Vietnam Export Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) announces its first-quarter 2025 financial results. The bank reported a pre-tax profit of 832 billion VND, a nearly 26% increase year-over-year.

Net interest income remains the bank’s main pillar, generating 1,354 billion VND. Non-credit income showed positive growth: service income reached 146 billion VND, a 32% increase, and foreign exchange income hit 202 billion VND, a 141% surge. Pure income from other activities also witnessed an impressive growth spurt, climbing to 109 billion VND, up 124% from the previous year.

Eximbank’s total operating income surpassed 1,800 billion VND, a 15% increase year-over-year. Profit from business operations before credit risk provision expenses stood at 959 billion VND, with a credit risk provision expense of 127 billion VND for the quarter.

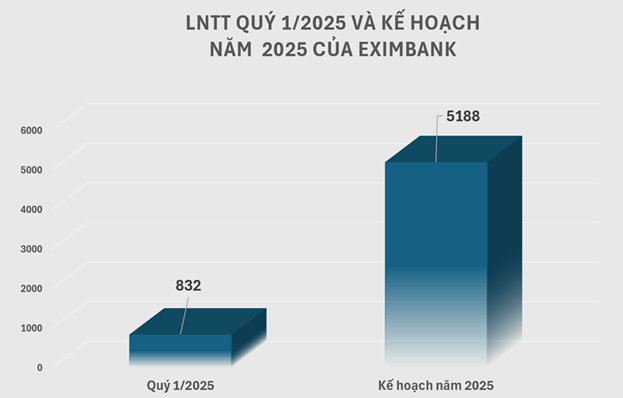

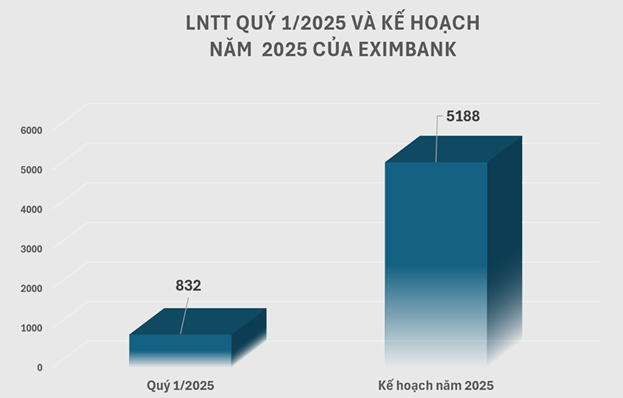

The bank’s total pre-tax profit reached 832 billion VND, a 26% increase year-over-year, achieving 16% of the 2025 profit plan.

As of March 31, 2025, the bank’s total assets amounted to 251,133 billion VND, a 5% increase from the beginning of the year.

Credit balance increased by 8.34% to 182,258 billion VND. Eximbank’s credit continued to flow into key segments and fields, including retail banking, SME enterprises, large corporate and FDI ecosystems, aligning with the government and State Bank of Vietnam’s (SBV) orientation on credit capital supply for the economy.

Customer deposits also rose by 5% from the beginning of the year to 175,759 billion VND.

Amid complex economic developments, the bank effectively managed its operational safety ratios as per SBV regulations: the ratio of short-term capital used for medium and long-term loans remained at 23-25%, lower than the SBV’s maximum limit of 30%; the LDR ratio was consistently maintained below 85% as per SBV regulations, and the CAR ratio fluctuated around 12%, higher than the SBV’s minimum requirement of 8%.

In Q1/2025, Eximbank achieved positive growth in foreign exchange.

|

During the first quarter, Eximbank launched multiple preferential programs to support businesses and individuals, offering optimized products and prioritizing customer experience. The bank also focused on comprehensive digital transformation.

At this year’s AGM, with consensus at the top and internal changes, Eximbank remains steadfast in its goals. The bank aims for an 11% increase in total assets to 265,500 billion VND, with targeted capital mobilization of 206,000 billion VND, a 16% increase. Credit balance is projected to grow by 16.2% to 195,500 billion VND. The pre-tax profit target is set at 5,188 billion VND, a 24% increase from 2024. Eximbank aims to tightly control bad debt, aiming to reduce the bad debt ratio to 1.99%.

Eximbank’s key tasks for 2025 and beyond include developing a customer base, segment targeting, enhancing efficiency, and boosting competitiveness. The bank will restructure its finances and asset portfolio, closely monitor credit quality, and leverage its centralized debt handling model. Additionally, Eximbank will improve capital efficiency, enhance profitability ratios, strengthen financial capacity, and enhance risk response capabilities. The bank has a roadmap for implementing Basel III and IFRS to align its information disclosure with international standards.

In the first-quarter 2025 banking industry profit landscape, Eximbank remains among the top performers in terms of profit growth. The improvement in credit performance, albeit modest (as of March 25, 2025, credit growth for the economy reached 2.5%), contributed to the industry’s profit increase. However, external factors, particularly the new US tariff policy, may impact credit and profit results in the coming quarters.

This situation calls for Eximbank’s strategic response, leveraging its inherent strengths alongside positive domestic economic signals.

– 20:48 29/04/2025

“Eximbank Empowers FDI Enterprises with Comprehensive Financial Solutions”

In a volatile global economic landscape, Vietnam remains a shining beacon for FDI attraction. Eximbank stands as a trusted financial partner for FDI enterprises, offering tailored financial solutions that optimize costs and enhance competitive advantage. With our support, businesses can unlock sustainable growth opportunities, bolstered by our agile approach to financing.

A New Era for Nhat Viet Securities: Unveiling the Appointment of a Visionary Leader

“Nhất Việt Securities appoints Ms. Nguyen Thi Thu Hang as its new CEO and legal representative, succeeding Mr. Tran Anh Thang. “