

Based on the closing price of DXG shares on April 29, 2025, at VND 15,150 per share, Dragon Capital is estimated to have invested over VND 42.4 billion in this purchase.

Previously, on April 11, Dragon Capital had also increased its stake in DXG by purchasing an additional 1.8 million shares, raising its ownership from 11.92% to 12.13%.

In another development, Mr. Ha Duc Hieu, a member of the Board of Directors, registered to purchase 5 million DXG shares. If successful, Mr. Hieu’s holdings will increase from 0.09% to 5.875 million shares, representing 0.66% of the company. The transaction is expected to take place between May 7 and June 4, 2025, through matching or negotiated deals.

Based on the closing price of VND 16,000 per share on May 7, Mr. Hieu is estimated to have invested VND 80 billion in this transaction.

Regarding financial performance, DXG reported a quarterly loss of VND 45.28 billion in the first quarter of 2025, compared to a profit of over VND 120 billion in the same period last year. However, the consolidated financial statements showed a 1.17% increase in profit after tax, amounting to VND 78.54 billion.

The company attributed the loss in the parent company’s financial statements to the absence of financial income from dividend receipts from subsidiaries and transfer transactions compared to the previous year.

On the other hand, the consolidated profit after tax for the first quarter of 2025 reached VND 78.5 billion, with VND 48.4 billion attributable to the parent company’s shareholders, representing a 54% increase year-over-year. This growth was primarily driven by increased revenue from the project development segment and a robust recovery in the Group’s real estate services segment.

As of March 31, 2025,

The company also witnessed a fourfold increase in cash and cash equivalents compared to the previous year, rising from VND 1,249 billion to nearly VND 5,106.7 billion.

Total liabilities increased by 18.6% from the beginning of the year to VND 16,577.7 billion, including short-term and long-term financial borrowings of over VND 7,545 billion. Profit after tax also increased from VND 1,487 billion to over VND 1,535.6 billion.

It is worth noting that DXG will hold its 2025 Annual General Meeting of Shareholders on May 9, 2025, at 2W Ung Van Khiem, Ward 25, Binh Thanh District, Ho Chi Minh City.

For the year 2025, DXG has set ambitious targets, aiming for a 62% surge in consolidated revenue to VND 7,000 billion and a 44% jump in profit after tax attributable to the parent company’s shareholders to VND 368 billion.

“A Stellar 46% Profit Margin: Vietnamese FMCG Company Targets 35.5 Trillion VND in Revenue.”

In today’s ever-evolving market, businesses must continuously adapt and innovate to keep up with the diverse and ever-growing demands of consumers. Masan Consumer (UPCoM: MCH), a leading consumer goods company in Vietnam, is poised for a breakthrough in 2025. With its dominant position in the market, clear strategic vision, and strong growth momentum, Masan Consumer is well-equipped to seize a significant market share and take its success to new heights.

“Investors Express Interest in Long-Term Partnership with BIG Post-Annual General Meeting”

The 2025 Annual General Meeting of Big Invest Group JSC (UPCoM: BIG) was arguably the most memorable event for shareholders since its listing on the stock exchange in early 2022. Aside from record-breaking growth figures, BIG garnered expressions of long-term commitment from numerous professional investors.

“TCH Finalizes Plans to Issue Over 200 Million Shares, Focusing on Two Major Projects in Haiphong”

The Hoang Huy Finance Investment Joint Stock Company (HOSE: TCH) convened an extraordinary general meeting for the 2025 financial year to approve a plan to increase its charter capital to nearly VND 8,700 billion. This move aims to bolster the company’s resources for two key real estate projects in Hai Phong.

“Vinamilk’s April Revenue Soars”

The traditional channel, Vinamilk’s primary distribution network, has shown positive signs of recovery with growth reflected in April’s results.