The Board of Directors of Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank – STB) has just issued a resolution on the policy to terminate the operation of 5 transaction offices directly under Ho Chi Minh City.

Specifically, the 5 transaction offices include:

– Nguyen Cong Tru Transaction Office, address: 44-50, 52, 54 Nguyen Cong Tru and 41 Ton That Dam, Nguyen Thai Binh Ward, District 1, Ho Chi Minh City. This transaction office is managed by District 4 Branch.

– Hoa Hung Transaction Office, address: 35 To Hien Thanh, Ward 13, District 10, Ho Chi Minh City. This transaction office is managed by Nguyen Van Troi Branch.

– Hoa Thanh Transaction Office, address: 420 Luy Ban Bich, Hoa Thanh Ward, Tan Phu District, Ho Chi Minh City. This transaction office is managed by Binh Tan Branch.

– Thong Tay Hoi Transaction Office, address: 342-342A Quang Trung, Ward 10, Go Vap District, Ho Chi Minh City. This transaction office is managed by Go Vap Branch.

– Hoang Hoa Tham Transaction Office: 29A Hoang Hoa Tham, Ward 6, Binh Thanh District, Ho Chi Minh City. This transaction office is managed by Binh Thanh Branch.

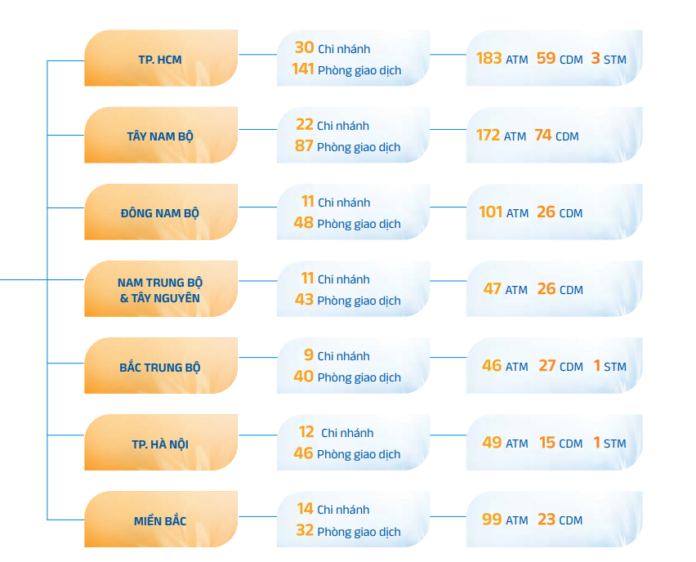

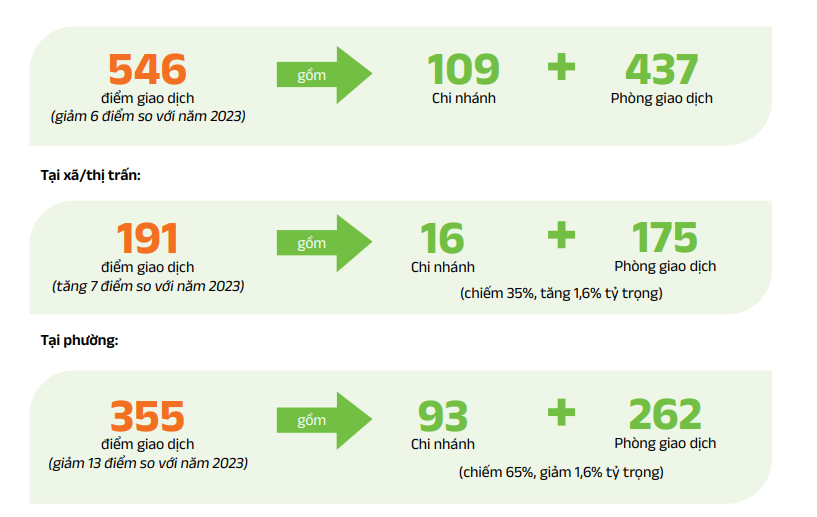

Sacombank is currently one of the largest private banks in Vietnam in terms of network coverage. According to the bank’s Q1/2025 financial statement, it has 1 head office, 109 branches, and 437 transaction offices across the country. The number of transaction offices remained unchanged in the first quarter of 2025.

In 2024, the bank reduced the number of transaction offices from 443 to 437, a net decrease of 6 transaction offices. Specifically, the bank opened 7 new transaction offices and closed 13 others.

In addition to the closure of transaction offices, the bank’s personnel also decreased by 354 people in 2024 and by 930 people in Q1/2025 to 16,128 people. Compared to the figure of 18,108 employees in 2019, Sacombank’s personnel has decreased by almost 2,000 people.

Sacombank has one of the largest transaction networks among private banks in Vietnam.

At the 2025 Annual General Meeting of Shareholders, Mr. Duong Cong Minh, Chairman of Sacombank’s Board of Directors, said that the bank would continue to streamline its organization, reducing staff at traditional transaction offices to serve its digital transformation strategy. “In 2024, the bank reduced nearly 500 employees. In the period of 2025-2026, Sacombank will continue to cut staff while promoting digital transactions,” said Mr. Minh. The bank tends to slightly reduce or streamline staff instead of massive new recruitment.

According to Sacombank, in 2024, the bank actively restructured its network to align with its digital transformation strategy, improving productivity and operational efficiency. The network of transaction points (including branches and transaction offices) of Sacombank decreased from 552 points to 546 points.

Sacombank tends to focus on increasing the coverage of service provision points in rural, remote, and mountainous areas. Currently, the bank has 191 transaction points in communes/towns, an increase of 7 points compared to 2023. Meanwhile, the number of transaction points in the wards decreased by 13 points to 355 points, including 93 branches and 262 transaction offices. The proportion of transaction points in the wards remains high due to the upgrade of administrative boundaries in some provinces from districts to towns – the location and operating area of the transaction points remain unchanged.

In 2025, the bank affirms that it will focus and be determined in restructuring its network, areas, branches, transaction offices, and personnel with insufficient professional qualifications and management capabilities to improve the efficiency and labor productivity of the Unit and the brand of Sacombank. At the same time, Sacombank will arrange, handle, and appropriately rotate managers at units with weak, average, or good business results.

In 2024, the bank tended to increase transaction points in communes/towns and reduce transaction points in wards.

In terms of business results, in Q1/2025, the bank recorded a pre-tax profit of VND 3,674 billion, up 38.4% over the same period, equivalent to 25.1% of the year plan. Mobilized capital in the system increased by 3.3%, reaching 33% of the growth plan. Loans increased by 4.7%, reaching 33.3% of the growth plan.

In 2025, Sacombank plans to have total assets of VND 819,800 billion, up 10% compared to 2024. Mobilized capital is expected to increase by 9% to VND 736,300 billion, and credit balance is expected to increase by 14% to VND 614,400 billion. The bad debt ratio is controlled below 2%. The bank targets a pre-tax profit of VND 14,560 billion, up 15% and the highest ever.

Previously, the bank had completed its 2024 business plan approved by the AGM of Shareholders. Accordingly, pre-tax profit reached VND 12,720 billion, completing 120% of the plan. Other indicators such as total assets, mobilized capital, and credit balance also achieved over 100% of the plan. The bad debt ratio was at 2.08%, and all limits and ratios ensured compliance with the State Bank’s regulations.

Sacombank: The Power of Business Savvy

Despite facing significant challenges from the restructuring plan, including constraints on capital increases, Sacombank has achieved notable successes in financial indicators, credit ratings, and risk management. These accomplishments have significantly enhanced the appeal of Sacombank’s stock, attracting the attention of domestic and foreign investors alike.

The Bank Dividend: Where Cash Flows Like Rain, or Not a Penny More

The shareholders are about to receive a windfall of cash dividends from the banks. While some banks generously distribute their profits, others retain substantial amounts of earnings, amounting to thousands of billions, without sharing this wealth with their investors.

“The CASA Growth Engine: Unlocking Sacombank’s Potential”

Sacombank has consistently ranked among the top 10 banks with the highest CASA, giving it a significant advantage of low-cost funding. This enables the bank to expand its lending activities, boost net interest income, and invest in developing a robust service ecosystem. Amidst a volatile interest rate environment and Sacombank’s ongoing restructuring journey, maintaining this position becomes even more crucial.

The New Coastal City: A Visionary $2.7 Billion Project for Ho Chi Minh City’s Future

The Coastal Reclamation Construction Investment Project, part of the Can Gio Coastal Tourism Urban Area Development Project, spans an impressive 1,357.12 hectares with a total investment of over VND 64 trillion.