I. MARKET DEVELOPMENT OF WARRANTS

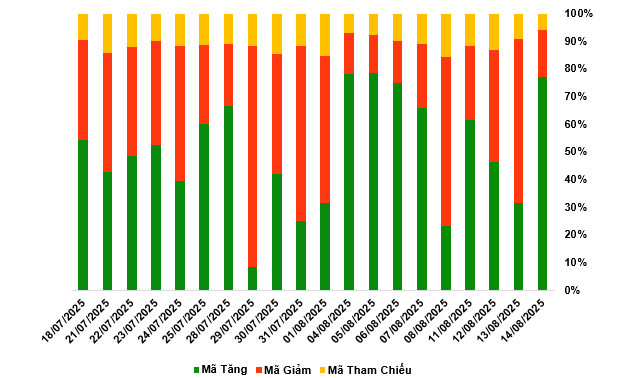

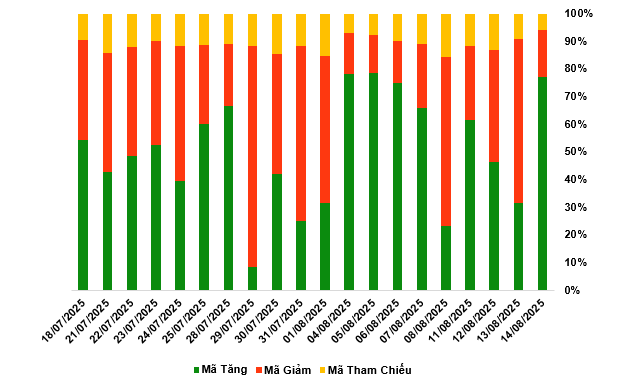

As of the trading session ending August 14, 2025, the market witnessed 200 rising codes, 44 falling codes, and 15 reference codes.

Market breadth in the last 20 sessions. Unit: Percentage

Source: VietstockFinance

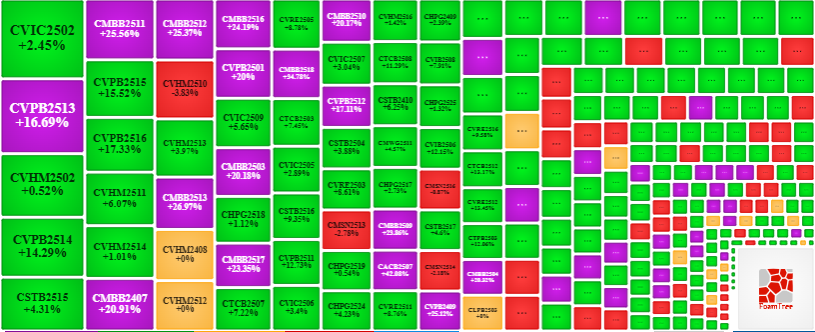

In the trading session of August 14, 2025, buyers returned to lead the market, causing most of the warrant codes to increase in price. Specifically, the large warrant codes in the group that increased in price were CVIC2502, CVPB2513, CVHM2502, and CSTB2515.

Source: VietstockFinance

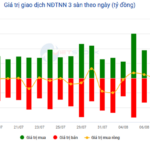

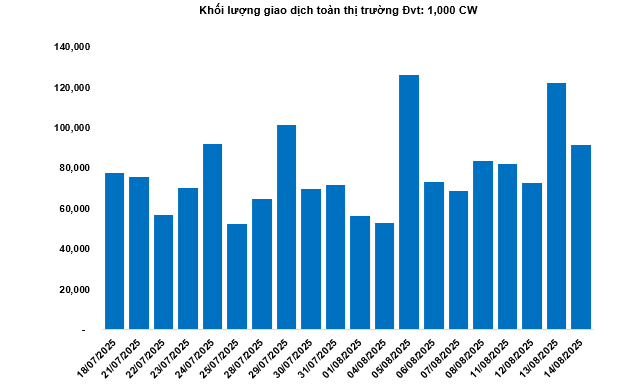

The total trading volume of the market in the session of August 14 reached 91.74 million CWs, a decrease of 25.15%; the trading value reached VND 214.08 billion, a decrease of 25.16% compared to the session of August 13. Of which, CHPG2518 was the code that led the market in terms of volume and value, with a total volume of 4.45 million CWs, equivalent to a value of VND 12.03 billion.

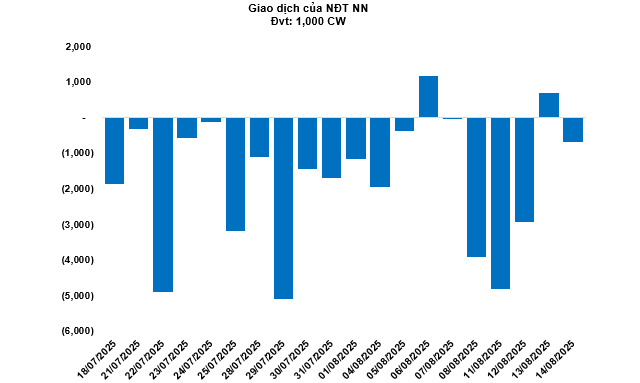

Foreigners returned to net selling in the session of August 14, with a total net selling value of 688,700 CWs. Of which, CHPG2515 and CHPG2512 were the two codes that were net sold the most.

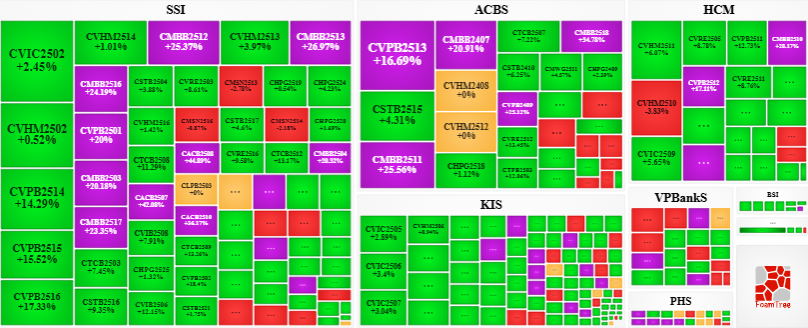

Securities companies SSI, ACBS, HCM, KIS, and VPBank are currently the organizations with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

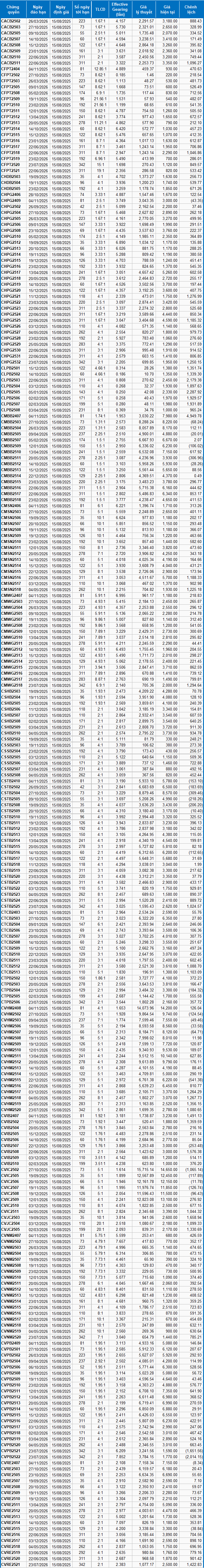

III. WARRANT VALUATION

Based on the valuation method suitable for the beginning of August 15, 2025, the reasonable prices of the warrants currently trading in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the interest rate on risk-free bills (government bills) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above valuation, CVPB2522 and CVPB2521 are currently the two warrant codes with the most attractive valuations.

The higher the effective gearing ratio of the warrant codes, the greater the increase/decrease in price following the underlying securities. Currently, CVNM2512 and CVPB2522 are the two warrant codes with the highest effective gearing ratio in the market.

Department of Economic Analysis & Market Strategy, Vietstock Consulting Department

– 18:58 14/08/2025

Market Beat on August 11th: Failing to Conquer the 1,600-Point Threshold.

The market closed with strong gains, as the VN-Index rose by 11.91 points (+0.75%), finishing at 1,596.86. The HNX-Index also climbed 4 points (+1.47%), ending the day at 276.46. It was a bullish day for the market, with 505 advancing stocks outpacing 297 declining ones. The VN30, a basket of Vietnam’s 30 largest stocks, mirrored this sentiment, as 21 stocks advanced against 9 declines.