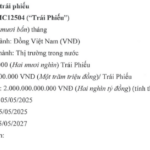

Baf Vietnam Agricultural Joint Stock Company (Stock Code: BAF, HoSE) has just announced the Resolution of the Board of Directors on issuing the company’s private bond issuance plan for 2025.

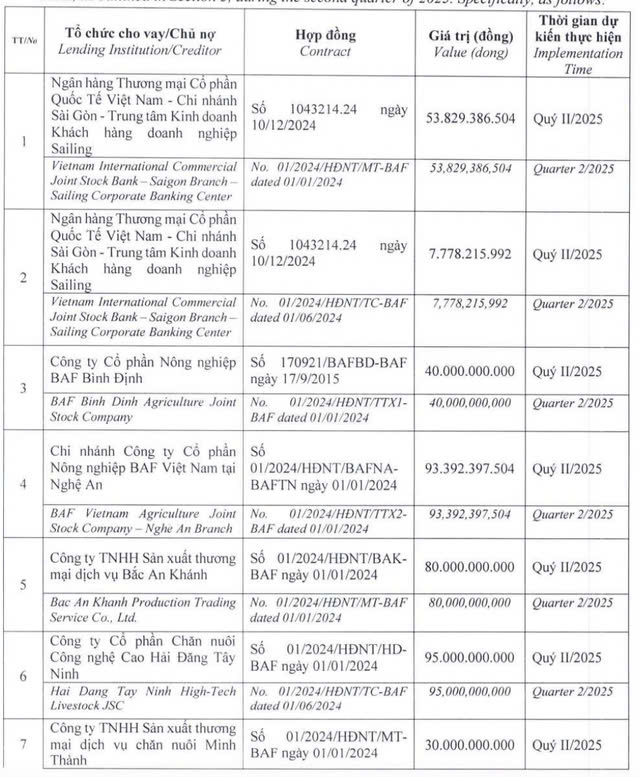

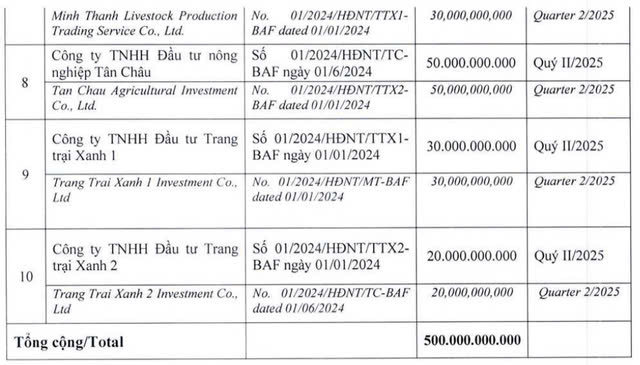

Accordingly, Baf Vietnam will issue 5,000 bonds with the code BAF12501, par value of VND 100 million/bond, with a total issuance value of VND 500 billion. The expected issuance time is in the second quarter of 2025, with a term of 36 months from the issuance date and a fixed interest rate of 10%/year.

This type of private bond is non-convertible, non-warrant-attached, and unsecured.

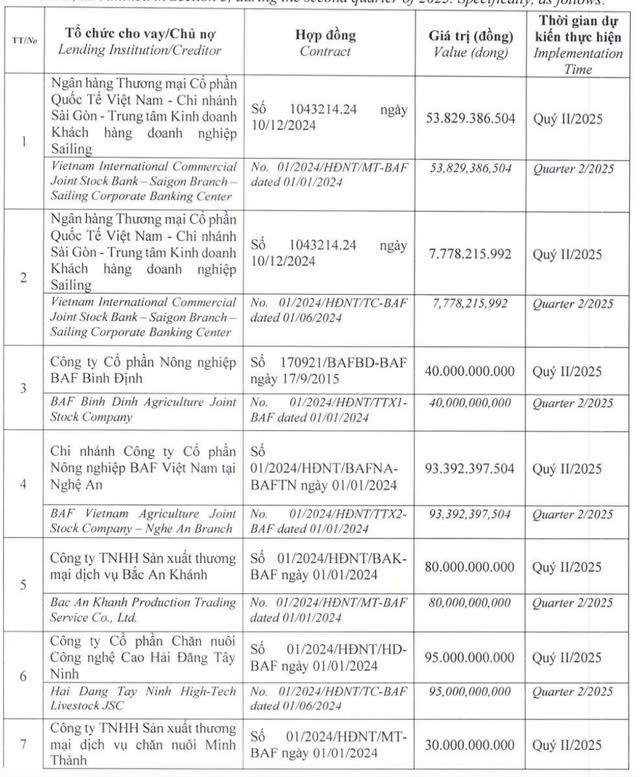

The proceeds from the issuance of the above bond batch are expected to be used by Baf Vietnam for the purpose of restructuring the company’s debts in the second quarter of 2025.

Source: Baf Vietnam

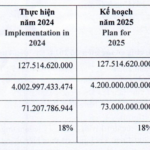

In terms of business results, according to the consolidated financial statements for the first quarter of 2025, Baf Vietnam recorded net revenue of more than VND 1,123.6 billion, a decrease of nearly 10% compared to the same period last year. In this quarter, the company’s main revenue came from livestock activities, with no revenue from the sale of agricultural products and other activities.

After deducting cost of goods sold of more than VND 833.1 billion, gross profit reached nearly VND 290.5 billion, up 127.5%.

In this period, the company also recorded financial income of nearly VND 4.3 billion, down 37.7% compared to the same period last year. On the other hand, financial expenses increased by 44.3%, to over VND 67.7 billion.

In addition, selling expenses increased by 56.3% compared to the first quarter of 2024, to VND 35.8 billion, and general and administrative expenses were VND 52.9 billion, up 117.7%.

Moreover, other income reached only VND 8.9 billion, down 91.1% year-on-year, mainly due to the absence of real estate investment disposal gains in this period, while the same period last year recorded nearly VND 99.4 billion.

As a result, after deducting various taxes and fees, Baf Vietnam reported a net profit of over VND 133.5 billion, up 12.5% over the same period last year.

For the full year 2025, Baf Vietnam expects to achieve net revenue of nearly VND 5,601.7 billion and net profit after tax of over VND 638.6 billion.

Thus, as of the first quarter of 2025, the company has achieved 20.1% of its revenue plan and 20.9% of its net profit plan.

As of March 31, 2025, Baf Vietnam’s total assets increased by 15.3% from the beginning of the year to nearly VND 8,588.1 billion. Of which, cash and cash equivalents were nearly VND 825 billion, 5.5 times higher than at the beginning of the year, and inventories were nearly VND 2,238 billion, up slightly by 3.8%, accounting for 26.1% of total assets.

In addition, the company’s construction in progress was nearly VND 988.8 billion, up 10.9% from the beginning of the year and accounting for 11.5% of total assets. This includes farm construction costs of over VND 710.2 billion, fixed asset/software purchases of nearly VND 182.5 billion, etc.

Notably, as of the end of 2024, Baf Vietnam owned 22 subsidiaries, but by the end of the first quarter of 2025, the company had acquired 3 more enterprises, bringing the total number of subsidiaries to 25.

On the liability side, Baf Vietnam’s total liabilities were nearly VND 5,518.8 billion as of the end of the first quarter of 2025, up 22.3% from the beginning of the year. Of which, loans and finance leases amounted to nearly VND 2,209.6 billion, accounting for 40% of total liabilities.

“VNDIRECT Research: Cautiously Awaiting the Outcome of Vietnam-US Trade Talks”

VNDIRECT Securities Analysis Unit (VNDIRECT Research) forecasts that the VN-Index will fluctuate between 1,230 and 1,520 points by the end of 2025, depending on three main scenarios. The outcome will hinge on the trade negotiations between the US and Vietnam, the number of Fed rate cuts, the State Bank’s interest rate management, and the results of the FTSE’s market classification review in September.

“Dragon Capital Increases Stake in DXG to Over 13%”

“In a notable trading session on April 29, 2025, foreign fund Dragon Capital, represented by Ms. Truong Ngoc Phuong, successfully acquired 2.8 million DXG shares through four of its member funds.”

“A Stellar 46% Profit Margin: Vietnamese FMCG Company Targets 35.5 Trillion VND in Revenue.”

In today’s ever-evolving market, businesses must continuously adapt and innovate to keep up with the diverse and ever-growing demands of consumers. Masan Consumer (UPCoM: MCH), a leading consumer goods company in Vietnam, is poised for a breakthrough in 2025. With its dominant position in the market, clear strategic vision, and strong growth momentum, Masan Consumer is well-equipped to seize a significant market share and take its success to new heights.