Vietnam Stock Market: A Tale of Intrigue and Volatility

The Vietnamese stock market witnessed a tug-of-war during the week’s final trading session. The VN-Index meandered around the reference mark before concluding the May 9 session with a slight dip of 2.5 points, settling at 1,267.3. Trading volume remained subdued, with matched orders on HoSE reaching VND 15.8 trillion.

In terms of foreign investment, after a positive buying streak, foreign investors resumed net selling with a net sell value of over VND 92 billion. Specifically:

HoSE: Foreigners net sold nearly VND 88 billion

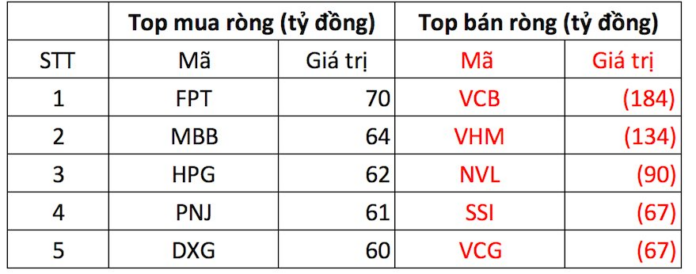

On the selling side, VCB witnessed robust net selling of approximately VND 184 billion, followed by VHM with net selling of VND 134 billion. Other stocks that experienced net selling in the tens of billions included NVL (-VND 90 billion), SSI (-VND 67 billion), and VCG (-VND 67 billion), among others.

Conversely, FPT emerged as the most prominently net bought stock across the market, attracting net buying worth VND 70 billion. MBB, HPG, PNJ, and DXG followed closely, each witnessing net buying in the range of VND 60-64 billion.

Fig. 1 – HoSE: Net buying and selling by foreign investors

HNX: Foreigners net sold VND 300 million

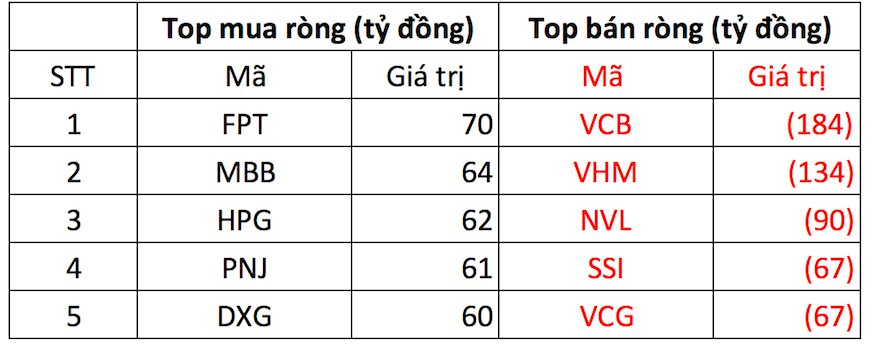

On the buying side, IDC and CEO witnessed net buying in the range of VND 5-7 billion. DL1, VC3, and HUT also experienced net buying in the billions.

Conversely, PVS faced substantial net selling of VND 16 billion, while TNG saw net selling of VND 3 billion. Additionally, BVS, AAV, and DTD underwent net selling ranging from several hundred million to several billion VND.

Fig. 2 – HNX: Net buying and selling by foreign investors

UPCOM: Foreigners net sold VND 4 billion

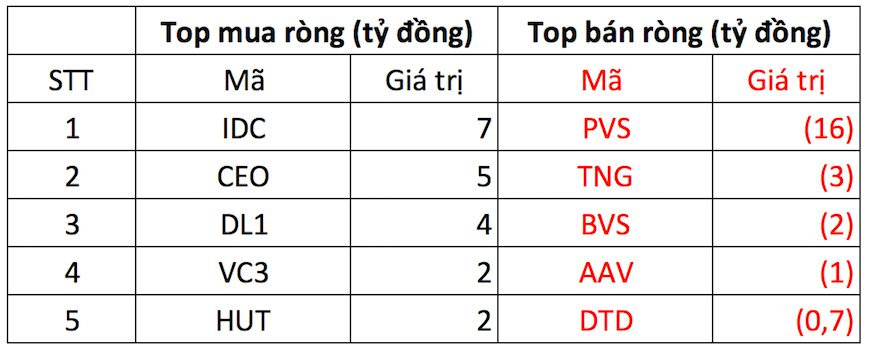

Turning to the buying side, ACV attracted net buying of around VND 12 billion. ABW, CSI, and HPD also witnessed net buying, albeit at lower levels.

Conversely, VEA faced the most significant net selling, amounting to VND 8 billion. NTC, QNS, and MCH also experienced net selling in the range of VND 1-3 billion.

Fig. 3 – UPCOM: Net buying and selling by foreign investors

“SCIC’s Third Attempt to Divest from Domesco Falls Through”

The State Capital Investment Corporation (SCIC) has announced its intention to auction off approximately 12.1 million DMC shares to the public. The starting price for this lot of shares is set at a substantial VND 1,531.5 billion.

Market Pulse May 5: Real Estate Sector Leads, VN-Index Surges Over 12 Points

The market closed with positive gains, seeing the VN-Index rise by 12.32 points (+1%), finishing at 1,238.62. Likewise, the HNX-Index climbed 0.87 points (+0.41%), ending the day at 212.81. It was a predominantly green market with 476 gainers compared to 247 losers. Within the VN30 basket, bulls held sway with 19 gainers, 7 losers, and 4 stocks closing flat.