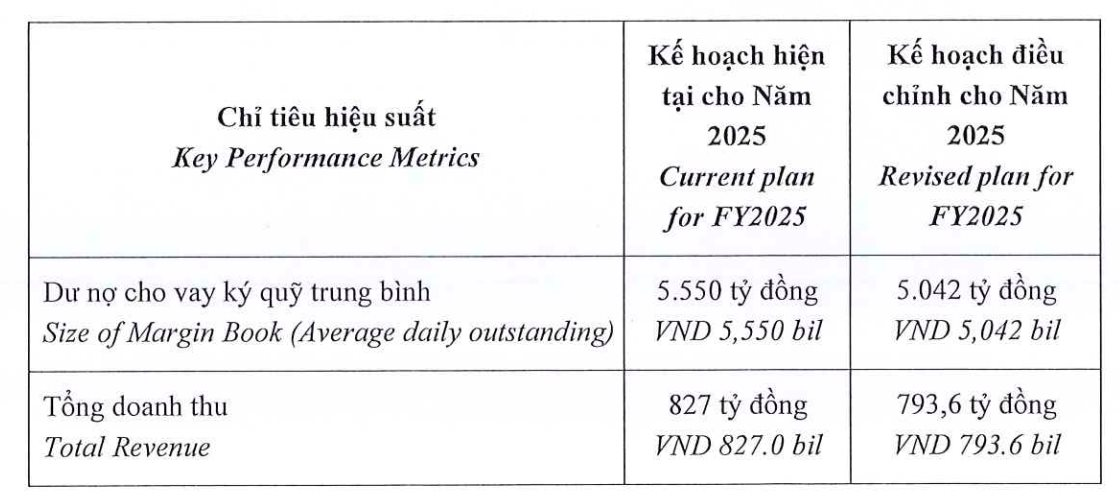

Yuanta Securities Vietnam has announced the decision of the Members’ Council to approve the adjusted business plan for 2025.

Specifically, Yuanta Securities adjusted downward its average securities lending target from VND 5,550 billion to VND 5,042 billion, a 9% decrease. The total revenue target was reduced from VND 827 billion to VND 793.6 billion, a 4% decrease.

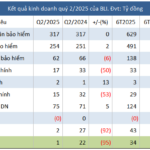

In the first half of 2025, Yuanta Securities reported operating revenue of VND 302 billion, a 65% decrease compared to the same period last year. After deducting all expenses, the company’s net profit was over VND 51 billion, a 28% decrease.

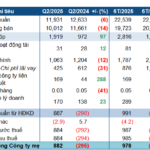

As of June 30, 2025, Yuanta’s total assets reached over VND 5,571 billion, a 3% increase from the beginning of the year. Of this, lending balance was nearly VND 4,432 billion, with margin lending balance accounting for VND 4,399 billion, an increase of nearly VND 200 billion.

According to the explanation, securities of customers participating in margin trading are held by Yunata as collateral for the loan. The market value of total collateral at the end of Q2/2025 was over VND 13,842 billion.

“Vice-Prime Minister Ho Duc Phoc Leads a Meeting with Ministries on Crucial Matters Concerning the Securities Law”

Vice Prime Minister Ho Duc Phoc gave specific instructions regarding the following matters: Maximum foreign ownership ratio; commercial banks acting as clearing members in the underlying securities market, central counterparty (CCP) clearing mechanisms; financial institutions guaranteeing bonds; and trading accounts.

The Attention-Grabbing Move of the Company Associated with Duc Hoang Anh

“The thriving Hung Thinh Loi Gia Lai Company, with a majority stake held by Hoang Anh Gia Lai Joint Stock Company, has just launched an enticing investment opportunity. The company has issued 10,000 bonds, coded HTL12501, offering a fixed interest rate of 10.5% per annum. These bonds have a maturity date of August 8, 2028, presenting a stable and attractive investment prospect for discerning investors.”

“PetroVietnam Drills into Profits with Reduced Costs and Interest Expenses”

In Q2 2025, EVNGENCO3, listed on the Ho Chi Minh Stock Exchange (HOSE: PGV), witnessed a remarkable surge in profits compared to the previous year’s loss-making quarter. This impressive turnaround can be attributed to a significant reduction in both cost of goods sold and borrowing expenses.