Deposit Growth Trajectory: A Tale of Contrasting Fortunes for Vietnam’s Banks

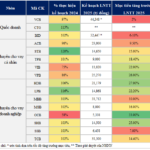

A survey of 27 listed banks (excluding Agribank) reveals a mixed bag when it comes to deposit trends. State-owned banks continue to dominate in terms of deposit volume, with BIDV, VietinBank, and Vietcombank occupying the top three spots. BIDV maintained its leading position with nearly VND 1,980 trillion in deposits as of Q1 2025, followed by VietinBank with over VND 1,620 trillion, and Vietcombank with VND 1,500 trillion. However, Vietcombank experienced a slight dip in deposits, down by approximately VND 5,500 billion compared to the previous year.

MB secured the fourth position in the top 10 banks with the highest deposits in the first quarter of this year.

A contrasting picture of deposit trends among banks.

VPBank stood out with an impressive growth trajectory in the first quarter, attracting over VND 66 trillion in additional customer deposits, bringing its total deposit base to more than VND 552 trillion.

In contrast to the growth witnessed by many banks, some institutions experienced a decline in deposits. Aside from Vietcombank’s minor decrease, Techcombank, a prominent private bank, saw a reduction of nearly VND 1,800 billion. TPBank, SeABank, and ABBank faced more significant declines, ranging from 4% to almost 5%.

Mr. Nguyen Quang Huy, a finance and banking expert from Nguyen Trai University, shared his insights with Tien Phong newspaper. He attributed the high credit growth, especially in the first months of the year, to the recovering economy and businesses resuming their production and investment activities after a period of contraction.

However, low deposit growth from households and economic organizations has widened the gap between credit growth and deposit mobilization. Mr. Huy explained that individuals are opting for alternative investment avenues due to the historically low deposit rates coupled with expected inflation, resulting in negative real returns. The shift towards real estate, gold, securities, and other higher-yielding investments is understandable, especially given the market’s anticipation of sustained low-interest rates.

“The contrasting performance in deposit mobilization among banks indicates a shift in competitive focus,” said Mr. Huy. “Instead of relying solely on interest rates, banks are now emphasizing value-added services and enhancing customer experience. This includes integrating financial, insurance, and personal investment services to retain customers and their capital.”

Mr. Huy further emphasized the importance of technology in this new competitive landscape, with larger banks leveraging their digital ecosystems to create additional value and attract long-term, loyal customers. Smaller banks, on the other hand, face the challenge of offering higher interest rates to remain competitive, which can impact their profit margins and capital reinvestment strategies.

Banks Explore Alternative Funding Sources

According to data from the State Bank of Vietnam, credit growth in the first quarter of 2025 outpaced deposit mobilization, resulting in a significant gap of VND 1,100 trillion. This disparity highlights the challenge faced by banks in balancing deposit growth with the need to support economic growth.

With deposit rates at historic lows, banks are facing increased competition from alternative investment channels such as securities, real estate, and gold. To address this challenge and ensure sufficient capital to support the economy, banks are exploring alternative funding sources. These include issuing bonds, obtaining international loans, and offering competitive interest rates to attract deposits.

For instance, VPBank recently announced a successful international loan syndication of USD 1 billion, with the option to increase the loan amount based on the bank’s future capital requirements.

VNDirect Securities highlighted the benefits of private placement bond issuances with long durations, such as those implemented in 2024. These initiatives not only bolster banks’ capital but also contribute to enhancing their medium and long-term capital ratios.

This year, banks are expected to continue their proactive approach to issuing private placement bonds, strengthening their medium and long-term capital positions, and fostering a rebound in the corporate bond market.

Launching the Strategic Human Resources Alliance for the Implementation of Resolution 57-NQ/TW

On May 7, 2025, the Forum on Developing New Impetus for the Nation and the Launch Ceremony of the Strategic Human Resources Alliance for the Implementation of Resolution 57-NQ/TW was held in Hanoi. This significant event, organized by FPT Corporation in collaboration with various ministries, departments, and organizations, aimed at contributing to the development of human resources to ensure the successful implementation of Resolution 57-NQ/TW.

The Evolution of Banking Strategies: Insights from the 2025 Annual General Meetings

The past month has seen a series of annual general meetings (AGMs) held by banks, capturing the attention of investors and the market. With the need to boost credit growth this year to support the economy, the banking sector is expected to have multiple growth drivers. However, businesses still face numerous challenges, both internally and externally. Thus, each bank’s strategy will be a key differentiator.

“Vicostone’s First Quarter Net Profit Down Nearly 20% Year-on-Year”

As of Q1 2025, Vicostone recorded a revenue of over VND 1,018 billion, a 5.2% decrease compared to the same period last year. Despite this, the company managed to maintain a strong profit with an after-tax profit of nearly VND 164.6 billion, reflecting a resilient performance in a challenging economic climate.