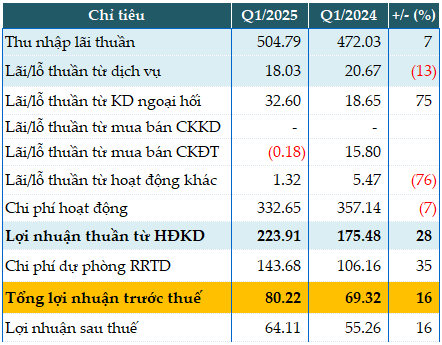

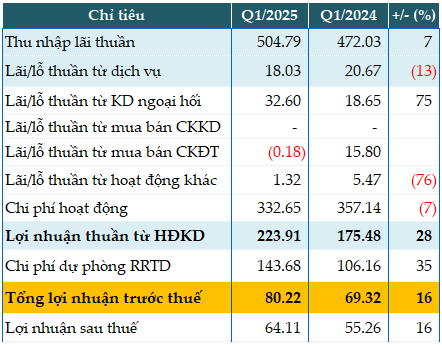

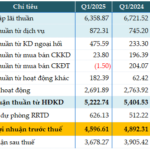

BVBank reported nearly VND 505 billion in net interest income for the first quarter, a 7% increase from the previous year.

Foreign exchange operations saw a significant surge, with profits reaching nearly VND 33 billion, marking a 75% increase due to higher trading volumes (up 20%).

Conversely, income from service activities decreased by 13% to VND 18 billion, while profits from other activities dropped by 76%, amounting to just over VND 1.3 billion.

The bank successfully reduced operating expenses by 7%, totaling VND 333 billion. Consequently, profits from business operations climbed by 28%, reaching nearly VND 224 billion.

Despite a 35% increase in credit risk provisions, amounting to nearly VND 144 billion, BVBank’s pre-tax profit exceeded VND 80 billion, reflecting a 16% year-over-year increase.

In relation to the set target of VND 550 billion in pre-tax profit for 2025, BVBank has accomplished 15% in the first quarter.

|

BVBank’s Q1/2025 business results in VND billion

Source: VietstockFinance

|

As of the quarter’s end, the bank’s total assets expanded by 6% from the beginning of the year to VND 110,118 billion. While deposits at the SBV decreased by 53% to VND 1,287 billion, deposits at other credit institutions surged by 19% to VND 16,077 billion. Customer lending increased by 4% to VND 70,821 billion, with over 76% catering to individual customers and small and medium-sized enterprises.

On the funding side, deposits and loans from the government and the SBV remained unchanged from the beginning of the year at VND 1,571 billion. Deposits from other credit institutions rose by 8% to VND 14,632 billion, and customer deposits increased by 5% to VND 71,012 billion.

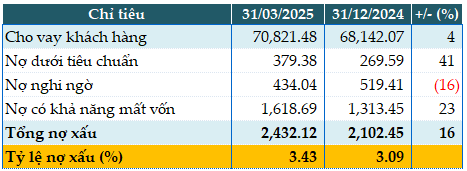

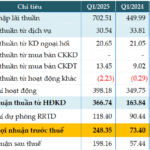

As of March 31, 2025, BVBank’s total non-performing loans stood at VND 2,432 billion, representing a 16% increase since the beginning of the year. The non-performing loan ratio also increased from 3.09% to 3.43% during this period.

|

BVBank’s loan quality as of March 31, 2025, in VND billion

Source: VietstockFinance

|

Han Dong

– 2:12 PM, April 28, 2025

The Largest Private Hospital System in the Northeastern Mountainous Provinces Unveils the Unprecedented

This business has unveiled an ambitious plan for the future, a strategy that showcases a bold and innovative vision. With a forward-thinking approach, they aim to make a significant impact and leave a lasting impression.

Unlocking Profitability: MSB’s Strategic Cost-Cutting Measures Yield Fruitful Results, with Q1 Pre-Tax Profits Soaring to VND 1,631 Billion, a 7% Increase

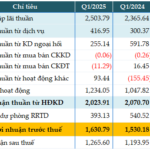

In the recently released consolidated financial statements for the first quarter of 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) reported a remarkable performance with a pre-tax profit of nearly VND 1,631 billion, reflecting a 7% increase compared to the same period last year. This impressive growth can be attributed to the bank’s effective management of credit risk provisions.

“Vietbank’s Q1 2025 Profit Soars: A Triple-Digit Surge in Core Income”

The consolidated financial statements for Q1 2025 reveal that Vietbank (VBB on UPCoM) recorded a remarkable performance with a pre-tax profit of over VND 248 billion, tripling its earnings from the previous year’s first quarter. This impressive growth is primarily attributed to the bank’s core income streams.