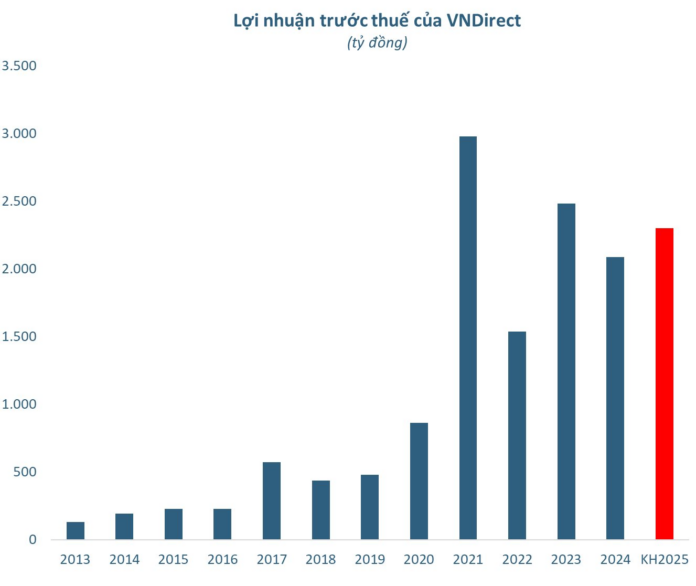

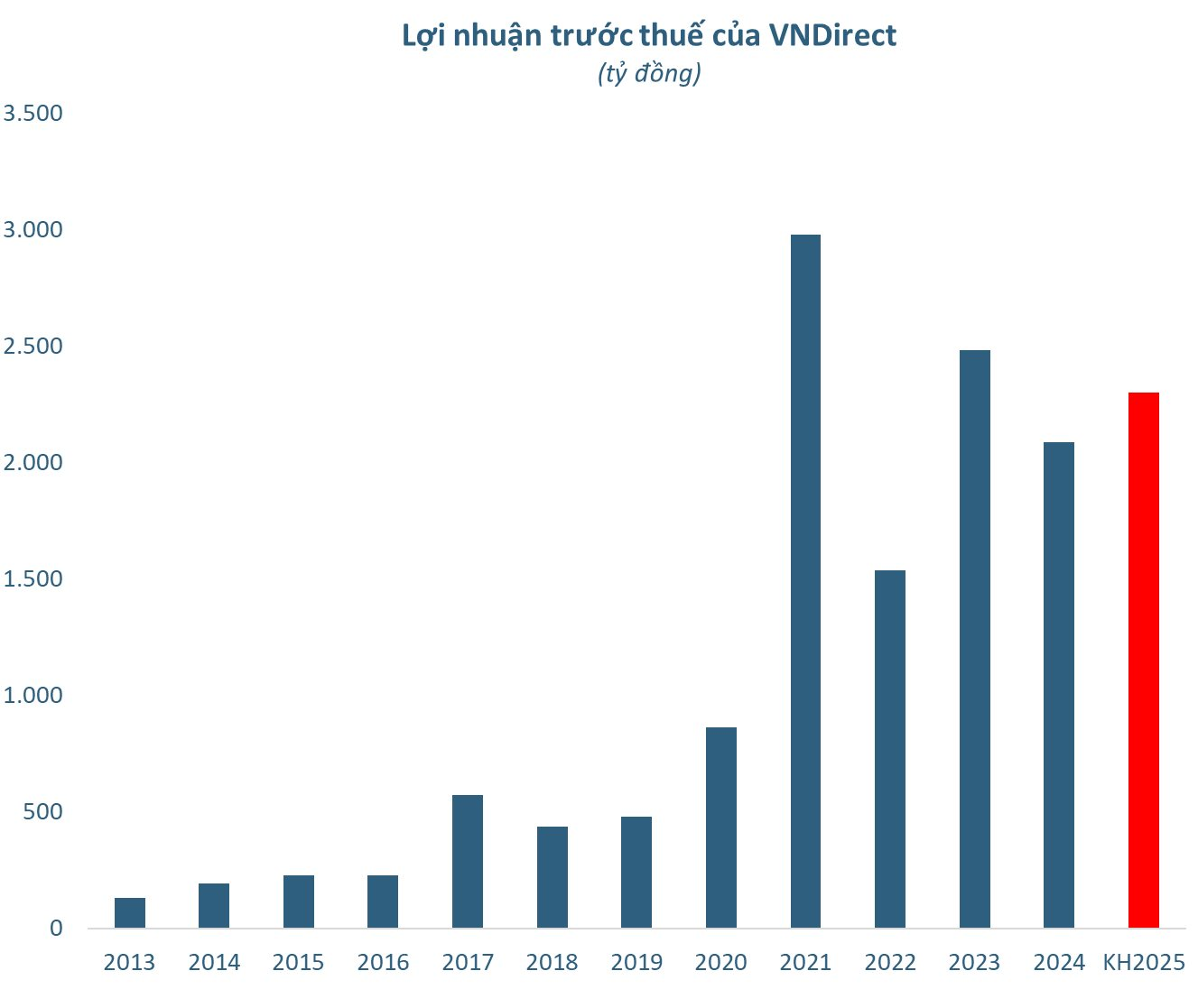

On May 28, VNDirect Securities Corporation (VND) will hold its 2025 Annual General Meeting of Shareholders in Hanoi. According to the recently published materials, VNDirect sets its 2025 plan with a total revenue of VND 4,412 billion and a pre-tax profit of VND 2,300 billion, an increase of 8% and 10% respectively compared to the previous year. The after-tax profit target is VND 1,840 billion.

According to the company, 2025 is expected to be a year of global economic and political fluctuations with challenges arising from geopolitical conflicts and economic risks associated with trade wars, leading to macroeconomic instability worldwide. Meanwhile, Vietnam is undergoing a crucial year of transition with numerous shifts and plans to boost economic growth in preparation for a new cycle.

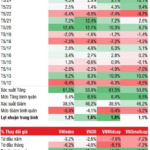

VNDirect assesses the market scenario with the VN-Index ranging between 1,400 and 1,520 points this year, listed companies on HOSE achieving EPS growth of 14-17%, and a target P/E of 12.3-13.4 times.

Source: VNDirect’s materials

In terms of specific strategies, the company remains committed to its comprehensive orientation in becoming an investment ecosystem for its clients participating in the market. It focuses on developing and enhancing its competitiveness in each customer segment, including Securities Brokerage Services, Investment Consulting & Asset Management, Investment Banking, and Connecting Overseas Markets…

In 2024, VNDirect’s operating revenue decreased by 19% to VND 5,324 billion. After deducting expenses, the company reported a 16% decline in pre-tax profit to VND 2,088 billion. Correspondingly, after-tax profit decreased by 15% to VND 1,718 billion, achieving nearly 83% of the set target.

With these results, VNDirect plans to pay a 2024 cash dividend of 5% (VND 500/share). Additionally, the company intends to implement a business bonus/supplementary salary policy for key employees based on 2024 business results. The estimated amount for this bonus is VND 70 billion.

As per the plan, this bonus policy will continue in 2025 following these principles: (i) the business bonus will be 5% of post-tax profit (according to the separate financial statements of the Company) if the target is achieved; and (ii) if the target is exceeded, an additional 20% bonus will be given for the surplus profit.

Vietnam Stock Market Outlook: Consolidating the Uptrend for VN-Index

The Vietnamese stock market ended the trading session on May 7th with a notable gain, as the VN-Index rose by 8.4 points, or 0.68%, closing at the 1250-point level.