A slew of businesses in Ho Chi Minh City, ranging from real estate to petroleum and telecommunications, have just been subjected to a tax enforcement measure by the Region II Tax Department, which has resulted in their inability to use invoices starting April 2025 due to prolonged tax arrears exceeding 90 days.

Topping the list is Duc Khai Joint Stock Company with a staggering tax debt of VND 560 billion, followed by Bach Khoa Viet Joint Stock Company in Commercial Trading, Consulting, and Investment Construction, which owes VND 221 billion.

One of the businesses subjected to invoice enforcement has tax arrears amounting to VND 506 billion

In addition to Duc Khai and Bach Khoa Viet, the other businesses facing invoice enforcement include Ho Chi Minh City Electrical Machinery Joint Stock Company (telecommunications and electronic components) with VND 7.1 billion in tax debt, Saigon Railway Printing Joint Stock Company (printing) owing VND 4.4 billion, GTG Wellness Healthcare Co., Ltd. (healthcare) with VND 641 million in arrears, and Saigon Industrial Mechanics and Construction Joint Stock Company (construction) indebted at VND 508 million.

The one-year validity of the invoice enforcement decision could potentially disrupt these businesses’ operations as they may be unable to issue invoices during this period.

Duc Khai Joint Stock Company, located at Floor 1, Block A3, D3 Street, Phu My Resettlement Area, Phu My Ward, District 7, Ho Chi Minh City, is a long-standing enterprise in the real estate industry. The company also engages in trade and logistics activities.

Bach Khoa Viet Joint Stock Company, a major player in the petroleum industry in the South, had previously faced a suspension of import-export procedures due to overdue tax debts.

Smaller businesses such as Ho Chi Minh City Electrical Machinery Joint Stock Company, specializing in telecommunications equipment, and Saigon Railway Printing Joint Stock Company, operating in the printing field, are also facing financial pressures.

According to regulations, if these businesses fail to settle their tax debts, more stringent measures may be imposed, including asset seizure, auction, revocation of business licenses, or even travel bans for their leaders. Decree 49/2025/ND-CP stipulates that individuals with tax debts exceeding VND 50 million and overdue for more than 120 days may be subject to temporary suspension of exit.

The Final Resting Place: A Cemetery’s Swan Song

The investor of the My Phuoc Tay People’s Cemetery Park project (located in Lang Bien Hamlet, My Phuoc Tay Commune, Cai Lay Town, Tien Giang Province) had their land revoked by the Tien Giang People’s Committee due to failure to fulfill financial obligations.

The Oil Magnate’s Misfortunes: A Tale of Tax Troubles, Mounting Losses, and Bank Loans

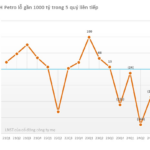

For the year 2024, NSH Petro witnessed a staggering 89% decline in revenue, amounting to just over VND 678 billion, a significant drop from the previous year’s performance. The company reported a staggering loss of nearly VND 790 billion in after-tax profits for 2024, a stark contrast to the VND 47 billion profit achieved in 2023.

How Much Tax Arrears Will Result in a Departure Postponement?

The proposed threshold debt amount that would trigger a travel ban for individuals and legal representatives of businesses has sparked a flurry of diverse opinions. This controversial topic has led to a heated debate, with strong arguments being presented from all sides. As the discussion unfolds, the implementation of this policy is temporarily put on hold, allowing room for further consideration and refinement.

The ‘Great Shift’ at the 30-Year-Old Real Estate Firm: Chairman Registers to Sell Over 18% of Company Shares as CEO Resigns Just Six Months into the Role

The Thuduc House leadership has been in a state of flux since 2022, with a string of executives facing legal troubles.