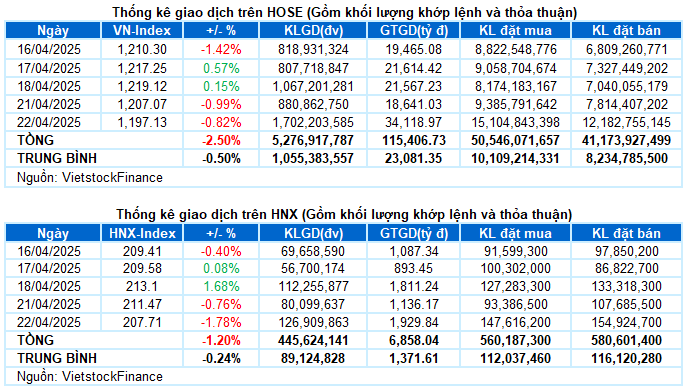

I. MARKET ANALYSIS OF STOCKS AS OF APRIL 22, 2025

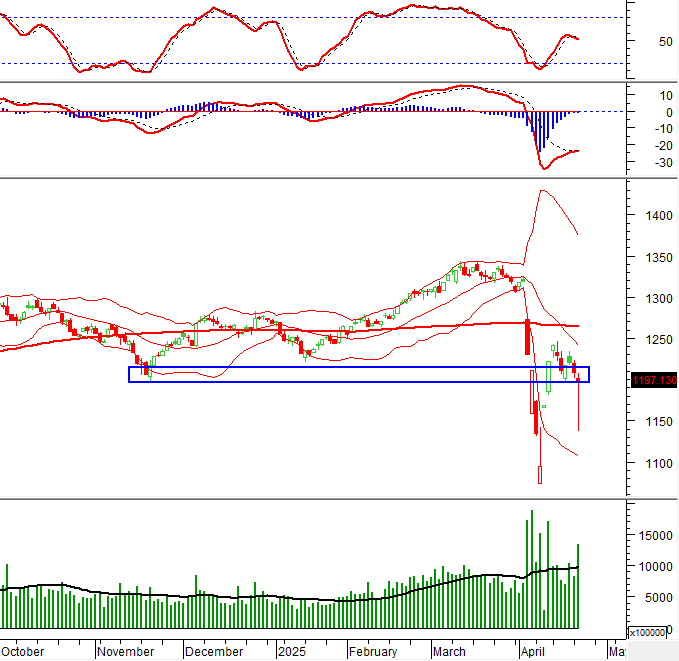

– The main indices continued to fall during the trading session on April 22. VN-Index decreased by 0.82%, reaching 1,197.13 points; HNX-Index lost 1.78%, falling to 207.71 points.

– The matching volume on the HOSE exceeded 1.3 billion units, a 63.5% increase compared to the previous session. The matching volume on the HNX also surged by 91.7%, reaching nearly 120 million units.

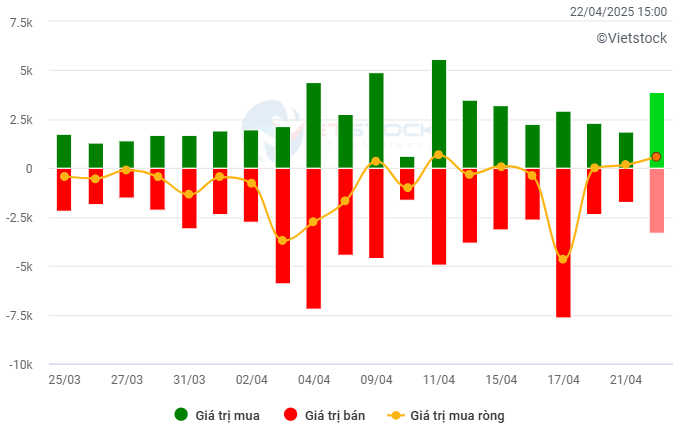

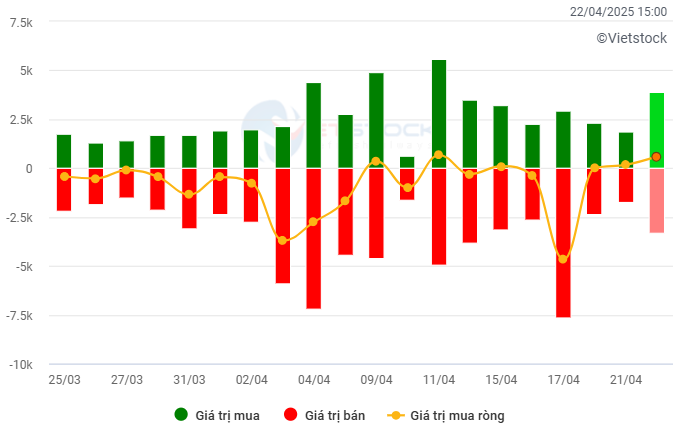

– Foreign investors continued to net buy with a value of over VND 524 billion on the HOSE and nearly VND 19 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by date. Unit: VND billion

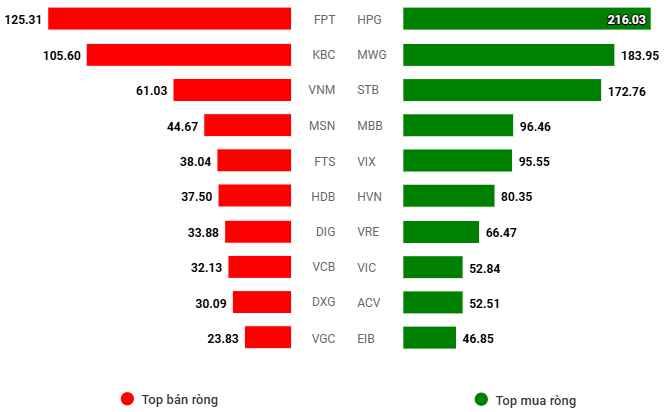

Net trading value by stock code. Unit: VND billion

– The negative red color continued to dominate the Vietnamese stock market during the trading session on April 22. Selling pressure prevailed from the beginning of the session, pushing the VN-Index gradually downhill with rather gloomy liquidity in the morning session. A big surprise came at the beginning of the afternoon session when a sudden wave of selling pressure hit, causing the VN-Index to evaporate nearly 70 points with dozens of stocks floor-lined up in a row. However, bottom-fishing force also participated quite well, helping the index recover somewhat in the remaining time of the session. At the end of the trading day on April 22, the VN-Index narrowed its loss to nearly 10 points, closing at the level of 1,197.13 points.

– In terms of impact, VIC, GVR, and TCB were the stocks that put the most pressure on the VN-Index, taking away nearly 4.5 points. Meanwhile, VHM was the pillar that played a “salvage” role, contributing more than 2.5 points to the effort to narrow the index’s decline.

– Stocks in the VN30 basket strongly recovered towards the end of the session, with the VN30-Index closing at 1,290.38 points, down slightly by 0.3% compared to the previous session. The breadth of the basket recorded 18 decreasing stocks, 10 increasing stocks, and 2 stagnant stocks. Of which, GVR, BCM, and VIC were the codes that decreased the most, losing from 4-6%. Conversely, VHM and MWG impressively reversed with strong gains of 4.5% and 3.1%, respectively.

The red color still spanned most industry groups. Energy, telecommunications, and materials were the hardest-hit groups with a series of deep-dropping codes such as BSR (-4.46%), PVD (-5.06%), PVS (-1.49%); VGI (-3.24%), CTR (-5.45%), FOX (-2.05%), YEG (-4.76%); GVR (-5.91%), VGC (-6.63%), KSV (-4.92%), HSG (-6.02%), etc.

In the real estate group, apart from a few bright spots such as VHM (+4.55%), NVL (+3.4%), and VRE (+0.98%), most of the remaining stocks were still surrounded by selling pressure. Typically, DIG, PDR, TIG, and NHA fell to the floor, while VIC, KBC, DXG, NLG, TCH, CEO, HDC, etc., decreased with large liquidity.

Industry is the only group strong enough to hold on to the green thanks to the positive influence of stocks such as ACV (+2.85%), HVN (+4.59%), HAH (+1.85%), VOS (+5.47%), FCN (+2.51%), and PAP, which hit the ceiling price.

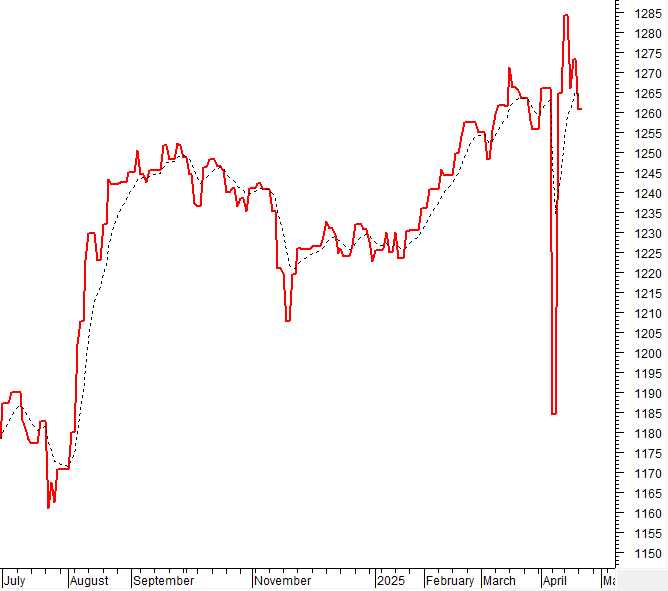

The unexpected strong buying force at the end of the session helped the VN-Index narrow its decline significantly, thereby continuing to hold the old bottom established since November 2024 (equivalent to the 1,195-1,215 point range). If the VN-Index continues to hold this level, the market outlook will be less negative, and a recovery rhythm is expected to appear in the coming time. On the other hand, the MACD indicator is likely to give a buy signal again after the distance with the Signal Line is narrowed. If the buy signal is confirmed, the risk of short-term adjustment will be reduced.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD indicator is likely to give a buy signal again

The unexpected strong buying force at the end of the session helped the VN-Index narrow its decline significantly, thereby continuing to hold the old bottom established since November 2024 (equivalent to the 1,195-1,215-point range). If the VN-Index continues to hold this level, the market outlook will be less negative, and a recovery rhythm is expected to appear in the future.

On the other hand, the MACD indicator is likely to give a buy signal again after the distance with the Signal Line is narrowed. If the buy signal is confirmed, the risk of short-term adjustment will be reduced.

HNX-Index – Hammer candle pattern appeared

HNX-Index narrowed its decline at the end of the session with the appearance of a Hammer candle pattern. This indicates that the buying force participated strongly again, and the index returned to test the old bottom of October 2023 (equivalent to the 204-208-point range). This threshold still plays an important supporting role for the HNX-Index in the future.

Currently, the MACD indicator is likely to give a buy signal again as the distance to the Signal Line is narrowed. If this state occurs in the next sessions, the risk of short-term adjustment will be reduced.

Analysis of Money Flow

Fluctuation of smart money flow: The Negative Volume Index indicator of VN-Index cut down below the EMA 20 day. If this state continues in the next session, the risk of sudden decline (thrust down) will increase.

Fluctuation of foreign capital flow: Foreign investors continued to net buy in the trading session on April 22, 2025. If foreign investors maintain this action in the coming sessions, the situation will be less pessimistic.

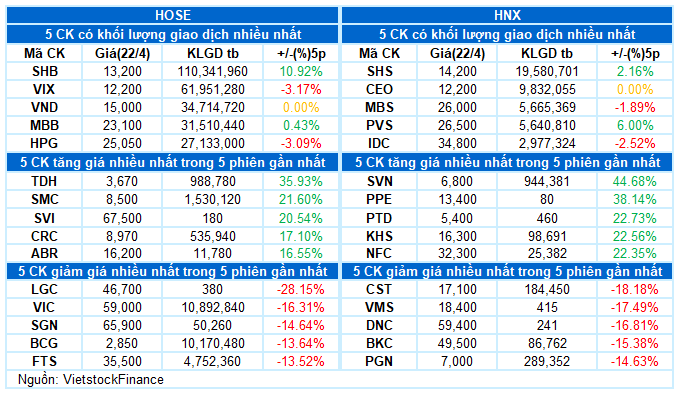

III. MARKET STATISTICS AS OF APRIL 22, 2025

Department of Economic and Market Strategy Analysis, Vietstock Consulting

– 17:15 04/22/2025

Market Beat: VN-Index Turns to Late Session Tug-of-War, Holding on to Green Tint.

The market closed with positive gains as the VN-Index rose by 5.88 points (+0.48%), settling at 1,229.23. Similarly, the HNX-Index witnessed an increase of 0.65 points (+0.31%), ending the day at 211.72. The market breadth tilted towards the bulls with 404 gainers versus 323 decliners. The VN30 basket also painted a positive picture, with 15 gainers outperforming the 13 losers, while 2 stocks remained unchanged, tilting the basket towards the green.

Shark PYN Elite: Deep-Value Adjustments Offer Golden Opportunity to Accumulate Quality Stocks

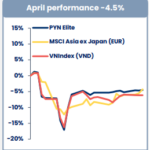

In PYN Elite’s April 2025 investment report, the large-scale foreign fund with approximately VND 22,000 billion in assets views the recent sell-off in the Vietnamese stock market as an opportunity to accumulate high-quality stocks at attractive discounts.

Stock Market Outlook for April 21-25, 2025: Returning to an Optimistic Mindset

The VN-Index concluded the week on a positive note, with a significant rise in trading volume, surpassing the 20-week average. This indicates a sustained influx of capital into the market. Moreover, foreign investors’ net buying, following an extended period of net selling, serves as a notable supportive signal, boosting investor sentiment and enhancing the short-term positive outlook.

Market Beat: Telecoms Shine as VN-Index Surges Over 13 Points

The trading session concluded with significant gains, as the VN-Index climbed by 13.87 points (+1.16%), reaching 1,211 points. Simultaneously, the HNX-Index experienced a notable surge, rising by 3.74 points (+1.8%) to close at 211.45. The market breadth tilted strongly in favor of advancers, with 636 tickers in the green versus 141 decliners. Dominating the VN30 basket, 23 constituents advanced, five declined, and two remained unchanged, painting a bullish picture across the board.

Market Beat: Afternoon Euphoria Sends VN-Index Soaring by 20 Points

The VN-Index defied the morning’s tug-of-war, surging in the afternoon session to close at 1,269.8 points on May 8, a substantial gain of 19.43 points. Mirroring this positive trend, the HNX-Index climbed 1.8 points to 215.21, while the UPCoM-Index inched up 0.06 points to 92.98. Trading value accelerated, surpassing 20,718 billion VND.