Vietnam-based real estate group, Dat Xanh Group (DXG), listed on the Ho Chi Minh Stock Exchange (HoSE), has announced a change in ownership among its foreign investor groups holding over 5% of the company’s shares.

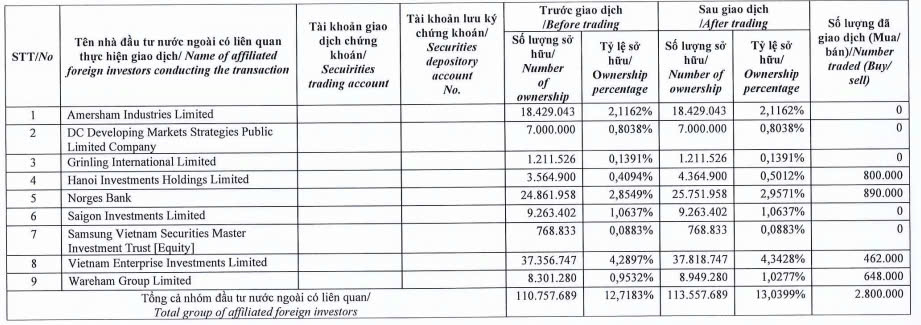

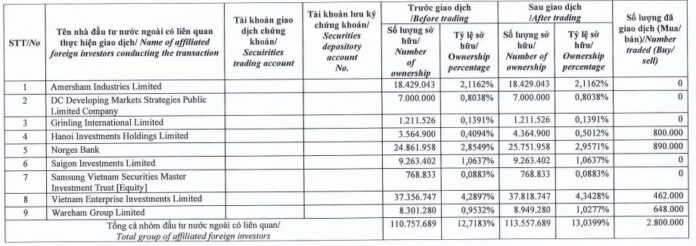

On April 29, 2025, Dragon Capital, represented by Ms. Truong Ngoc Phuong, utilized four of its member funds to successfully purchase 2.8 million DXG shares.

Specifically, Hanoi Investments Holdings Limited acquired 800,000 DXG shares, Norges Bank purchased 890,000, Vietnam Enterprise Investments Limited bought 462,000, and Wareham Group Limited secured 648,000 shares.

Source: DXG

Following this transaction, Dragon Capital’s ownership in DXG increased from nearly 110.8 million shares to approximately 113.6 million, raising their stake in the company from 12.7183% to 13.0399%.

Based on DXG’s closing price on April 29, 2025, of VND 15,150 per share, Dragon Capital is estimated to have invested over VND 42.4 billion in this purchase.

In terms of financial performance, Dat Xanh Group’s consolidated financial statements for Q1 2025 showed a slight decline in revenue compared to the previous year, standing at over VND 924.9 billion, a 13.1% decrease. However, gross profit increased by 8%, reaching nearly VND 510.3 billion.

The group also reported higher financial income of VND 11.7 billion, a 39% jump from the same period last year. Conversely, financial expenses rose by 11% to nearly VND 138.8 billion. Selling expenses and administrative expenses also increased slightly, reaching VND 146.3 billion and VND 79.2 billion, respectively.

For the quarter, Dat Xanh Group posted a net profit of over VND 78.5 billion, a modest improvement of VND 907 million compared to Q1 2024.

As of March 31, 2025, the group’s total assets grew by 15.3% from the beginning of the year, reaching over VND 33,669.1 billion. Inventory accounted for VND 13,386.7 billion, or 39.8%, of total assets. Additionally, cash and cash equivalents surged to nearly VND 5,106.7 billion, representing 15.2% of total assets, a significant four-fold increase compared to the previous year.

On the liabilities side, total liabilities stood at VND 16,577.7 billion, an 18.6% increase. Notably, total loans and finance lease liabilities amounted to over VND 7,545.2 billion, a 44.9% jump, comprising 45.5% of total liabilities.

The Textile Business with the Highest Export Ratio to the US in the Industry Plans to Reward Shareholders with a 50% Dividend as Record-High Profits are Projected.

This textile business has secured enough orders to last until the end of the year and anticipates that ongoing government negotiations will ease tariff pressures. The company’s leadership remains confident in their financial plan for 2025, stating that there is no need for adjustments at this time.

The Smart Money Sells: Foreigners Dump Vietnamese Shares, Offloading Bank Stocks

The sell-off continued into the afternoon session, with VCB and VHM bearing the brunt of it. VCB witnessed a substantial sell-off, with approximately VND 184 billion changing hands, while VHM followed suit with a notable sell-off of VND 134 billion.

![[IR AWARDS] December 2024: A Month of Revealing Insights](https://xe.today/wp-content/uploads/2024/12/Screenshot_01-100x70.png)