The VinFast Limo Green is a newly launched all-electric 7-seater MPV in Vietnam. With a claimed range of 450 km on a single charge, it targets customers who use their vehicles for ride-hailing services.

For ride-hailing drivers, the distance achievable on a single charge is a critical parameter, determining whether the vehicle suits their operational needs.

The VinFast Limo Green being tested by “Mê Xe” (Car Enthusiasts). Screenshot from the video.

The “Mê Xe” team has conducted two tests with different operating conditions to verify the achievable range in various scenarios, providing potential users with practical insights about this vehicle.

In their tests, the team simulated two distinct driving conditions: regular driving and economical driving. In both tests, they drove until the battery was completely depleted.

Test 1: Full Load, Maximum Speed

In the first test, the team aimed to replicate real-world conditions with six adult passengers, driving at the maximum allowed speed, and without employing any specific energy-saving techniques.

Methodology

The journey commenced at Vincom Long Bien, Hanoi, in the morning. Six individuals, including the driver, were on board, along with filming equipment.

The first test included six occupants in the vehicle. Screenshot from the video.

The vehicle was set to Normal mode, without regenerative braking, and the air conditioning was functioning normally. On the highway, the car maintained a speed of 120 km/h, without drafting or wind-dodging, and with no restrictions on acceleration.

The trip’s goal was to reach Cam Pha, Quang Ninh, and then return to Hanoi.

Key Findings

The car started with a full battery, displaying 450 km of estimated range. Shortly after entering the highway, the battery dropped to 94%, with an estimated 423 km remaining. Upon reaching Halong City (59% battery), the team had traveled 117 km, and the system indicated 265 km remaining.

When the battery reached 44% (169 km traveled), the team decided to turn back. On the return journey, at 18% (248 km), they aimed for Hai Duong to find a charging station.

The vehicle came to a halt just before reaching the charging station, requiring a push to the charging spot. Screenshot from the video.

Below 10% battery, the driver adopted a more conservative driving style, maintaining speeds of around 80-90 km/h. When the battery reached 1%, the car had traveled 300 km and was only 5.8 km away from the charging station. Ultimately, the car came to a stop at 0% battery after 306.5 km.

Test 2: Economical Driving

In contrast to the previous test, the “Mê Xe” team implemented various measures to conserve battery power.

Methodology

For this journey, the team maintained the same route from Hanoi to Quang Ninh and back. However, there were only two occupants in the vehicle, along with light luggage. The car was set to Eco mode, with regenerative braking at its highest level.

The second test had only two individuals in the car. Screenshot from the video.

The air conditioning was set to 26°C, with the fan at level 1, and it was turned off when not needed. The vehicle maintained a steady speed of 70–80 km/h, occasionally drafting and avoiding sudden acceleration. The trip started at Vincom Long Bien at 2:30 PM, heading towards Cam Pha and then back to Hanoi.

Key Findings

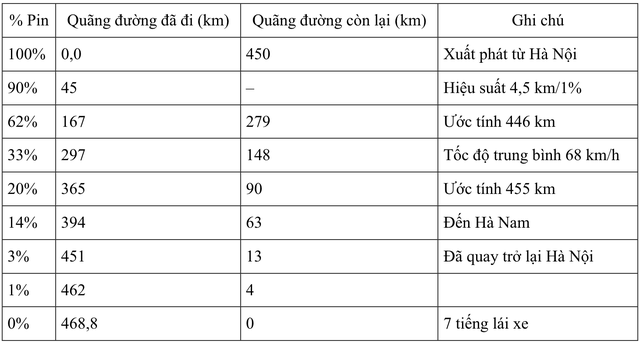

Even at 90% battery, the efficiency was impressive, achieving 4.5 km per 1% of battery – a significant improvement over the previous test (3 km/1%). At the BOT Van Don tollgate (62% battery), the team had traveled 167 km, and the system indicated 279 km remaining, totaling an estimated 446 km – almost identical to the manufacturer’s claim.

The test concluded with the vehicle traveling nearly 470 km; it did not come to a complete stop as in the previous test. Screenshot from the video.

When the battery reached 33%, the car had covered 297 km. At 20%, the total estimated range was 455 km. As the team approached Sun Urban City in Ha Nam province with 14% battery, the display showed 63 km remaining. Upon returning to Hanoi, with 3% battery, the total distance reached 451 km – surpassing the 450 km mark.

The team continued driving to fully deplete the battery. Ultimately, the car came to a halt at 0% battery after an impressive 468.8 km and approximately 7 hours of continuous driving.

Conclusion: When driven with a light load and energy-saving measures in place, the achievable range until the vehicle completely ran out of battery power was an impressive 468.8 km, surpassing the manufacturer’s claim of 450 km.

Conclusion

The two tests highlight a significant difference:

- Full load, high speed: 306.5 km – approximately 68% of the claimed range.

- Economical driving: 468.8 km – exceeding the claimed range by nearly 19 km.

This demonstrates that the manufacturer’s figure of 450 km is not unrealistic, but it requires ideal conditions: light load, low and stable speed, and energy-saving driving strategies. In more challenging conditions, the range may decrease by over 30%.

Similar to fuel efficiency figures for gasoline vehicles, achieving the manufacturer’s claimed range for electric vehicles requires the implementation of energy-saving techniques. Screenshot from the video.

It’s important to note that the maximum achievable distance on a single charge for electric vehicles is comparable to the fuel economy figures for gasoline cars. To attain the manufacturer’s claimed range, energy-saving measures are necessary.

For users, the key takeaway is that driving habits significantly impact the range of electric vehicles. While manufacturers provide maximum range figures, it is the driver’s habits and practices that ultimately shape the real-world experience.

“United We Ride: VNPAY Taxi and Vietnamese Taxi Companies Gear Up for Market Domination”

With a strong technological foundation, VNPAY Taxi pledged to enhance competitiveness and expand market share alongside over 200 Vietnamese taxi companies at a recent event. In a challenging market landscape, VNPAY Taxi aims to be a key player in empowering local taxi firms to thrive and succeed.

The Battle for Dominance in Vietnam’s Ride-Hailing Market: Grab’s Profits Soar While Gojek Struggles with Losses, Ultimately Deciding to Concede.

By the end of 2023, the four major players in the ride-hailing game had accumulated a staggering total loss of 14,000 billion VND.