“Cash Dividend Storm”

A “storm” of cash dividends is approaching, bringing cheer to shareholders across the banking sector.

The Board of Directors of LPBank, a prominent Vietnamese joint-stock commercial bank, has passed a resolution to distribute cash dividends for 2024. This decision was made based on the plan approved by the Annual General Meeting held earlier this year. The payment date is set for May 28, with a payout ratio of 25%, meaning each share will receive VND 2,500. As a result, LPBank will be distributing a total of VND 7,468 billion in dividends, making it the highest cash dividend payout among banks this year.

At the recent Annual General Meeting, Mr. Nguyen Duc Thuy, Chairman of LPBank’s Board of Directors, mentioned last year’s commitment to distribute dividends of no less than 18%. The Board also expressed their desire to maximize dividend payouts in the coming years. For 2025, they are considering a dividend payout of 20% in cash or 5-7% in stocks. The management also encouraged shareholders to actively use the bank’s products and services, contributing to the bank’s growth.

LPBank leads the way with the highest cash dividend payout ratio this year.

Joining the dividend distribution trend, VPBank, another leading joint-stock commercial bank in Vietnam, has announced May 16 as the record date for shareholders to receive cash dividends. The payment date is set for May 23, with a payout ratio of 5% of the par value (VND 500 per share). VPBank plans to distribute a total of VND 3,967 billion in cash dividends, marking the third consecutive year of cash dividend payouts. In 2024, the bank distributed VND 7,934 billion in cash dividends, equivalent to a 10% payout ratio. Over the past three years, VPBank has allocated nearly VND 20,000 billion for cash dividends, demonstrating its commitment to rewarding shareholders.

TPBank, a pioneer in digital banking, has also announced a cash dividend payout of 10%, with a record date of May 14 and a payment date of May 23. With a payout ratio of 10% of the par value (VND 1,000 per share), TPBank is set to distribute VND 2,642 billion in cash dividends to its valued shareholders.

VIB, a well-known Vietnam-based joint-stock commercial bank, also joins the fray with a cash dividend payout of 7%. The record date for this distribution was set on April 23, and the payment date is scheduled for May 23. With a total payout of VND 2,085 billion, each share will receive VND 700, reflecting the bank’s commitment to shareholder value.

While some banks shower their shareholders with generous dividends, others are left in the lurch.

SeABank, a prominent player in the Vietnamese banking industry, reported a post-tax profit of over VND 3,620 billion for 2024, with accumulated undistributed profits of over VND 3,740 billion. However, SeABank has decided to retain the undistributed profits from 2024 to strengthen its financial position and boost its capital for future business endeavors.

ABBank, another notable Vietnamese bank, has proposed to retain its entire post-tax profit of over VND 470 billion from 2024 to implement its strategic plans and increase its charter capital in the future. Along with the accumulated profits from previous years, ABBank currently holds a total of VND 2,311 billion in undistributed profits but has not distributed any dividends as of yet.

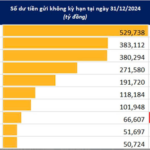

Sacombank, despite having a staggering accumulated profit of nearly VND 25,352 billion, has not planned any dividend distribution for 2025. This marks the ninth consecutive year of no dividend payouts for Sacombank, as the bank is still in the process of restructuring.

Eximbank, with accumulated undistributed profits of over VND 2,526 billion as of 2024, has decided against distributing dividends for the previous year to reinforce its financial position.

“The CASA Growth Engine: Unlocking Sacombank’s Potential”

Sacombank has consistently ranked among the top 10 banks with the highest CASA, giving it a significant advantage of low-cost funding. This enables the bank to expand its lending activities, boost net interest income, and invest in developing a robust service ecosystem. Amidst a volatile interest rate environment and Sacombank’s ongoing restructuring journey, maintaining this position becomes even more crucial.

“Core Business Activities of OCB Maintain Strong Growth Momentum in Q1 2025”

Oriental Commercial Joint Stock Bank (HOSE: OCB) has announced its Q1 2025 financial report, boasting impressive results with a remarkable pre-tax profit of VND 893 billion, showcasing a strong and consistent growth in its core operations.

“Bank Dividend Policies: Striking a Balance Between Shareholder Rewards and Fortifying Financial Position?”

“To cash dividend or to retain earnings, that is the question on the minds of bank executives as they gear up for the 2025 annual general meetings. With a volatile macroeconomic climate, striking a balance between keeping shareholders happy and fortifying the financial foundation of the bank is a delicate matter.”

“Forging a Green and Intelligent Future”: Sacombank Champions Sustainable Transport Initiatives.

“As a bank born and bred in Ho Chi Minh City, Sacombank is proud to stand alongside the city and is committed to contributing to its growth. Our financial products and services are designed to bring high, sustainable, and practical value to the people. A testament to this is the open-loop payment solution that Sacombank is implementing with the city’s transport industry,” said Ms. Nguyen Phuong Huyen, Director of Sacombank’s Retail Banking Division.

“The Battle of the Banks: VPBank and Techcombank’s Race to the Top”

“Techcombank and VPBank, two of Vietnam’s leading private banks, are not just rivals in size and scale but also in their ambitious plans to transform into comprehensive financial groups. Both institutions have set their sights on diversifying their offerings by venturing into the insurance sector and significantly expanding their securities and asset management arms. This strategic shift underscores their commitment to becoming one-stop shops for all their customers’ financial needs, solidifying their positions as industry leaders.”