Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 576 million shares, equivalent to a value of more than 12.2 trillion dong; HNX-Index reached over 41.1 million shares, equivalent to a value of more than 653 billion dong.

The VN-Index opened the afternoon session with the return of buyers, helping the index regain the reference level, but towards the end of the session, selling pressure increased again, causing the index to close in the red. In terms of impact, VHM, FPT, BID, and VNM were the most negative influences on the VN-Index, with a 5.6-point drop. On the other hand, VIC, SAB, GEE, and LPB remained in the green and contributed over 2.2 points to the overall index.

| Top 10 stocks with the highest impact on the VN-Index on April 28, 2025 |

Similarly, the HNX-Index also had a rather pessimistic performance, with the index negatively impacted by KSV (-1.98%), BAB (-4.27%), IDC (-1.89%), and PVI (-1.22%)…

|

Source: VietstockFinance

|

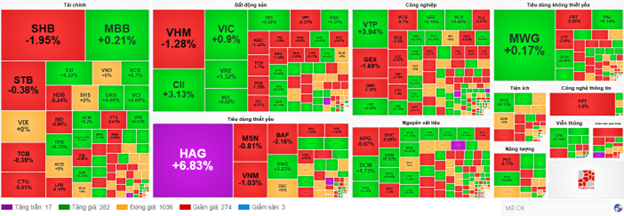

The industrial sector was the group with the strongest gain in the market, up 1.44%, mainly driven by ACV (+4.42%), MVN (+2.81%), HVN (+0.98%), and VTP (+2.75%). This was followed by the non-essential consumer goods and essential consumer goods sectors, which increased by 0.44% and 0.43%, respectively. On the other hand, the information technology sector recorded a decline of 2.47%, mainly due to FPT (-2.58%), CMG (-0.32%), CMT (-4.96%), and HPT (-0.47%).

In terms of foreign trading, they continued to sell a net amount of more than 12 billion dong on the HOSE exchange, focusing on VHM (120.39 billion), FPT (104.8 billion), GEX (68.5 billion), and BID (51.43 billion). On the HNX exchange, foreigners bought a net amount of more than 20 billion dong, focusing on SHS (15.91 billion), CEO (2.2 billion), NTP (2.17 billion), and VFS (1.9 billion).

| Foreigners’ buying and selling activities |

Morning session: Bleak liquidity, market continues to diverge

The indexes fluctuated below the reference level as market liquidity remained bleak. At the midday break, the VN-Index lost 3.69 points, or 0.3%, to 1,225.54 points; the HNX-Index fell slightly by 0.12% to 211.48 points.

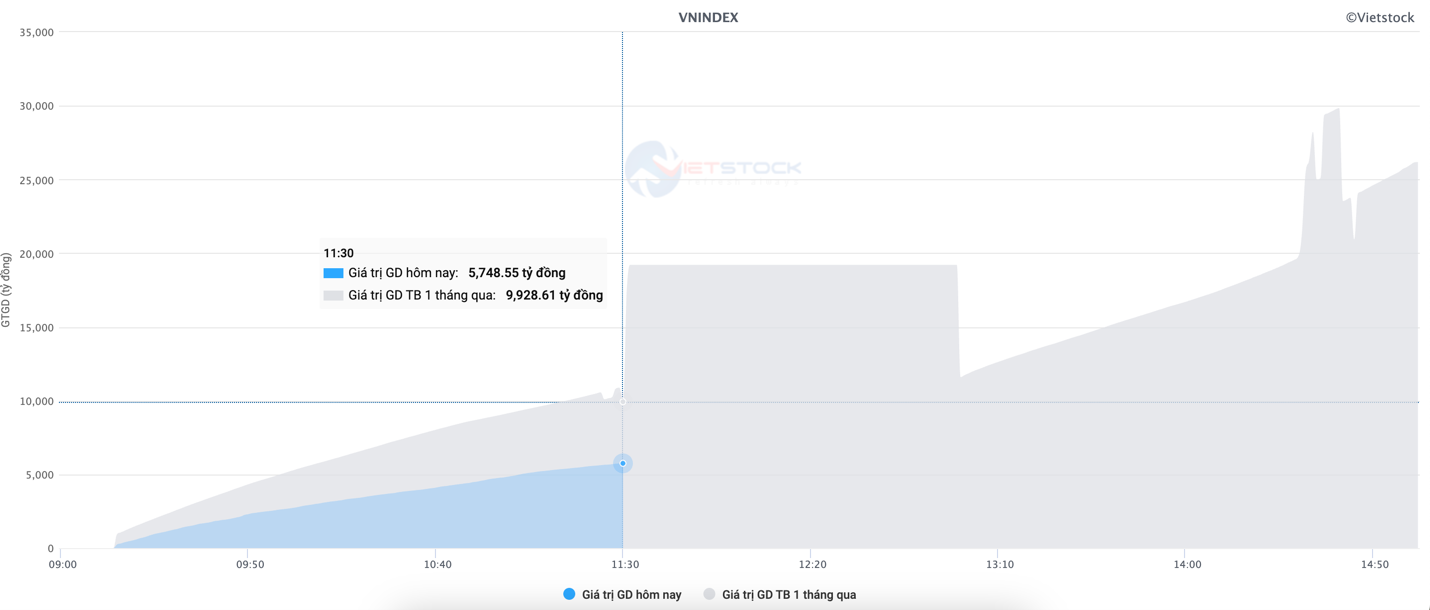

Market liquidity continued to decline as the holiday approached. The matching value reached only 5.7 trillion dong on the HOSE and 295 billion dong on the HNX, down 42% and 55%, respectively, compared to the 1-month average.

Source: VietstockFinance

|

In terms of impact, VHM, BID, and FPT were the most negative influences, taking away nearly 3 points from the VN-Index. Meanwhile, only VCB and SSB made notable positive contributions, adding over 1 point to the index.

The significant pressure on FPT (-1.87%) caused the information technology sector to temporarily lag the market with a decline of 1.75%. The remaining sectors mainly diverged. For example, the materials sector faced pressure from HPG (-1.17%), GVR (-1.47%), KSV (-1.98%), BMP (-1.75%), DPR (-2.36%), and DHC (-1.38%). However, many stocks maintained positive momentum, such as HSG (+2.25%), NKG (+1.26%), DCM (+1.88%), KSB (+3.3%), CSV (+1.09%), MSR (+3.53%), LAS (+1.13%), etc.

The industrial sector was a rare bright spot, with a standout gain of 1.17%. Several stocks attracted notable buying interest despite the generally bleak market sentiment, including CII (+3.52%), VTP (+4.31%), ACV (+4.64%), PVT (+1.44%), VSC (+1.22%), SCS (+1.37%), HBC (+6.78%), and NCT (+2.48%).

Foreign investors continued to sell a net amount of nearly 351 billion dong on all three exchanges in the morning session. VHM and FPT were the two stocks that were net sold the most, with values of 113 billion and 61 billion dong, respectively. On the buying side, SAB and MBB led with relatively modest values of nearly 27 billion dong.

10:35 am: Money flows were cautious ahead of the holiday

Investor caution caused the main indexes to fluctuate around the reference level. As of 10:30 am, the VN-Index fell 2.5 points, trading around 1,226 points. The HNX-Index fell 0.24 points, trading around 211 points.

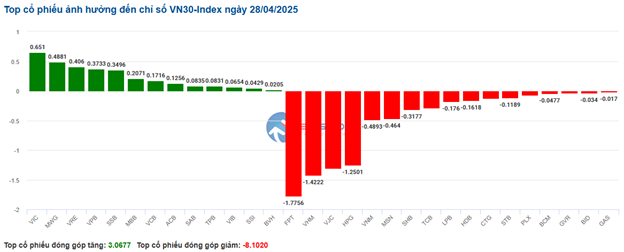

Most of the stocks in the VN30 basket faced selling pressure. Notably, FPT fell 1.77 points, VHM fell 1.42 points, VJC fell 1.31 points, and HPG fell 1.25 points. Conversely, only a few stocks remained in the green, with VIC contributing 0.65 points, MWG contributing 0.48 points, VRE contributing 0.41 points, and VPB contributing 0.37 points to the overall index.

Source: VietstockFinance

|

The industrial sector led the market’s gain, although it still experienced strong divergence. Notably, large-cap stocks such as ACV rose 7.06%, MVN rose 1.93%, VTP rose 4.22%, and PVT rose 1.68%… Conversely, the selling pressure continued for some stocks, including VJC falling 3.74%, GMD falling 0.98%, HAH falling 1.32%, and VCG falling 1.16%…

Following that, the telecommunications sector also showed a positive performance, with most large-cap stocks in the green, such as VGI rising 1.02%, CTR rising 2.26%, FOX rising 0.22%, and SGT rising 0.61%… Conversely, only a few stocks declined, including YEG falling 1.73%, TTN falling 0.61%, VNB falling 0.73%, and DST falling 1.92%… However, the negative impact was not significant.

On the other hand, the information technology sector diverged, with the selling side having a slight advantage. Declining stocks included FPT falling 1.6%, POT falling 6.62%, and CMT falling 2.13%. Conversely, rising stocks included CMG rising 0.79%, SMT rising 3.88%, and ITD rising 0.42%.

Compared to the opening, the number of stocks standing at reference prices continued to account for a large proportion, with over 1,000 stocks. However, buyers and sellers were relatively balanced, with 282 rising stocks and 274 falling stocks.

Source: VietstockFinance

|

Opening: Fluctuating start

On April 28, as of 9:30 am, the VN-Index and HNX-Index fluctuated with a cautious market sentiment, continuously oscillating around the reference level.

The red dominated the VN30 basket, with 18 declining stocks, 10 rising stocks, and 2 stocks standing at the reference price. Notably, VJC, HPG, SHB, and BCM were the stocks with the most significant declines. Conversely, MWG, SSB, BVH, and VCB were the stocks with the strongest gains.

The non-essential consumer goods sector led the groups with a positive impact on the market this morning, with a gain of 0.69%. Notably, stocks such as MWG rose 1.16%, PNJ rose 0.29%, GEE rose 3.72%, FRT rose 0.92%, OIL rose 1.04%, and DGW rose 1.68%…

Following that, the energy sector also contributed positively to the overall market performance, with stocks such as PVS rising 0.38%, PVD rising 0.56%, PVC rising 1.12%, and AAH rising 4.88%…

Market Beat: Afternoon Session Divergence, VN-Index Curbs Gains

The widening divergence in the afternoon session erased most of the morning’s gains. At the close, the VN-Index pared its intraday gains, rising just 2 points to 1,241.95. The HNX-Index edged up 0.08 points to 212.89.

Stock Market Update for April 28-29, 2025: The Tug-of-War Continues

The VN-Index ended the week with a slight decline, maintaining a tug-of-war stance as alternating weeks of gains and losses have been prevalent in recent times. This reflects the unstable sentiment of investors following the sharp decline at the end of March 2025. At present, the index is struggling to surpass the crucial resistance level at the 200-week SMA. If this condition persists, the prospect of the VN-Index establishing an upward trend in the coming period will face further challenges.

The Market Wrap: VN-Index trims losses thanks to late buying spree

The unexpected surge in buying pressure towards the end of the session helped VN-Index trim its losses significantly, thus successfully defending the old support base established in November 2024 (corresponding to the 1,195-1,215 point range). If the VN-Index continues to hold this fort, the market outlook will be less negative and a recovery rally is expected in the coming period. Moreover, the MACD indicator is poised to generate a buy signal again as the gap with the Signal Line narrows. Should this buy signal be confirmed, the risk of short-term corrections will be mitigated.

The Market Mind: Caution Still Lingers

The VN-Index pared its gains, forming an Inverted Hammer candlestick pattern and failing to breach the previous peak established in mid-April 2025 (1,230-1,245 points). The cautious sentiment among investors was further reflected in the trading volume, which remained below the 20-day average. To sustain its upward trajectory, the index needs to surpass this threshold in the upcoming sessions. Nonetheless, the MACD and Stochastic Oscillator indicators remain upward-pointing and have generated buy signals. If this status quo persists, the short-term optimistic outlook is likely to extend.