The Ho Chi Minh City Stock Exchange (HoSE) has announced the listing and first trading date for Vinpearl Joint Stock Company’s stock code VPL.

Accordingly, Vinpearl will debut on HoSE on May 13th, with a reference price of 71,300 VND per share. With nearly 1.8 billion listed shares, equivalent to a charter capital of nearly VND 18,000 billion, Vinpearl is valued at nearly VND 128,000 billion (equivalent to about USD 5 billion). The price fluctuation band on the first trading day is +/-20%.

With a valuation of nearly VND 128,000 billion, Vinpearl surpasses veteran names such as Vinamilk, ACB, and Masan Group in terms of market capitalization, ranking among the top enterprises on the Vietnamese stock market.

In the first quarter of this year, Vinpearl recorded net revenue of over VND 2,970 billion, up 77% over the same period last year, with after-tax profit reaching over VND 90 billion. This year, Vinpearl sets a business plan with net revenue from production and business activities of about VND 14,000 billion and after-tax profit of about VND 1,700 billion.

In the first quarter of this year, Vinpearl’s net revenue increased by 77% compared to the same period last year.

To achieve this goal, Vinpearl focuses on five business orientations: market diversification, improving sales channel efficiency, developing the MICE segment (meetings, incentives, conferences, exhibitions), multi-generational tourism, and ecosystem expansion.

In 2024, Vinpearl earned a net profit of VND 2,600 billion, 3.8 times higher than the previous year. However, the company’s consolidated revenue in 2024 was mostly from real estate transfers, totaling nearly VND 5,900 billion, almost ten times higher than the previous year.

Vinpearl announced that, at the beginning of 2024, the company transferred control of its business operations related to the project in Phu Quoc City, Kien Giang Province, to Phu Quoc Tourism Development and Investment Joint Stock Company as the investor.

As of December 31, 2024, Vinpearl’s total assets on the balance sheet were nearly VND 76,500 billion, up 74% from the beginning of the year. The increase was due to a threefold rise in accounts receivable, totaling more than VND 20,700 billion, as VND 17,000 billion in loans receivable was accrued.

With its debut on HoSE on May 13th, Vinpearl becomes the sixth member of the Vingroup ecosystem listed on the stock exchange, alongside Vincom Retail, Vinhomes, VEFAC, Sach Viet Nam, and parent company Vingroup.

“Unlimited Innovation”: Unlocking Private Sector Growth

The government has unveiled a series of strategic resolutions, known as the “Fab Four,” which are set to revolutionize Vietnam’s future. These include Resolution 57-NQ/TW, which focuses on breakthrough development in science, technology, innovation, and digital transformation; Resolution 59-NQ/TW on international integration; Resolution 66-NQ/TW, which aims to reform law-making and enforcement; and Resolution 68-NQ/TW, dedicated to fostering private economic growth. These resolutions are designed to work in harmony, creating a vibrant and innovative Vietnam, open to global opportunities, with a robust private sector and a legal system to match.

“SGI Capital: The “Haunting” 1200-Hour Mark Turns Supportive, Investors Should Stay Upbeat.”

“According to SGI Capital, the market valuation is significantly cheaper compared to past instances of 1200. Such low valuations are a prerequisite for ensuring low-risk, high-return potential.”

The Battle for Private Banking Supremacy in Vietnam

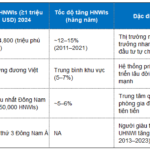

According to the Knight Frank Wealth Report 2024, Vietnam is home to approximately 5,459 individuals with liquid assets exceeding $10 million, accounting for 0.2% of the global high-net-worth individual (HNWI) population and ranking sixth in Southeast Asia. The Asia-Pacific region, hailed as the “Asian Century,” has witnessed robust economic growth, leading to a rapid increase in the number of HNWIs and ultra-high-net-worth individuals (UHNWI). Knight Frank predicts a 26% rise in Vietnam’s ultra-rich population (those with assets over $30 million) by 2026, reaching approximately 1,551 individuals, while the millionaire cohort is expected to grow from 72,135 to 114,807. Additionally, McKinsey estimates that Vietnam’s personal financial assets will reach around $600 billion by 2027, exhibiting a 15% annual growth rate between 2011 and 2021, double the regional average, underscoring the surging demand for comprehensive wealth management services.