April marks the annual general meeting season for banks, and the industry is facing both opportunities and challenges. On the one hand, there are opportunities arising from the accommodative monetary policy and the system-wide credit growth target of up to 16% to support economic growth in 2025. On the other hand, there are challenges due to economic difficulties stemming from both internal and external pressures, as well as the increasing cost of capital, which is leading to a continued squeeze on net interest margins.

This year’s meetings not only reviewed the 2024 business results but also reflected each bank’s strategy for the coming period. Notably, shareholders’ concerns are shifting strongly towards substantive governance issues, such as business orientation, risk management, and responses to macroeconomic fluctuations, including the impact of US tax policies in recent times. The strategic messages conveyed at these meetings, therefore, serve as important references for assessing the feasibility of the business objectives set by the banks.

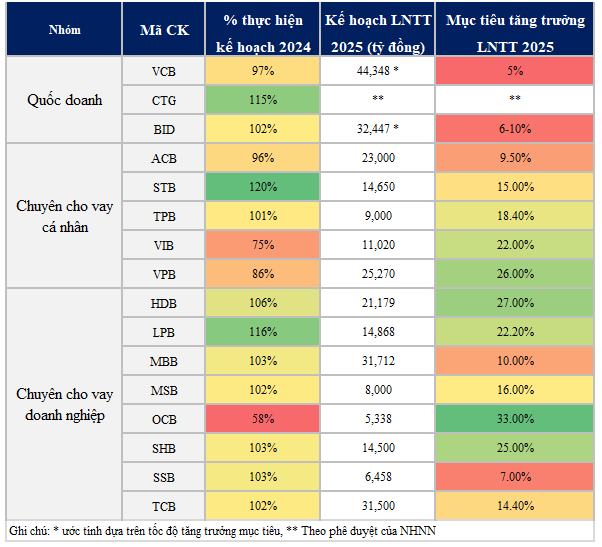

In 2024, despite economic challenges, many banks achieved or exceeded their profit plans. The state-owned group performed positively, with CTG and BID surpassing their targets by 15% and 2%, respectively, while VCB reached 95% of its plan. The group of banks specializing in personal lending showed a strong divergence, with VIB and VPB being impacted by the reduction in NIM due to weak consumer credit in recent years. In contrast, banks focusing on corporate lending exceeded their plans, achieving an average credit growth of 22.5%. Notable performers in this group include LPB, MBB, and TCB, all of which exceeded their targets.

Moving into 2025, the profit plans of the banks show a clear differentiation. State-owned banks such as VCB, BID, and CTG have set modest profit growth targets, ranging from 5% to just under 10%, reflecting a cautious approach as they prioritize their role in leading and supporting low-cost credit for the economy. While they have been assigned a relatively high credit growth rate of 15-16% compared to previous years, it is evident that these state-owned banks have also planned for a further narrowing of their net interest margins this year. In contrast, private banks demonstrate a more pronounced growth expectation, indicating a proactive business strategy and confidence in their ability to seize opportunities during the recovery phase.

Among the banks specializing in personal lending, those with positive business results in the previous year, such as ACB and STB, have set moderate profit growth targets for 2025. On the other hand, banks with a high proportion of consumer loans, such as VPB and VIB, have set ambitious profit growth targets of over 20%, reflecting their determination to regain momentum after a challenging 2023 and 2024. This ambition is not only a demonstration of their resolve but also has a solid basis, as a recent survey by the State Bank of Vietnam indicates that credit institutions anticipate a revival in consumer credit and an increase in demand for lifestyle loans this year.

|

Table 1: Evaluation of the implementation of the 2024 business plan and the 2025 profit before tax (PBT) plan of banks

Source: Compiled from 2025 Annual General Meeting

|

Regarding banks specializing in corporate lending, the general trend for 2025 is stable growth, reflecting a cautious approach after the previous period of acceleration. Notably, OCB aims for a 33% increase in profit as an effort to make up for the low completion rate in 2024. Meanwhile, MBB remains committed to sustainable development. Banks that previously recorded strong growth, such as LPB and TCB, have planned for slower growth this year, indicating a strategic adjustment after two years of rapid expansion. HDB is a unique case, thanks to its advantage of owning the consumer finance company HD Saison, and it targets high growth, building on the positive results from the previous year.

Amid the announcements of profit-before-tax targets for 2025, a critical question arises regarding the feasibility of these plans. With the prolonged low-interest-rate environment and the continued erosion of net interest margins (NIMs), achieving these profit targets will not be easy. Therefore, to make a more comprehensive assessment, it is essential to understand the specific operational orientations of each bank for this year.

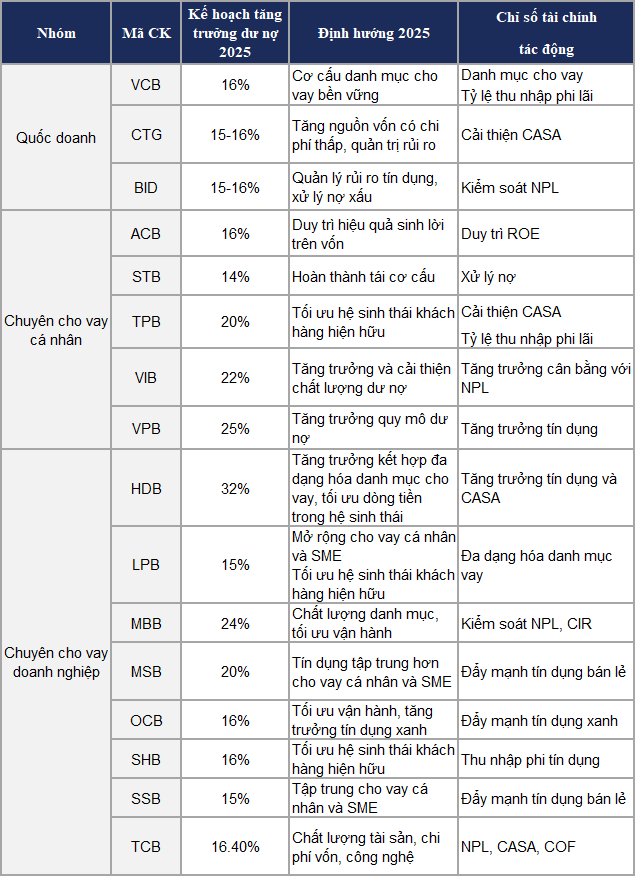

|

Table 2: 2025 Annual General Meeting Strategies

Source: Compiled from 2025 Annual General Meeting

|

This year’s strategic orientations indicate that banks are pursuing profit scale while striving for a balance between growth, efficiency, and risk management. State-owned banks emphasize pillars such as technology optimization, enhancing credit quality, risk management, and bad debt handling. This approach demonstrates their continued focus on maintaining system stability, avoiding aggressive growth strategies, and prioritizing internal health—a crucial aspect amid ongoing macroeconomic fluctuations, particularly the escalating trade war tensions.

Among the banks specializing in personal lending, VPB and VIB express high expectations for the recovery of consumer credit, targeting over 20% growth in outstanding loans in 2025. ACB maintains its strategy of “selective growth” after shifting towards lending to medium and large enterprises last year, while also focusing on improving capital efficiency and enhancing ROE through operational cost management. Meanwhile, STB is expected to complete its restructuring and bad debt handling process. TPB concentrates on its existing customer ecosystem, thereby improving CASA and non-credit income and laying the foundation for more stable long-term growth.

Within the group of banks focusing on corporate lending, the 2025 strategy is diverging into two distinct directions: one group aims to optimize existing resources, while the other seeks to diversify their customer base. HDB, LPB, MSB, and SSB choose to expand into the SME and retail segments, which offer higher profit margins. In contrast, MBB and TCB prioritize improving asset quality and operational optimization through technology application, while SHB intends to deepen its engagement with existing customers to increase the proportion of non-credit income. Notably, MBB demonstrates a strategy of sustainable development and support for the economy, aiming for strong credit growth while accepting a moderate profit target. OCB, on the other hand, focuses on product orientation according to customer segments, emphasizing green credit—a trend that the market is strongly promoting.

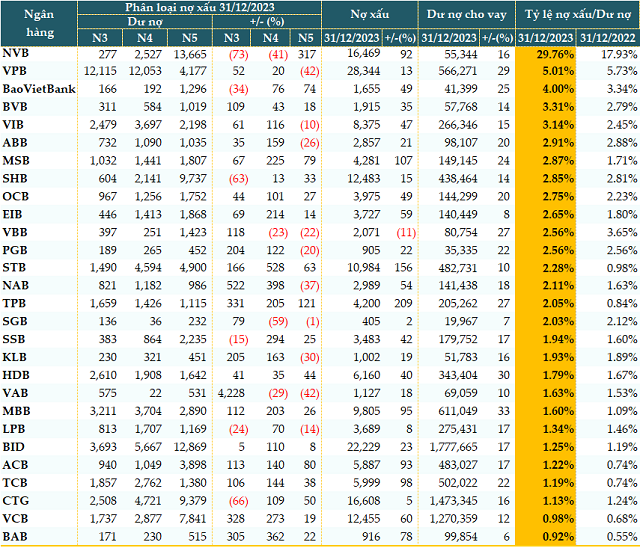

While the banks have been granted a high credit growth rate, the expected continued reduction in NIM to support growth, and the challenging prospect of improving service income, effective management of operating costs and credit quality are paramount for achieving profit targets.

During the 2025 annual general meetings, banks are reshaping their strategies to adapt to the new context. Notably, there is a strong expectation for a recovery in retail credit, indicating a potential shift in credit dynamics from the production-business sector towards consumer credit to stimulate domestic demand. This is particularly relevant given the ongoing pressure on Vietnam’s export market due to tariffs.

Le Hoai An, CFA – Nguyen Thi Ngoc An, HUB

– 11:03 05/05/2025

The Capital Injection Conundrum: Why Are Businesses Still Struggling to Secure Loans Despite Banks’ Efforts?

The banking sector injected nearly VND 200,000 billion into the economy in the first few months of the year, yet businesses still cry out for easier access to this capital. Experts assert that directing this bank funding towards businesses requires a harmonious interplay between governing policies, strategic banking initiatives, and proactive enterprise from businesses themselves.

The Surprising Secrets to Overcoming a Sharp Decline in Deferred Revenue

Deferred interest income plays a pivotal role in shaping a bank’s profit structure and can serve as a window into the bank’s asset quality. Moreover, it acts as a harbinger of profit quality. With the expiration of debt moratorium circulars, some banks have unveiled issues pertaining to this very item.

The Central Bank Injects an Additional 164 Trillion VND into the Economy Since the Lunar New Year of 2025

According to estimates released by the State Bank of Vietnam, the credit scale of the entire banking system as of March 12 reached VND 15,810 trillion, an increase of nearly VND 194 trillion compared to the end of 2024, and a further VND 164 trillion surge since the Lunar New Year.

The Latest Credit Growth Figures: Unveiling the Banking System’s Performance

“The banking sector is off to a strong start this year, with credit growth outpacing that of the previous year. According to Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, as of March 12, credit growth in the banking system had increased by 1.24% compared to the end of 2024, indicating a significant improvement.”