The stock market closed positively on May 8th, with the VN-Index gaining nearly 20 points to close at 1,269.8 points, an increase of 19.43 points. The HNX-Index also saw a rise of 1.8 points, ending the day at 215.21.

On the HoSE exchange, 230 codes witnessed price increases, with 11 reaching the ceiling price. Notably, the driving force behind investors’ interest in the market was the positive cash flow during this session, with liquidity across the three exchanges surpassing 20,230 billion dong, a nearly 20% increase compared to the previous session.

The Director of Analysis and Investment at a securities company shared that this was an extremely positive session due to the return of cash flow, with stocks in real estate, public investment, and oil and gas sectors receiving favorable information. Importantly, foreign investors returned to buying stocks that they had previously sold. Notably, this was the fourth consecutive session of net buying by foreign investors since the implementation of the new KRX system.

Positive cash flow boosts the stock market. Photo: Hoang Trieu

Mr. Huynh Anh Tuan, CEO and Member of the Board of Directors of VikkiBankS, a digital banking securities company, stated that the stock market traded cautiously during this session as there was no official news from the negotiations between Vietnam and the US early that morning.

President Trump posted on his social media that he would announce an important agreement with a country that evening, and many hoped it would be Vietnam. However, this remained an expectation. As mentioned earlier, the 90-day tax delay has helped the VN-Index recover, but it has not been immune to sessions with large volatility, influenced by news developments.

Nevertheless, the market is still in a recovery trend, driven by negotiation expectations. While a formal agreement may not be in place, Trump’s approach of granting tax exemptions to certain goods recently indicates his willingness to ease the previously imposed high tariffs. As a result, the market sentiment has gradually turned more positive with each session.

Market Pulse May 5: Real Estate Sector Leads, VN-Index Surges Over 12 Points

The market closed with positive gains, seeing the VN-Index rise by 12.32 points (+1%), finishing at 1,238.62. Likewise, the HNX-Index climbed 0.87 points (+0.41%), ending the day at 212.81. It was a predominantly green market with 476 gainers compared to 247 losers. Within the VN30 basket, bulls held sway with 19 gainers, 7 losers, and 4 stocks closing flat.

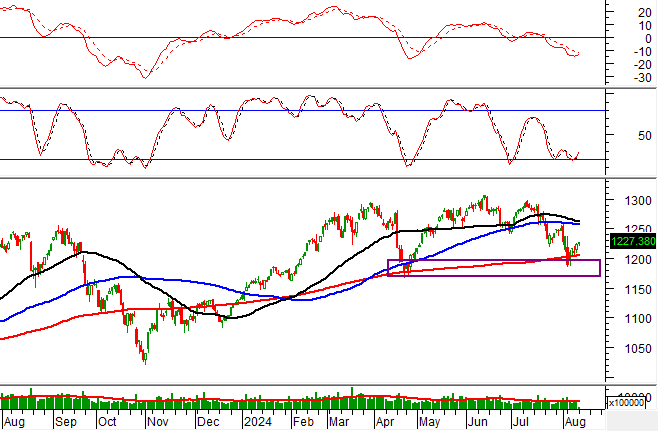

Market Beat: VHM Sees Foreign Sell-Off of $5 Million, VN-Index in a Tug-of-War

The market closed with the VN-Index down 2.43 points (-0.2%), settling at 1,226.8 points. The HNX-Index also witnessed a decline of 0.27 points (-0.13%), ending the day at 211.45. The market breadth tilted slightly towards the bullish side, with 396 gainers outweighing 353 losers. Within the VN30 basket, bulls held a slight edge, as evidenced by 15 advancing stocks, 13 declining stocks, and 2 stocks remaining unchanged.

Market Beat: Afternoon Session Divergence, VN-Index Curbs Gains

The widening divergence in the afternoon session erased most of the morning’s gains. At the close, the VN-Index pared its intraday gains, rising just 2 points to 1,241.95. The HNX-Index edged up 0.08 points to 212.89.