City Auto Joint Stock Company (code: CTF) recently announced insider trading by insiders and related persons of the company.

Specifically, Mrs. Ngo Thi Hanh, wife of Mr. Tran Ngoc Dan, Chairman of City Auto’s Board of Directors, registered to purchase 6 million CTF shares to increase her ownership rate. The transaction is expected to take place from May 7 to June 5, 2025, through matching and agreement methods.

If successful, Ms. Hanh will increase her holding of CTF shares from 150,000 shares to 6.15 million shares, equivalent to an increase in ownership ratio from 0.16% to 6.43% of capital.

Calculated at the closing price of VND 21,850/share on April 29, Ms. Hanh will have to spend about VND 131 billion to increase her ownership in the company.

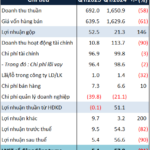

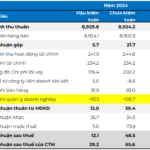

In terms of financial results for the first quarter of 2025, CTF recorded a 57% decrease in consolidated after-tax profit compared to the same period, reaching just under VND 3 billion. The company attributed the profit decline to the stagnant auto market in the first quarter of 2025.

On May 20, the company will hold the 2025 Annual General Meeting of Shareholders in Ho Chi Minh City. Accordingly, CTF plans to achieve a revenue of VND 8,600 billion, up 5% compared to 2024, and a pre-tax profit and after-tax profit of VND 126 billion and VND 100.8 billion, up 121% and 110% respectively over the same period. The dividend ratio for 2025 is 10%.

Post-Audit 2024: SMC Turns Profitable, Avoids Delisting Thanks to Novaland Agreement

The Ho Chi Minh Stock Exchange (HOSE) has withdrawn its delisting decision for SMC Trading Investment Joint Stock Company (HOSE: SMC) following the release of the company’s 2024 audited financial statements, which confirmed its profitability.

“ACBS: Navigating Challenges in Q1 with a 31% Profit Dip: The Impact of Proprietary Trading, Brokerage, and Loan Provision Costs”

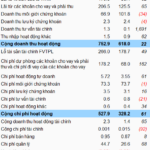

In Q1 of 2025, ACB Securities Joint Stock Company (ACBS) recorded a pre-tax profit of nearly VND 182 billion, a 31% decrease compared to the same period last year. This performance accounts for over 13% of the company’s full-year target of VND 1,350 billion. The decline can be attributed to a downturn in proprietary trading and brokerage, coupled with increased loan loss provisions.