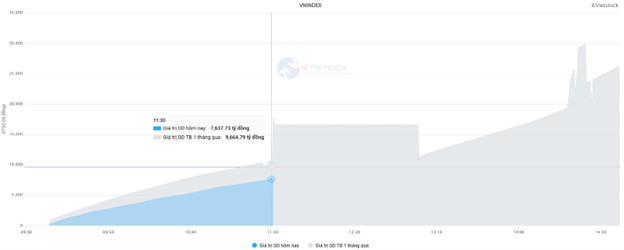

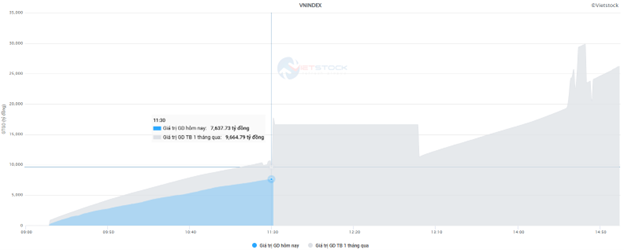

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 787 million shares, equivalent to a value of more than 18.3 trillion dong; HNX-Index reached over 57.2 million shares, equivalent to a value of more than 809 billion dong.

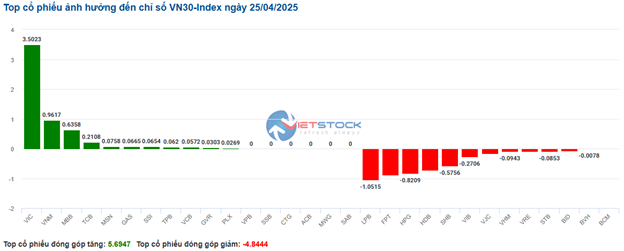

| Top 10 stocks with the most significant impact on the VN-Index on April 25, 2025 |

VN-Index opened the afternoon session with buyers gradually returning, helping the index continue to break out. However, selling pressure reappeared towards the end of the session, causing the index to fluctuate and close in the green. In terms of impact, VIC, VHM, VNM, and MSN were the most positive influences on the VN-Index, contributing over 7 points to the gain. On the other hand, VCB, BID, LPB, and STB continued to face selling pressure, taking away more than 3 points from the overall index.

Similarly, the HNX-Index also witnessed optimistic movements, positively influenced by stocks such as BAB (+7.34%), KSV (+0.65%), SCG (+3.08%), and VFS (+3.87%)…

|

Source: VietstockFinance

|

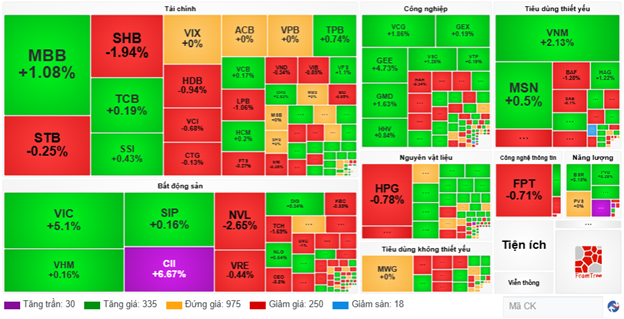

At the close, the essential consumer goods sector witnessed the strongest rally with a 2.2% gain, mainly driven by stocks like MCH (+4.61%), VNM (+3.55%), MSN (+3.51%), and SAB (+0.61%). This was followed by the real estate and energy sectors, which rose by 2.11% and 1.33%, respectively. Conversely, the telecommunications sector witnessed the most considerable decline in the market, falling by 1.87%, mainly due to VGI (-2.71%), CTR (-1.76%), VTK (-3.98%), and ADG (-1%)

In terms of foreign trading activities, foreign investors net sold over 575 billion dong on the HOSE exchange, focusing on stocks like VIC (148.05 billion), FPT (147.25 billion), STB (137.6 billion), and VCI (61.29 billion). On the HNX exchange, foreign investors net sold over 23 billion dong, mainly offloading PVS (17.69 billion), IDC (16.45 billion), DTD (600 million), and VFS (460 million).

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Clear Divergence

After the VN-Index retreated from the resistance level of 1,230 points, money flow showed clearer signs of divergence towards the end of the morning session. At the midday break, the VN-Index turned slightly negative, settling at 1,222.9 points, while the HNX-Index lost 0.38% to reach 210.26 points. The market breadth was relatively balanced, with 324 gainers and 336 losers.

Liquidity in the morning session remained unchanged from the previous session’s low levels. Specifically, the VN-Index matching volume reached 345 million shares, equivalent to a value of over 7.6 trillion dong, while the HNX-Index recorded nearly 29 million shares, with a value of over 413 billion dong.

Source: VietstockFinance

|

In terms of impact, VIC was striving to support the market, contributing nearly 3 points to the VN-Index, significantly outperforming the rest. Meanwhile, selling pressure intensified on BID, LPB, and FPT, taking away nearly 2 points from the overall index.

The number of sectors turning red is increasing. Notably, the telecommunications and information technology sectors recorded the most significant declines, as large-cap stocks in these sectors faced substantial corrective pressures, such as VGI (-2.42%), CTR (-0.94%), MFS (-1.67%); FPT (-1.43%), and CMG (-0.63%). Selling pressure also spread to the financial sector, with the number of stocks losing more than 1% gradually increasing, notably BID, STB, HDB, SHB, LPB, OCB, VIB, FTS, BSI, and PTI…

On the other hand, essential consumer goods, energy, and industrials were the sectors that maintained a positive recovery momentum, with standout performances from stocks like MCH (+5.5%), VHC (+3.63%), VNM (+1.6%); BSR (+2.55%), AAH (+13.51%); CII (+6.25%), GMD (+2.04%), HAH (+1.51%), DPG (+2.03%), ACV (+1.11%), and PVT (+1.21%).

Notably, foreign investors net sold heavily in the morning session (nearly 628 billion dong on all three exchanges) after net buying quite positively before. STB was the main focus of the sell-off, with a net sell value of over 147 billion dong, followed by FPT and VIC, which were also net sold for over 70 billion dong each. In contrast, MWG led the net buying side, but the value was only about 48 billion dong.

10:30 AM: Money Flow Divergence, Energy Sector Takes the Lead

Liquidity remained unchanged, and the main indices fluctuated around the reference level due to selling pressure after the initial rally, indicating investors’ divergent sentiments. As of 10:30 AM, the VN-Index gained 3.7 points, trading around 1,226 points, while the HNX-Index edged slightly lower, trading around 211 points.

Stocks in the VN30 basket witnessed mixed performances, but buying pressure slightly outweighed selling pressure. Specifically, VIC, VNM, MBB, and TCB contributed 3.5 points, 0.96 points, 0.64 points, and 0.21 points to the index, respectively. Conversely, LPB, FPT, HPG, and HDB faced strong selling pressure, taking away nearly 3.5 points from the VN30-Index.

Source: VietstockFinance

|

The energy sector quickly rose to become the group with the most positive impact on the market in the morning session, with a gain of 2.34%. Notably, AAH and ITS hit the daily limit-up, rising by 13.51% and 13.21%, respectively. Other gainers in the sector included PVS (+0.38%), PVD (+0.28%), POS (+2.4%), and TVD (+0.91%)…

The essential consumer goods sector also witnessed a positive momentum, with most large-cap stocks in this group recording decent gains. Specifically, MCH rose by 4.61%, VNM by 2.13%, MSN by 0.17%, HAG by 1.22%, and QNS by 0.9%…

Regarding the real estate sector, divergent movements were observed, with selling pressure slightly outweighing buying pressure, preventing the group from breaking out strongly compared to the opening. Negative performances were seen in some large-cap stocks, such as VHM (-0.16%), BCM (-0.18%), VRE (-0.44%), KBC (-1.1%), and NVL (-2.65%)… Meanwhile, some stocks maintained their positive momentum, including VIC (+5.1%), HDG (+1.3%), NLG (+0.18%), and IDC (+0.27%)…

Compared to the opening, fluctuations persisted, but buyers slightly outweighed sellers. There were 335 gainers and 250 losers.

Source: VietstockFinance

|

Opening: Maintaining a Slight Gain

On April 25, as of 9:30 AM, the VN-Index rose over 5 points to 1,228.86 points, while the HNX-Index also edged slightly higher to 211.98 points.

U.S. stocks continued their upward trajectory on Thursday (April 24) as large-cap technology stocks rallied, and investors sought signs of progress in global trade. At the close of the April 24 session, the S&P 500 rose 2.03% to 5,484.77 points, the Nasdaq Composite gained 2.74% to 17,166.04 points, and the Dow Jones Industrial Average advanced 1.23% to 40,093.40 points, or 486.83 points, due to a 6.6% decline in IBM shares. This was the first time the Dow Jones index closed above the 40,000 mark since April 15.

As of 9:30 AM, the VN30 basket witnessed 11 declining stocks, 16 advancing stocks, and 3 unchanged stocks. Among them, VJC, VRE, LPB, and HDB were the top losers. Conversely, VIC, GVR, MBB, and MSN were the top gainers.

The real estate sector was the group with the most positive impact on the market in the morning session, rising by 1.18%. Notably, VIC increased by 4.47%, BCM by 0.72%, NLG by 1.97%, IDC by 0.54%, HDG by 1.3%, and SZC by 0.33%…

Following closely was the materials sector, with most stocks in this group trading in positive territory from the beginning of the session, such as HSG (+1.11%), NKG (+0.84%), MSR (+3.13%), GVR (+1.06%), PHR (+2.1%), and DCM (+0.64%)…

– 3:01 PM, April 25, 2025

Stock Market Outlook for April 21-25, 2025: Returning to an Optimistic Mindset

The VN-Index concluded the week on a positive note, with a significant rise in trading volume, surpassing the 20-week average. This indicates a sustained influx of capital into the market. Moreover, foreign investors’ net buying, following an extended period of net selling, serves as a notable supportive signal, boosting investor sentiment and enhancing the short-term positive outlook.

Market Beat: Afternoon Euphoria Sends VN-Index Soaring by 20 Points

The VN-Index defied the morning’s tug-of-war, surging in the afternoon session to close at 1,269.8 points on May 8, a substantial gain of 19.43 points. Mirroring this positive trend, the HNX-Index climbed 1.8 points to 215.21, while the UPCoM-Index inched up 0.06 points to 92.98. Trading value accelerated, surpassing 20,718 billion VND.

Market Beat: Telecoms Shine as VN-Index Surges Over 13 Points

The trading session concluded with significant gains, as the VN-Index climbed by 13.87 points (+1.16%), reaching 1,211 points. Simultaneously, the HNX-Index experienced a notable surge, rising by 3.74 points (+1.8%) to close at 211.45. The market breadth tilted strongly in favor of advancers, with 636 tickers in the green versus 141 decliners. Dominating the VN30 basket, 23 constituents advanced, five declined, and two remained unchanged, painting a bullish picture across the board.

The Shark Money Trail 09/05: Proprietary Traders Sell HOSE-listed Shares Worth Over VND 213 Billion

The self-sponsored trading arms of securities companies continued to offload stocks on the Ho Chi Minh Stock Exchange (HOSE) on May 9, while foreign investors maintained a relatively balanced trading stance.